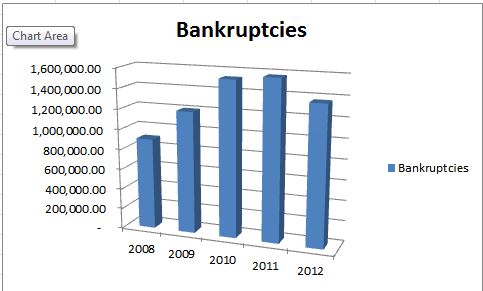

In the 12 month period ending March 31, 2012– 1,367,006 people filed for bankruptcy. This is down from 1,571,183 people who filed for bankruptcy in 2011 but up considerably from 901,927 in 2008, 1,202,503 in 2009 and 1,531,997 in 2010.

If you have ever considered declaring bankruptcy, understanding the gist of bankruptcy laws will help you come up with the best decisions concerning your financial status. If you can no longer manage to pay your debts and are unable to pay all your creditors, the last resort is filing bankruptcy which can protect a debtor who is unable to service his or her debts, and provides a working solution for your creditors.

What Protection Can Filing Bankruptcy Provide

What Protection Can Filing Bankruptcy Provide

Before considering this option, you should consult a bankruptcy lawyer to tell you whether there will be ramifications. You can weigh the downsides of this option and decide whether you should file your petition. Bankruptcy is an alternative that can help people restructure their financial position. However, there are negative consequences that come with it. Firstly, you ruin your credit. This may impede your future ability to borrow from any financial institution or lender.

How Does an Individual Become Bankrupt?

No matter how bad your financial position you are not technically “bankrupt” until you go through the legal proceedings. And although it sounds like a bad thing, technically it is a method to help you not only get a fresh start but also to resolve outstanding debt issues to the satisfaction of both the debtor and the creditor.

You can end up in bankruptcy proceedings in two ways.

1) You may apply voluntarily

or

2) One of your creditors may petition the bankruptcy court to have you declared bankrupt under the Bankruptcy and Finance Act.

Bankruptcy Laws That You Need to Know

Bankruptcy law is a wide legal field that deals with a variety of different situations. Not all issues leading to bankruptcy are filed under a single provision, but rather, each situation or party filing bankruptcy applies to a distinct bankruptcy law. There are three major provisions of bankruptcy law named after the different chapters of the laws that created them.

1. Chapter 11 Bankruptcy: this part of the law provides for a reorganization to settle debts and is often called rehabilitation bankruptcy since the goal is to allow the organization to emerge as a healthy ongoing organization with manageable debt. It deals with partnerships and corporations. In this section, a party seeking a declaration of bankruptcy (debtor) proposes a plan to pay his debts. This part of the law, if considered, allows a debtor to keep his business alive, whilst making payments to creditors. However, parties can also seek relief allowing the creditor to forgive some of all of his debts. This chapter does not wipe away the responsibility of the debtor, but rather provides an opportunity to renegotiate the terms of the debt, i.e. either the interest rate, length of time or even the dollar value, thus reducing the amount you owe often only paying 5 or 10 cents on the dollar.

2. Chapter 13 Bankruptcy: This chapter is very similar to chapter 11 except that it applies to wage and income earners rather than corporations. As the statistics above show, due to the economic bubble and housing crash millions of people were forced to declare bankruptcy in the years since 2008. Chapter 13 bankruptcy provides that a person whose earnings have reduced to the extent that it is not sufficient to pay debts can seek relief from a bankruptcy court. Here, a person qualifying under chapter 13 is allowed to pay a portion of debt in installments. To qualify for chapter 13 as of April 1, 2013, your unsecured debt must be under $383,175.00 (up from $360,475.00) and your secured debt must be under $1,149,525.00 (up from $1,081,400.00).

3. Chapter 7 Bankruptcy: Chapter 7 bankruptcy is sometimes also called liquidation bankruptcy. Debtors (individuals or companies) are forced to liquidate non-exempt assets to pay back their creditors. It provides the opportunity to eliminate debts such as a house or vehicle that is ‘underwater’ i.e. you owe more than it is worth. Creditors holding secured debt i.e debt based on collateral such as houses and cars are paid from the proceeds of the sales of these items. But if you are current on the payments and able to afford to continue to pay for the house or car, you may be able to keep it as long as you don’t have much equity. These are known as exemptions.Unsecured debtors are paid from a pool of funds created by selling the remaining assets. These debtors each receive a percentage of the pool based on what percentage of the debt they own. This law differs from chapter 13, which protects the assets of applicants.

4. Exemptions for specific persons, income, and property: As we saw in the chapter 7 discussion, some items can be exempt from bankruptcy proceedings under certain circumstances. Chapter 11 and 13 can allow you to keep all of your possessions while under chapter 7 only specific assets are exempt and then only under certain circumstances. Chapter 7 bankruptcy is generally suited for people with little to no income, and little to no ability to repay their debts who wish to start over with a ‘clean slate’.

See Also:

- 5 Tips to Avoid Bankruptcy

- Dealing with Student Loan Debt and Bankruptcy

- Are You Too Broke for Bankruptcy?

- Dealing with Student Loan Debt and Bankruptcy

- Five Activities That Can Ruin Your Credit Score

Recommended by Amazon:

- How to File for Chapter 7 Bankruptcy

- Chapter 13 Bankruptcy: Keep Your Property & Repay Debts Over Time

- The Complete Idiot’s Guide to Personal Bankruptcy

- Bankruptcy and Debtor/Creditor: Examples & Explanations

- The New Bankruptcy: Will It Work for You?– Veteran Nolo author and consumer debt expert explains all of the options available to people with an unmanageable debt burden. Filled with clear-cut answers and practical suggestions, the book reassures readers concerned about: wiping out all of their debts; losing their housekeeping their car and other property; retaining their credit cards; losing their job; losing custody of their children; going to jail and much more. Written in plain English, examines the pros and cons of filing for bankruptcy, discusses its possible repercussions, outlines the differences among various kinds of bankruptcy and proposes several alternatives to filing. Includes sample, completed bankruptcy forms.