Preparing for Retirement: What Is a Gold IRA?

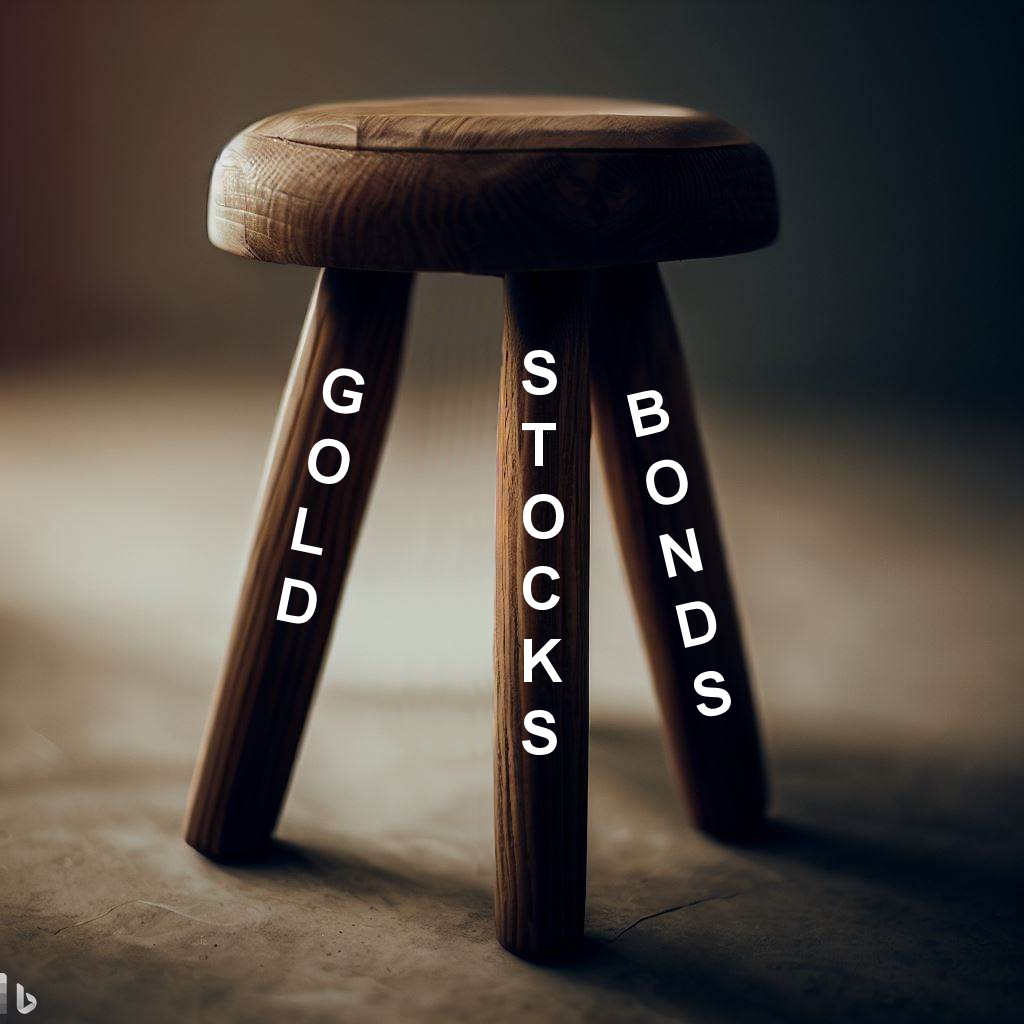

Conventional wisdom says that you need a mix of stocks and bonds because when one goes up the other typically goes down. But what if both go down at the same time (as happened in 2008)? Wouldn’t it be nice if instead of a two legged stool of (stocks and bonds) you could have a 3 legged stool that was even more stable?

Preparing for Retirement: What Is a Gold IRA? Read More »