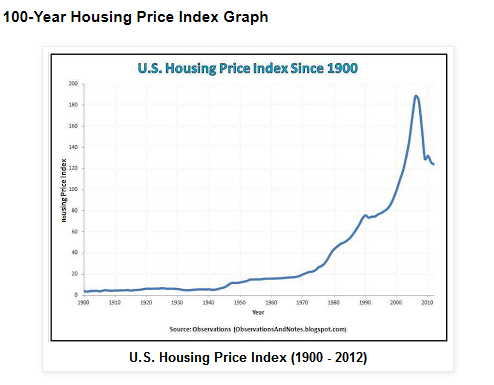

Investing in real estate got a bit of a bad reputation during the crash of 2008. Early in the new millennium people had developed the idea that real estate only appreciated in value and never fell. This idea was propigated primarily by this chart.

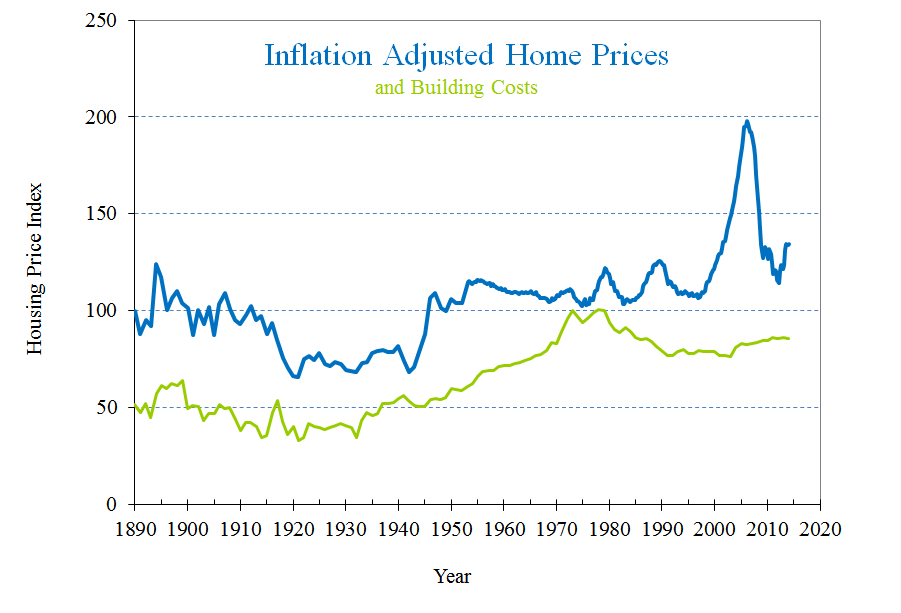

But what most people don’t realize is that when you adjust housing prices for inflation you get an entirely different picture.

So like any other investment buyers need to check the fundamentals and be sure your real estate is priced fairly. And if you are buying as an investment, you always have to do your “due diligence” and be sure your investment will be profitable. But here are 6 reasons real estate can be a good investment.

1. Positive Cash Flow

In the real estate industry, cash flow refers to the amount of money that you make from your rental property per month after deducting all expenses (including maintenance, mortgage, taxes and insurance). Whether you purchase your real estate property with your own cash or obtain it through a bank loan, you should strive for a positive monthly cash flow. The most important thing about cash flow is the fact that it grows over time. This is because of two primary reasons. First of all, your loan (mortgage) is a fixed cost… meaning that you pay the same amount every month, but inflation allows you to raise your rents over time. And second, if you acquired the property using a bank loan, you will eventually pay off the loan and you will be able to keep the portion that was formerly going to the bank.

2. Leverage

Real estate is among the few investment vehicles that provide investors with the opportunity to easily take advantage of the banks’ money. You just have to make a down payment and the bank pays for the rest. So if you calculated your costs correctly and have a positive cash flow (see #1) then you are making a profit on the bank’s money.

3. Inflation-proof investment

As we said in number 1, rent usually increases with inflation while mortgage expenses remain stable. This translates to increased cash flow with lower expenses on holding a real estate property. As inflation goes up, you can raise the rent. If housing prices go up, fewer people can afford to buy meaning more potential renters. More tenants increase housing demand, so rents also escalate.

4. Appreciation

Real estate investments tend to appreciate more in times of inflation. Buying houses with obvious problems (i.e. a “fixer-upper”) and removing the negative can result in a substantial increase in the value of the house. For anyone who has ever watched HGTV you have seen how you can buy a house for one price add 20% in renovation costs and sell it for twice what you paid for it. Of course, you have to know what you are doing, buy right, estimate your costs correctly and build in a contingency fund for “surprises” you find during the remodel process. HGTV stars Tarek & Christina El Moussa even started a coaching program called Success Path Education to help coach people wanting to get in to the “house flipping” business while avoiding some of the problems highlighed on the various renovation shows.

5. A forced retirement plan

Most people aren’t good savers. People simply lack the self-discipline to set aside monthly deposits for their SEP, IRA, or 401k plans. However, investing in real estate is a serious commitment. The bank doesn’t look kindly if you decide to not make your mortgage payment one month. So generally, people make these payments faithfully. Over the years, your equity will grow in the house and when the mortgage is paid off the positive cash flow jumps dramatically providing you with a sizable retirement income.

6. Tangible asset

Lastly, investing in real estate is a great way to diversify your investment portfolio, since it is backed by hard or tangible assets. Investing in real estate is different from buying stocks of a company that may be in the limelight today and gone tomorrow. In fact, cases of Lehman Brothers and Enron are reminders that even the most stable appearing companies are not infallible. individual tenants may come and go, and there may be hurdles in the real estate industry over time, but the property isn’t going to disappear. And with many millennials soured on the idea of home ownership, there will be a steady flow a people looking to rent.

Conclusion

As you can see, real estate can be a great investment vehicle that boasts significant benefits. There are a variety of real estate training programs if you’re interested in getting started. However, it pays to remember that it isn’t a get rich quick scheme. Investing in real estate takes time and effort as well as flexibility and ambition to be successful.