After you have a health issue, a lot of things change in your life. It comes with major stress and financial problems as well. However, although it may not be easy, if you don’t give up and instead take the right action, you can move past it over time. Here are four tips you should use to help you in dealing with the financial aspects of a medical condition:

Be Calm in the Storm

One of the most important things to do is not to panic. When you have medical bills piling up, you might be tempted to make rash decisions or clam up and do nothing. But neither is the proper approach.

The right move is to take some time for yourself. Relax, rewind, and just put one foot in front of the other. Staying calm will allow you to make better decisions overall. That way, you don’t get caught up in fear and emotion, which can lead you down the wrong path.

Seek Legal Help From Professionals

“The doctor who treats himself has a fool for a patient.” and the same is true for a lawyer. Getting legal help is nothing to be ashamed of. When you have a great lawyer on your team, all of the sudden you can find ways to get compensated. For instance, a social security disability attorney will know how to navigate your case and be best suited to getting you a Social Security settlement, while an accident attorney would be best suited to assist in an accident settlement. They could get you money or compensation for your disability if the situation warrants it. Did You Know You Can Negotiate Your Medical Bills? Well, you can. You should never pay more than an insurance company would reimburse the Doctor/Hospital for the same procedure. If you are unable to negotiate this yourself that is another reason you may need to hire a professional to assist you.

Cut Back on Other Purchases

Your budget is going to be one of the biggest concerns you have moving forward. Anytime you have the chance to save money, you should take it. When you are in a better financial situation, you can go back to spending money on various items. For now, it’s best to keep your spending under a certain amount as you pay your bills. See Frugal Living 101 for more info.

Make a Financial Goal and Stick With It

You don’t just want to save money to pay your bills. You should also work toward something that you are excited about. For instance, maybe you have a new item that has been on your mind. If you are excited about finding ways to get more money, then your discipline will raise.

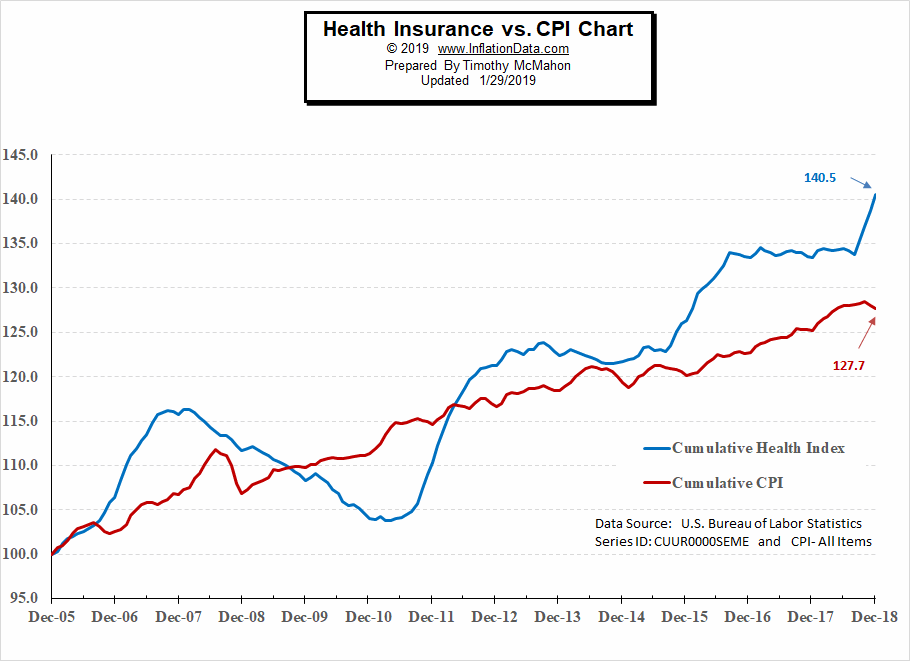

Health insurance costs are up over 40% since 2005 compared to overall prices being up “only” about 28% as you can see from this chart from InflationData. See the full article on Health Insurance Inflation.

But that doesn’t mean you have to give up. When it comes to having a medical condition, it is never easy. However, it is made even more difficult by the fact that it can come with major bills to pay. If you are feeling overwhelmed about this, don’t worry. If you develop the right plan, you can overcome it and get your life back to normal.

You might also like: