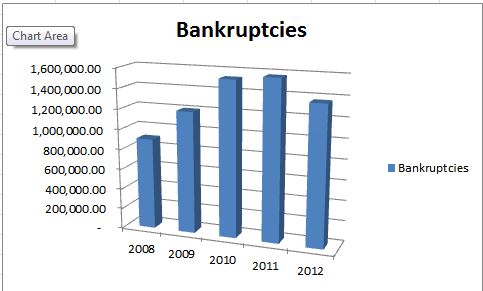

Many Americans recently have faced the spectre of filing bankruptcy. Some of these people have been facing long-term unemployment and other factors due to the economic downturn in America.

Is it possible to be too broke to file bankruptcy?

People who have waited until their unemployment has run out, may be too broke to file for bankruptcy in the court. Even though, they can arrange an initial consultation with a bankruptcy lawyer without any cost, filing bankruptcy can cost a few thousand dollars. Usually, for filing Chapter 7 bankruptcy, a bankruptcy lawyer charges $1000 to $2500 depending on the nature and complexity of the applicant’s case. Plus, the court charges almost $300 as a bankruptcy filing fee. Nowadays an individual is required to take a pre-bankruptcy credit-counseling course and a post-bankruptcy financial management course. Each course costs between $25- $50.

On the other hand, if you have to decide between paying your rent or credit card bill, I think it’s not a difficult decision to make, as people can live without credit cards and it is better to have a home. At times, a few creditors may become threatening and people give in and try to make small payments even when they do not have them. Therefore, if you are planning to file bankruptcy, avoid throwing money at an account, which will be discharged in bankruptcy Chapter 7.

For those who cannot afford the fees of bankruptcy lawyers to file bankruptcy in court, the waiting phase becomes difficult as creditors become ruthless. Some bankruptcy lawyers ask their clients to maintain records on how the creditors are approaching them. When creditors leave threatening messages on an answering machine, they might be violating the Fair Debt Collection Practices Act (FDCPA). This act was instituted by Congress to discourage creditors from using offensive, misleading, and inequitable debt collection practices. When a creditor crosses the line, your bankruptcy lawyer can get sanctions against that creditor. This may just cover the bankruptcy filing cost.

Filing bankruptcy is one of the most stressful and difficult times in one’s life because you are left with very few options. However, you must keep in mind that it will not last forever. Having a professional bankruptcy attorney on your side is very important and will give you confidence and extra support to face this difficult time and avoid any additional problems.

See Also:

- Bad Financial Advice Abounds

- How To Develop Winning Money Management Skills

- Overspending Solutions- Government and Personal Debt

- How to Hurt Your Credit Score

- When is Filing Bankruptcy Necessary?

Bankruptcy Resources from Amazon:

- How to File for Chapter 7 Bankruptcy

- The New Bankruptcy: Will It Work for You?

- The Elements of Bankruptcy, 5th (Concepts & Insights)

- Personal Bankruptcy Laws For Dummies

- Glannon Guide to Bankruptcy: Learning Bankruptcy Through Multiple-Choice Questions and Analysis, 3rd Edition

This guest post is written by Muhammad Azam who is a professional blogger. He has written on different financial topics such as legal advice, bankruptcy lawyer, asbestos lawyer , and on other legal law and personal finance related topics.