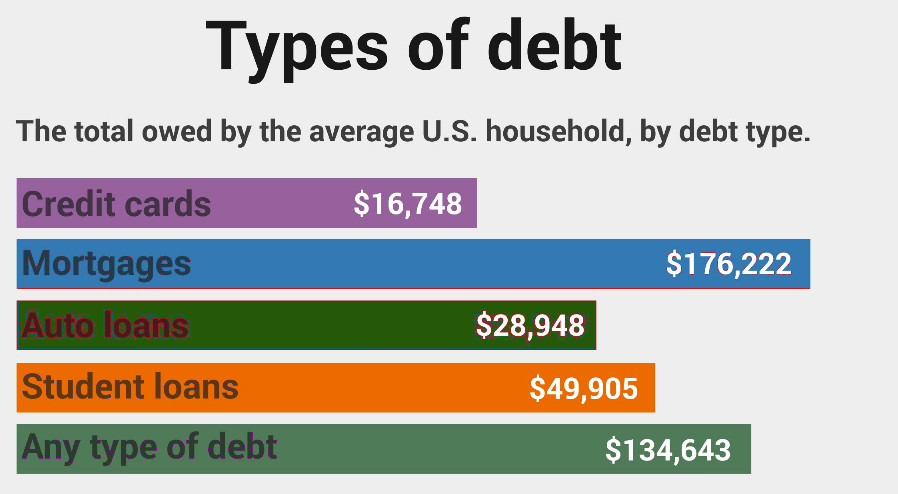

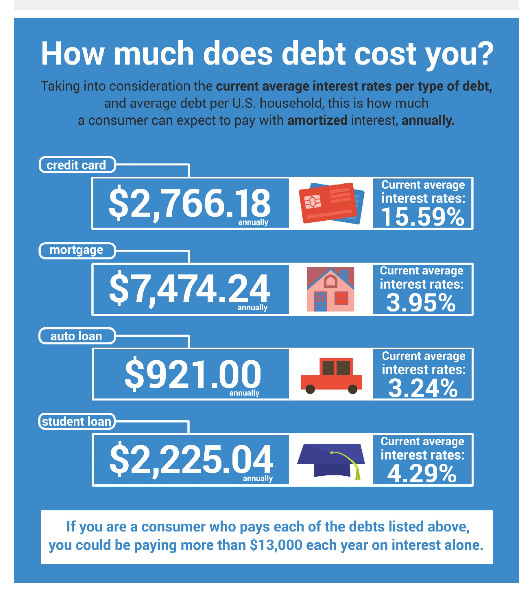

Household debt continues to accumulate but not for the reason you may think. While spending is at an all-time high, so is the true debt builder: Interest. Interest rates vary across different types of loans, but the sheer amount of the loans makes the interest accumulate to staggering amounts.

Mortgages are the biggest offender despite the increased attention around credit card debt. While the rates are quite a bit lower than credit cards, the total loan amount makes a big difference. The average mortgage owed by the average U.S. household is just over $176,000. The average interest rate tied to that is 3.95%. This is a sharp contrast to the 15.59% average interest-rate that credit cards carry, but adds up to almost $7,500 a year in interest payments alone. Over the course of a 30-year mortgage, the additional cost can buy another house.

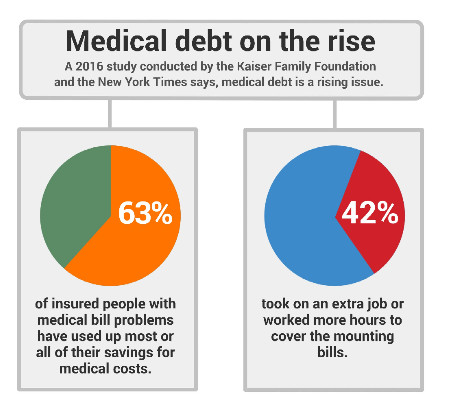

Medical bills have become a crushing source of debt for many Americans as well. With the increase in obesity and the diseases that accompany it including heart disease, diabetes, and atherosclerosis, medical costs have risen exponentially in the past 20 years. Even those that are insured aren’t safe from crushing medical bills. More than 60% of insured people with medical problems have used up most or all of their savings to help combat medical bills. Over 40% have resorted to picking up a second job or extra hours to help work off the extra bills.

Debt is an emotionally stressful state to be in. Whether it’s student loan debt or auto loans debt, most of us are swimming in debt. In this infographic from Investment Zen, we get a better picture of the overall debt situation most Americans face. If you’re ready to take the journey to being debt-free, check out the section on getting out of debt. You’ll be glad you did.

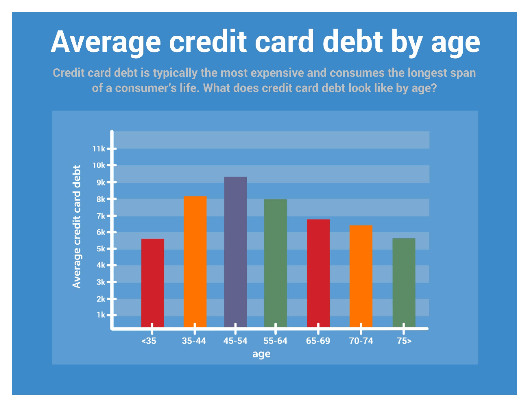

Because of the higher interest rates Credit Card debt can have a significant impact on your finances and it tends to peak between the ages of 45-54 and then slowly declines. But it seems to be a shame that even people over the age of 75 are still burdened by almost $6,000 in credit card debt.

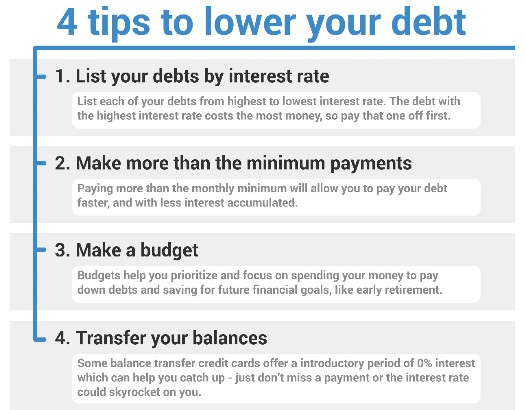

4 Tips to Lower Your Debt

- Start by Listing all your debts and then sort them by interest rate.

- The only way to get ahead is to pay more than the minimum

- Make it a priority to pay off your debt.

- Use Balance Transfers wisely.

You might also like: