Take Back the Retirement You Dreamed Of

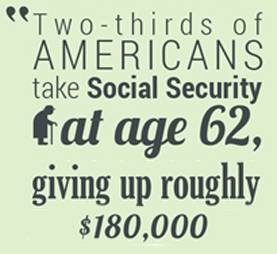

With the current economy some people are postponing retirement for a few years or working part-time during retirement in an effort to pay the bills. No one wants to end up in retirement working at Walmart as a “Greeter” or cashier… so lets look at what can be done to plan for a quality retirement.

Take Back the Retirement You Dreamed Of Read More »