How Much Do Dental Implants Cost? How to Save up for Them

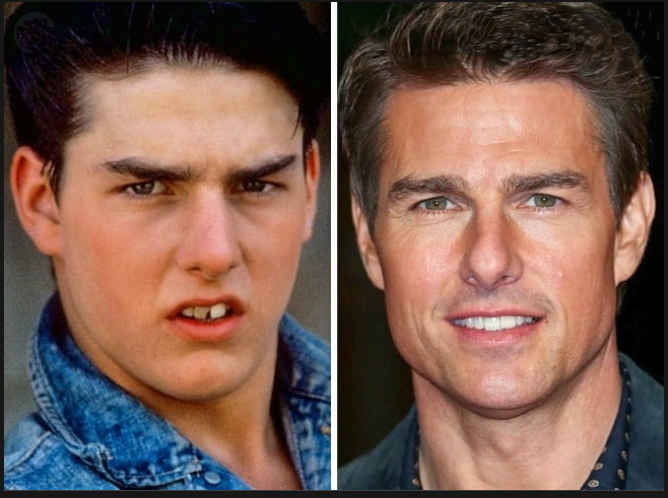

Everyone wants a perfect white Hollywood smile. But, as you can imagine, a movie star set of pearly whites is not cheap. Even Tom Cruise had to go through quite a bit of work to get that perfect smile.

However, a perfect smile is not the only reason to get dental implants; you may need to replace a tooth that was lost to an accident or disease.

If you need dental implants and your insurance does not cover the expense, (and you don’t have a moviestar bank account), you may need to save up for them. Here, we’ll go over some of the details concerning dental implants, and we’ll provide tips on how to finance them.

How Much Do Dental Implants Cost? How to Save up for Them Read More »