Building a better financial future for your family is best achieved by making smart financial decisions and taking advantage of opportunities. One way to do this is through saving money, which is easy to say but can prove tricky to do. But by implementing the methods in this article you can build a brighter future.

Step #1 Start with a Budget

Creating and following a budget is the foundation to saving money. When you plan your income and spending, it’s easier to avoid overspending. There are plenty of free online tools that can help you create a budget, or you can work with a financial advisor to get started.

Start by figuring out what you earn in a month and your regular expenses. Be sure to include things like groceries, transportation costs, bills, and debt payments. Then see where you can cut back on expenses or find cheaper alternatives.

See: 6 Budgeting Pointers to Get Your Finances Back on Track and Guide to Creating an Annual Family Budget Plan

Step # 2 Make Your Money Work for You

One of the smartest things you can do with your money is to make it work for you. This means investing in stocks, mutual funds, Exchange Traded Funds, Gold, Real Estate or other types of investments that will either give you a return on your money or help protect your purchasing power.

It’s important to remember that there is risk associated with investing, so don’t invest more than you can afford to lose. And be sure to consult with a financial advisor before making any major decisions. But if done correctly, investing can help you grow your wealth over time and provide some stability during tough economic times.

See: Portfolio Diversification: The Key to Financial Stability

Step # 3 Avoid Taxes

There is a big difference between avoiding taxes and evading taxes. The first is legal while the second isn’t. Federal Judge Learned Hand is famously quoted for saying that “there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible”. Tax evasion however is “Intentional nonpayment or avoidance of lawfully assessed taxes, especially through fraud or concealment of income.”

Typical methods of legally avoiding or at least delaying taxes are via IRAs, 401Ks, 403Bs, and Trusts. As you become more sophisticated in your investment you can consider things like a “Delaware Statutory Trust” (DST). Investors can potentially benefit when a DST is used correctly in real estate planning. Though DSTs have their pros and cons, by deferring capital gains taxes, DSTs potentially help investors build and maintain wealth through real estate investment opportunities, For more information on DSTs you can check out DST properties for sale.

Step #4 Automate Your Finances

Automating your finances includes both paying bills and saving. Automating your “billpay” will help you avoid penalties, interest, and late fees all of which can be considered as a “stupidity tax”. Avoiding these drains on your wealth will accelerate your savings plan drastically. Interest alone on a $15,000 credit card debt at 24% interest will drain $3,600 per year from your assets without making a dent in the principal balance.

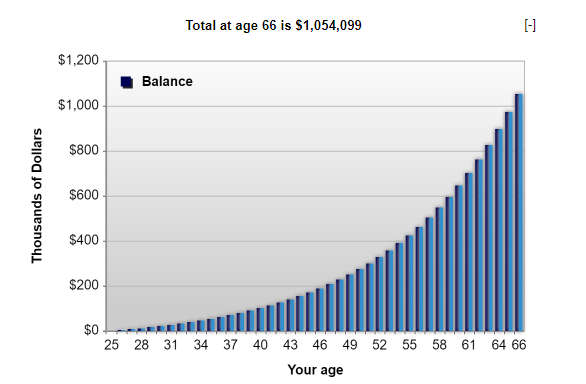

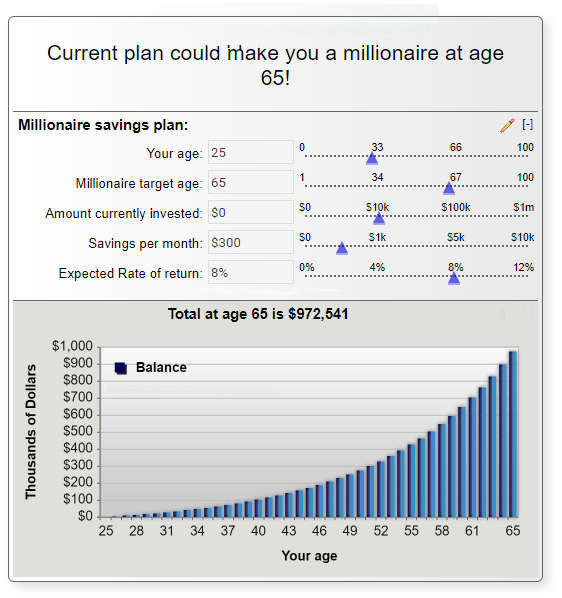

On the other hand, using our millionaire calculator we can see that if you start investing $300/month ($3,600/yr) at age 25 and earn an 8% rate of return you will become a millionaire by age 66. That is just paying yourself rather than the Credit Card company.

One of the best ways to save money is to automatically transfer it from your checking account to a savings or investment account. This way, you can’t forget, you probably won’t even miss it, and you’ll be building your savings without any extra effort.

Almost all banks offer this service for free, so contact your bank and see how you can set it up. You might also want to look into online-only banks with higher interest rates on their savings accounts.

Step #5 Invest in Yourself

One of the smartest things you can do for your financial future is to invest in yourself. This means taking courses and learning new skills to help you get ahead in your career. Not only will this make you more valuable to employers, but it will also allow you to earn more money over time.

Check with your local community college or online course providers if you’re not sure where to start. They offer a wide range of courses on everything from personal finance to marketing to software development. And if you already have some skills under your belt, consider getting a certification or advanced degree that will set you apart from the competition.

Step #6 Create an Emergency Fund

Another smart thing you can do for your financial future is to create an emergency fund. This includes setting aside enough money each month to cover several months’ worth of expenses if you lose your job or face a major unexpected expense.

The exact amount will depend on how much monthly income you have but aim to have some good amount as your starting point and adjust depending on your unique situation. You might be able to set up automatic bank transfers that take out small amounts every payday, so it won’t even feel like a sacrifice.

And if possible, try not to touch this savings account unless necessary, since having access to cash when something goes wrong could make all the difference between an “emergency” and an inconvenience.

Step #7 Cut Unnecessary Expenses

Most people sign up for many different online services and end up paying monthly fees without even realizing it. These subscription services are usually easy to cancel, so take some time to go through your bank statement or credit card bill and look at all the recurring payments you’re making each month.

If there are any that you don’t use regularly, call the company’s customer service number or log in to their website to see how you can cancel the subscription. There might be an early termination fee, but canceling unnecessary subscriptions could save you hundreds of dollars per year.

Conclusion

These are smart ways to build a better financial future for your family! So no matter your situation, there’s something here that will help you get started. So take some time and figure out which tips are the best fit for you, and then get to work on creating a more secure financial future. It won’t be easy, but it’ll be worth it in the end.

You Might Also Like: