Buying your first house can be an exciting time. It can also be a nightmare trying to get the right amount budgeted for it. Most people sidestep the question by simply going to a bank and asking how much they qualify to borrow. Unfortunately this is a very common mistake. Banks are not financial planners they are in the business of lending money, they know nothing about your lifestyle so they simply sue some basic rules to determine how much they will loan you. They do take into consideration your other obligations but they will often offer you more than you would be wise to borrow. This can lead to serious debt issues if unexpected expenses arise.

Fortunately, following a few basic tips will allow you to create a budget that will help you get the most out of your new home without driving you crazy. Here are some ways to beat overspending and still make your new home a place you want to live.

Purchase Price

First, start with the purchase price of the home, which you can get from your real estate company.

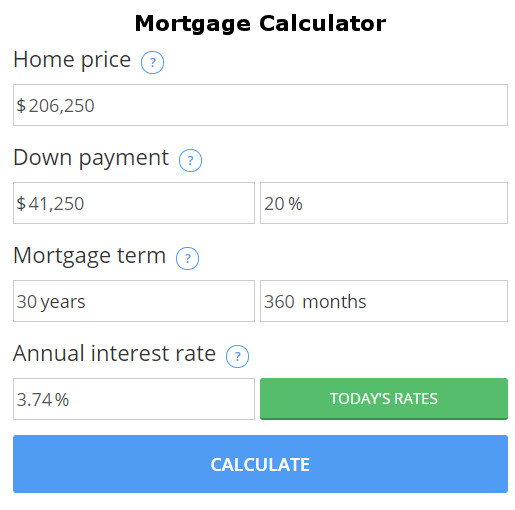

Figuring out your monthly mortgage premiums is incredibly easy – just plug the number into your mortgage calculator. You will also need to know the annual interest rate, and the amount you have for a down payment. You can use the calculator to play with the term. You can start by entering 30 years and that will get you the lowest monthly payment. If you want to pay it off faster you can decrease the term perhaps trying 25, 20 and 15 years to see how much of a difference reducing the term makes. You’ll probably be surprised at the savings you can achieve by paying just a little more each month.

Remember, your mortgage premiums are directly related to the interest rate on your house, so you’ll be able to save quite a bit of money by reducing the interest rate by even half a percentage point.

Monthly Payments

Next, you’ll want to look at the other monthly payments every homeowner needs to make: taxes and home owners’ insurance. These costs are usually part of your monthly mortgage payment (i.e. you pay them to the mortgage company and they pay the tax authorities and insurance company, so they are sure they are being paid). These extras tend to add a few hundred extra dollars a month. Make sure to shop around for a good insurance policy by a reputable company. Shopping around can save you hundreds of dollars a year for many years.

Utilities

This is only the beginning of your budget journey, though. In addition to the actual cost of owning the house there are lots of ancillary expenses like the utility bill. Calculating this can be a bit tricky since every house is different depending on size, insulation, location, climate, etc. You might be able to get some idea from the current homeowner. Simply ask to see the current utility bills. Most electric bills list not only the current bill amount but also the usage for the previous 12 months. Although they don’t usually include the actual dollar amount you can estimate it from the data given. Unfortunately, most electric bills aren’t straightforward. For instance they may charge one amount for the first 1000 KWH and a different amount for the next so many. Plus there are different taxes and fees so you can’t just take the per KWH number and multiply it by the number of KWH per month. And you can’t just assume that every month is the same as the one on the bill you are looking at, since every month is different depending on the differing heating and cooling load. But you can still get a rough estimate simply take the current total bill including taxes and fees and everything and divide it by the number of KWH. This will give you the real amount the homeowner is paying per KWH which will be higher than what the utility says they are charging per KWH. Then you simply multiply this number times the listed KWH for each of the last 12 months and you will get a good estimate of what the actual bill will be. Of course, if you waste more electricity than the current owner (or are more frugal) your “mileage” will vary. Also not that in addition to electricity some houses heat with gas, some localities charge for water and sewer, etc.

Maintenance

After you’ve got utility bills squared away, you’ll also want to consider the most unfortunate costs you’ll have to deal with – repairs. While you probably won’t need to pay for a home repair every month, you still want this to be part of your budget. Consider putting away about three hundred dollars every month for repairs – this is equivalent to the cost of a simple repair that has to be done by a professional.

Once you’ve got all that done, you’ll have a fantastic starting budget for your new house. You will still have plenty of other costs to deal with, but you’ll have everything related to your home squared away. Having the right budget in place will give you a chance to enjoy your home and stop worrying so much about your new financial responsibilities.

You might also like: