Beware Of Foreign Exchange Fluctuations When Buying A U.S. Home

To say that the global COVID-19 pandemic wreaked havoc worldwide would be an understatement. Even, the world’s largest and most powerful economy, the United States, suffered a significant impact from the shutdown related to the disease. The impact is being felt across all sectors, especially housing — an industry that was booming just months prior.

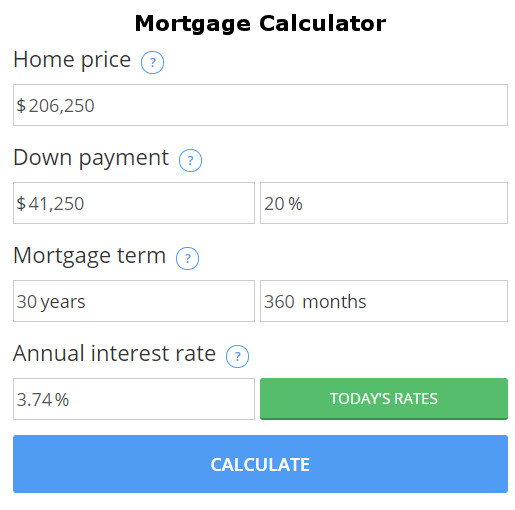

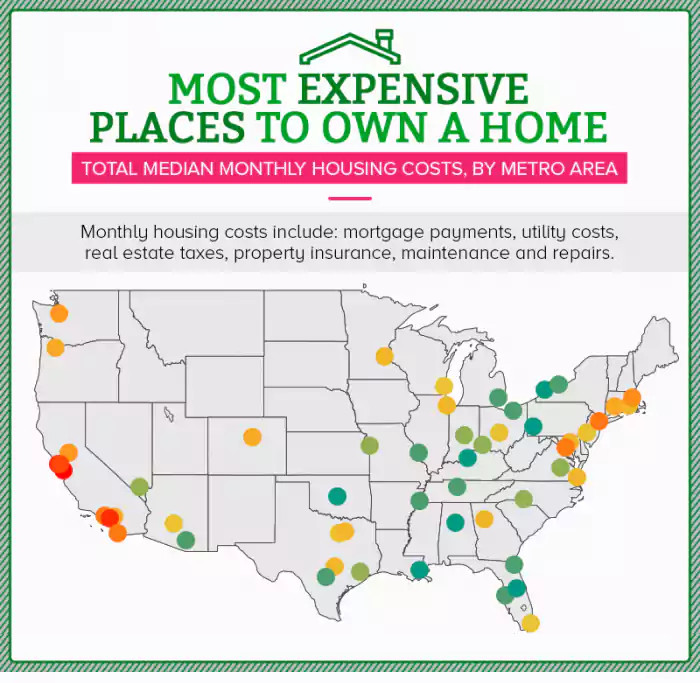

But foreign buyers with cash to spend should be able to find their dream home in any major city. As fans of HGTV’s “House Hunter’s International” know house hunting is no longer limited to one’s own country, today people often buy second homes in countries other than their own. One factor rarely discussed on TV shows however is the impact of different currencies on the cross-border buying process. If you earn money in one country and buy in a different country the currency exchange rate can have a big impact on the cost that you see. For instance, if you see that the housing prices in another country have fallen 30% in the local currency but the currency has appreciated 30% against your currency the price in your currency might be roughly the same. For more information, you can read this Forex FAQ to understand some of the risks involved in transacting with a different currency.

Beware Of Foreign Exchange Fluctuations When Buying A U.S. Home Read More »