4 Reasons Estate Planning is a Must

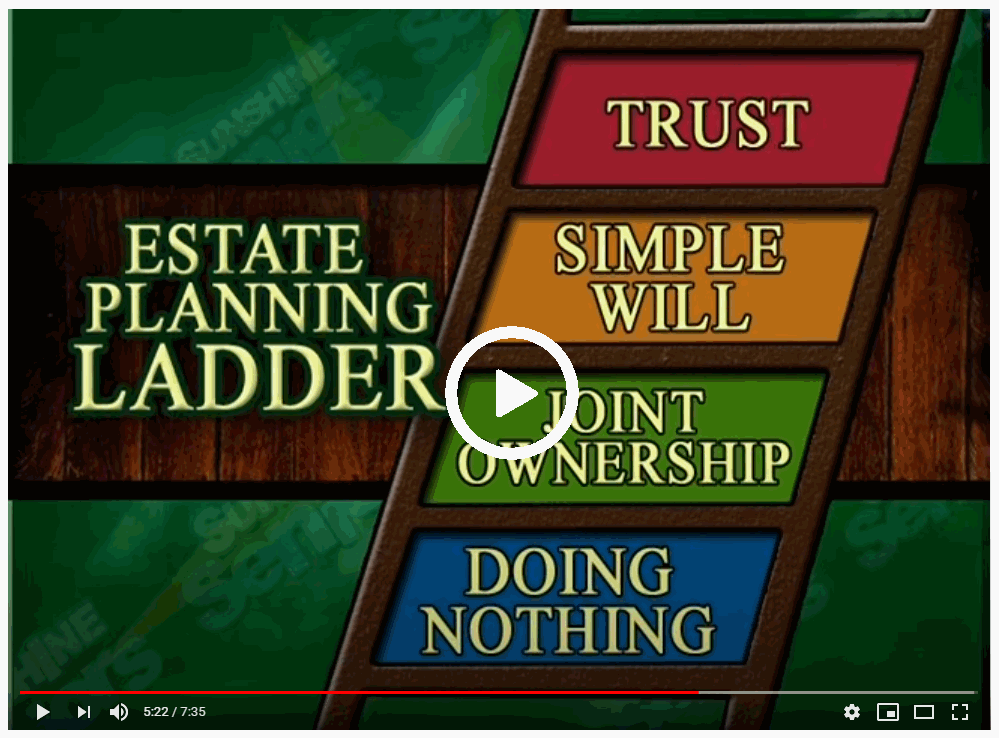

Estate planning is the process of making plans for the transfer of your assets and properties after your demise. While it may not be a topic that people want to think about, it is an essential aspect of life that must be given due consideration. Estate planning involves the preparation of crucial legal documents such as wills, trusts, power of attorney, and advance medical directives.

4 Reasons Estate Planning is a Must Read More »