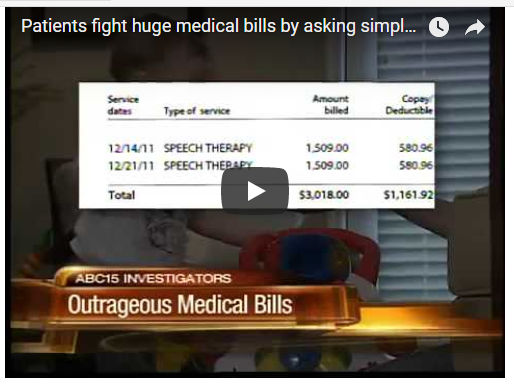

It is an unfortunate fact that millions of Americans continue to struggle with overwhelming medical bills every single month. Even if you have excellent insurance, you might still be hit with unexpected expenses and fees after visiting the hospital. Here is a look at five tips that will help you pay off your medical bills without breaking the bank.

Contact the Billing Department Immediately

Medical expenses are the leading cause of bankruptcy in the United States, and that is just one of the reasons why you need to collect as much information as possible throughout this process. Before your bills are late, you should contact the hospital’s service provider and ask for a hard copy of everything. Whenever they offer to reduce fees or waive payments, you must get that information in writing.

Schedule a Meeting with the Hospital Administrator

If you aren’t able to come to an agreement with the billing department, then you need to move up the chain of command. Hospital administrators often have quite a bit of leeway when it comes to making payment plans. At the meeting, you should be able to show the administrator exactly how much you make and what you can pay every month. Collection agencies typically get 50% of whatever they collect so hospital administrators have a big incentive to do everything in their power to keep these accounts out of collections.

Research Charity Care Programs

Some of the biggest hospitals in the country are nonprofit organizations, and many of them have charity care programs specifically for struggling patients. These programs are generally overseen by a hospital’s financial counselor, and you might need to contact them directly to get details. Even if you don’t qualify for any assistance, a counselor can help you explore all of your financial options.

Here are the top 10 Non-Profit Hospitals in the Country ranked by number of beds (according to Becker’s ASC Review):

- NewYork-Presbyterian Hospital (New York City) — 2,292 Beds

- Florida Hospital Orlando — 2,141 Beds

- Jackson Memorial Hospital (Miami) — 1,724 Beds

- University of Pittsburgh Medical Center Presbyterian — 1,590 Beds

- Orlando (Fla.) Regional Medical Center — 1,483 Beds

- Indiana University Health Methodist Hospital (Indianapolis) — 1,462 Beds

- Baptist Medical Center (San Antonio) — 1,422 Beds

- Montefiore Medical Center – Moses Division Hospital (Bronx, N.Y.) — 1,418 Beds

- Barnes-Jewish Hospital (St. Louis) — 1,326 Beds

- Cleveland Clinic — 1,309 Beds

Apply for a Third-Party Medical Credit Card

Healthcare credit cards are different than traditional credit cards. Most of them are highly regulated by the federal government, and they often offer extremely low rates as long as you continue to make payments. They have minimal credit requirements as well, and that means you should be able to qualify as long as you or a loved one has a consistent work history. One of these credit cards might be able to keep you afloat while you explore your other options.

Consider Filing a Lawsuit

Some accidents are completely out of your control, and you could be entitled to compensation if your injury or ailment wasn’t your fault. Those who are struggling with severe injuries should contact an attorney to explore all of their legal options. The attorneys from Alexander Law Group say that there are a variety of case types that may be eligible for litigation including: Auto, Aviation, Bicycle and Motorcycle Accidents, Birth, Burn and Brain Injuries, Sexual Assault, Product Liability, Spinal Cord Injury and Wrongful Death. A settlement in any of these areas could cover hospital bills and other related expenses.

No matter what path you decide to take, you must stay on top of your medical bills. Ignoring debt collectors and hospital administrators is only going to make the situation worse, and outstanding accounts could tarnish your credit score for years.

You might also like: