Almost everything we do in life requires that we exhibit some form of trust. When we go to the grocery store we are trusting that the food is wholesome and the package contains what is says it does. When we go to the gas station we are trusting that the pump is dispensing gasoline and not water. When we choose an investment adviser, a doctor or a lawyer we have to exhibit even more trust because we often don’t even know what we don’t know. So choosing an untrustworthy individual could prove disastrous to our health or wealth.

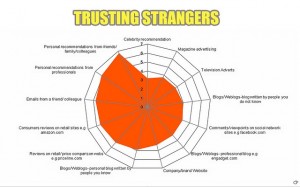

In the chart to the right we see the progression from the types of recommendations we trust most to those of lesser trust. The scale is from zero to seven, with seven representing the most trust. Personal recommendations from friends, family and colleagues rates a 6 ¾ on the trust scale while a celebrity recommendation only rates a three on the trust scale.

In today’s article Dennis Miller looks at trust and deciding who to trust with your future. ~Tim McMahon, editor

I Didn’t Believe the IRS Anyway

By Dennis Miller

Lois Lerner’s emails are back from the dead—sort of. The former IRS official’s BlackBerry, however, is still long gone. The IRS intentionally destroyed it in June 2012 (after congressional staffers interviewed Lerner about the IRS targeting conservative groups) as the Deputy Assistant Chief Counsel acknowledged in a recent sworn declaration.

We’ve all met someone we just don’t trust but don’t know why. There’s often a pretty good reason to feel that way.

Has someone ever made an insincere attempt to flatter you? Their words might be complimentary, but their body language, tone, and/or context let you know the compliment is phony. Does this guy really think I’m that stupid?

So, up goes your trust wall. If he’ll lie about this, he’ll lie about anything.

The IRS debacle is a prime example of why we build trust walls. The emails Congress requested had (supposedly) been deleted when several hard drives crashed. I asked my colleague Alex Daley (our in-house technology guru) what the probability was of that happening. Here’s what he had to say:

Everyone who ever owned a computer knows that hard drives are finicky beasts. In fact, Google uses a LOT of hard drives and so they have published all kinds of research on their failure rates. The gist: there’s about a 1 in 36 chance a hard drive fails in any given month. The math says then that if the IRS was practicing good data center management practices—we have to assume, however silly it might seem, that the agency responsible for holding the most personal information on American citizens outside the NSA is following best practices—then the chance of seven hard drives failing at the same time and wiping out the data on them is about 1 in 78 billion.

How rare is that? The odds of winning the Florida Lottery are roughly 1 in 23 million. So it’s 340 times more unlikely than you winning a state lottery. The odds of winning the Powerball are 1 in 175 million; for Mega Millions, the odds are 1 in 259 million.

Of course, we give the IRS too much credit. The risk of hard drives failing increases with age, and we suspect the IRS, like much of the government, isn’t spending a lot of time rotating hard drives. The odds also increase if you keep all the drives in one place, using old-fashioned persistence techniques. Then a fire, flood, electrical issues, or any other number of problems could easily wipe out the whole lot at once.

At one point there seemed to be only one plausible explanation for allowing so much data to disappear: negligence.

Turns out, however, the data weren’t even gone. As Judicial Watch President Tom Fitton last week:

Department of Justice attorneys for the Internal Revenue Service told Judicial Watch on Friday [August 22] that Lois Lerner’s emails, indeed all government computer records, are backed up by the federal government in case of a government-wide catastrophe. The Obama administration attorneys said that this back-up system would be too onerous to search. The DOJ attorneys also acknowledged that the Treasury Inspector General for Tax Administration (TIGTA) is investigating this back-up system. ….

There are no “missing” Lois Lerner emails—nor missing emails of any of the other top IRS or other government officials whose emails seem to be disappearing at increasingly alarming rate. All the focus on missing hard drives has been a diversion.

It sure seems clear why so many Americans feel put down. Does the government really think we’ re that stupid? Maybe. I look at it this way: I suppose it’s possible a dog can eat your homework. It’s still a lousy excuse that no one will believe. It’s no wonder politicians rank so low on our trust scale.

Whom Can You Trust?

The IRS is in our lives, period. If you live here in the US or you’re a US citizen living abroad, you can’t sever the relationship. Here’s the upside, though: for the most part you can choose to conduct your private affairs with trustworthy people.

One of the most common emails I receive is from readers looking for a trustworthy broker or financial advisor. Most come with sad tales: they had to fire their advisor because something felt fishy. Maybe they’d been directed to overly risky investments or high-fee mutual funds. Some couldn’t pinpoint their advisor’s exact offense but just knew in their gut something was amiss.

We should all expect the people we pay to help manage our money to put our interests ahead of their own. One reader said that paying fees to an advisor to put his money into high-fee investments made it almost impossible to end up with the growth he needed. He clearly wasn’t getting the service he deserved and had good reason to look elsewhere.

The Female Brain Detects Deception Best

I recently finished reading The Female Brain by Louann Brizendine, M.D. Dr. Brizendine shares quite a bit of scientific evidence to support the existence of female intuition. In brief, women score higher on tests for reading nonverbal communications and on average have more receptors for those cues than their male counterparts.

That explains why my youngest daughter recently fired an attorney. I was quite proud. She explained, “I got tired of feeling like I was being talked down to!” When I asked her to elaborate, she felt he thought she was stupid and should blindly follow his advice without question. She was picking up on the little things that might seem trivial but cause our subconscious mind to take notice.

At one point in my career, I sought advice from a top public speaker. (Maybe I wanted to be more like my daughters.) This speaker had an uncanny ability to “read, sense, and feel” his audience. He did this mostly through nonverbal clues and suggested I read Body Language by Julius Fast to help my subconscious mind tune in to nonverbal cues.

I read the book and learned that much of it was based on works like Kinesics and Context: Essays on Body Motion Communication by ?Ray L. Birdwhistell. So I read those books too and worked to sharpen my subconscious mind’s nonverbal recognition skills. Perhaps that also helped me picked up on the suspect explanations coming from the IRS. It’s certainly helped me trust my gut when deciding whether or not to do business with someone.

An attorney, stockbroker, money manager, or certified financial planner can have a great track record and all the requisite credentials you could ask for. That’s not enough. If he or she makes you uncomfortable but you aren’t sure why, don’t ignore your instincts. Switching course and hiring someone new can be an expensive headache, but it can save you over the long run.

For weekly, no-nonsense tips on protecting your bottom line and living rich at any age, sign up here to receive my free missive, Miller’s Money Weekly directly in your inbox each and every Thursday.

You might also like:

- Why We Lied to Our Kids about Their Inheritance

- The Importance of Hiring the Right Lawyer

- Does It Make Sense to Pay High Mutual Fund Fees?

- How to Choose a Financial Advisor