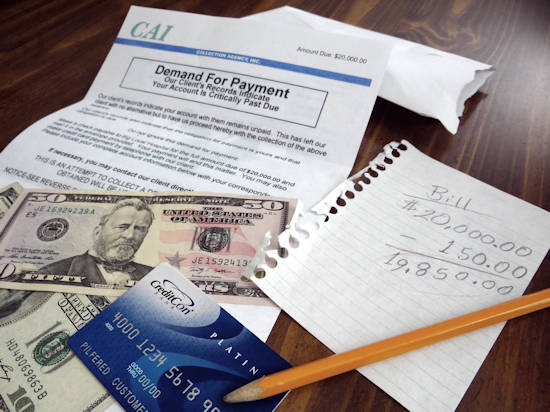

Important Tips for Managing Your Family Debt

If you want to pay off your debts, it’s important that you approach the task the right way. So, we’ve put together important tips for managing debt as a family that will help you do it!

Important Tips for Managing Your Family Debt Read More »