When you're ready to buy a home, make sure your finances are in good shape BEFORE applying for a loan. A solid financial standing will help to ensure a smooth mortgage loan application. It could also establish you as a premiere buyer that property sellers will favor over other buyers. Here are a few tricks to help you get your finances in order before you purchase a property.

Check Your Credit Score

Get a copy of your credit score from one or more of the top U.S. consumer credit monitoring agencies. Review it to be sure it is up to date with complete and accurate information. Checking two credit reports will make it easier to catch discrepancies. Report any errors to the agency so that they can be corrected. Pay your bills on time to keep your credit score as high as possible, aiming for a score of 725 or higher to get the best loan terms.

Pay Off Consumer Debt

Pay down or eliminate any bills and outstanding credit balances you owe. When you apply for a loan, the amount of debt you owe will be considered in terms of how much of a mortgage you can afford. Use the "Debt Snowball" system. Start by paying off smaller balances. Then apply that payment you no longer need to make to the next balance to be tackled. Work toward a healthy debt-to-income ratio that will be acceptable when you apply for a mortgage loan.

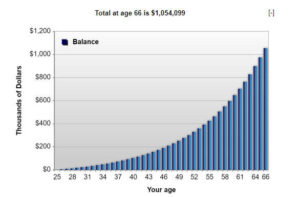

Save for a Down Payment

Trim your monthly budget to cut costs, and deposit more of your income into a savings account or an investment portfolio for a down payment on your property purchase. This would be a good time to sell things you no longer need or to get a part-time job and add more to your savings for a down payment. The bigger your down payment on a property, the smaller mortgage you will have to borrow, which will make it likelier for your loan application to be approved.

Shop for the Best Home Loan

Compare terms for several home loans to get the best deal. Although the interest rate may be similar to most mortgage loans when you apply, you might be able to get a discount for opening a savings account or checking account at the financial institution where you plan to finance your property purchase. A high credit score and low debt balance can also help you get the best available loan rate.

Take steps now to prepare for buying property by assessing your financial resources and credit score. A few minor adjustments can help you save thousands of dollars over the life of a mortgage loan when you are ready to purchase a property.

You might also like:

Shortcuts To Building A Better Financial Future

Building a better financial future for your family is best achieved by making smart financial decisions and taking advantage of opportunities. One way to do this is through saving money, which is easy to say but can prove tricky to do. But by implementing the methods in this article you can build a brighter future.

Getting Your Finances in Order for the New Year

Money plays a major role in your family’s quality of life. Thankfully, it’s never too late to get your finances in order and the New Year is a great time to get your finances on the right track. Consider some of the best tips to help get you started.

Get The Best Deal When Buying Or Selling Your Home

Whether you are thinking about buying or selling your home, the aim is to get the best price. Understanding what buyers look for or the Seller’s motivation will help you get the best deal.

Top 5 Home Upgrades and Repairs Worth Your Money

If you’re going to sink money into a home upgrade or repair, you want it to be worth your money. The value you might get in return can be the benefit the project gives your home, money that you save in the long run, or even increased property value. Many of the top home projects might even accomplish several of these simultaneously.

5 Ways You Can Save More Money Every Month

We can all agree that saving money and preparing for your financial future is a vital task. But, those who intend to save money may find that a rising cost of living combined with flat wages makes saving difficult. Many will find that there is not enough money left over at the end of the month to save anything at all. While saving money can be challenging, these tips can help anyone reach their financial goals.