Can a Double-wide Save Your Retirement?

Retirement is actually a fairly recent invention. In ancient times people didn’t often live long enough to retire and those that did were often unable to accumulate enough savings to live on and thus simply relied on their children to support them while also continuing to contribute to the family to the best of their ability. There were several attempts to establish a government pension including one established during the Revolutionary war and although the states were responsible for making payments, they fulfilled their obligation to only 3,000 disabled veterans. Private pensions however, got their start during WWII. During the war, the National War Labor Board froze wages in an effort to prevent (i.e. to mask) inflation. But simultaneously there was a massive shortage of workers due to the war effort so companies offered other benefits like the defined benefit pension plan to woo workers.

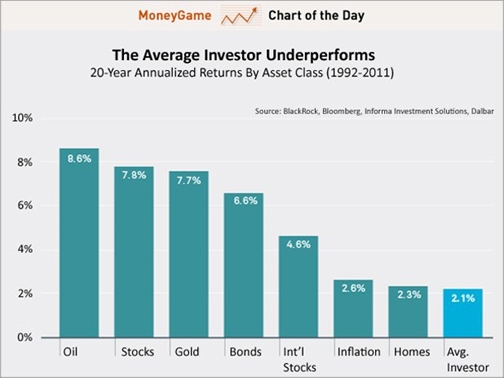

But then in the 1960’s and 70’s massive stock market gains made some companies believe that their pension plans were “over-funded” so they began raiding their pension plans but then the stock market took back the gains and the plans were underfunded so companies began switching to individual IRA’s and 401k plans. So then people were no longer guaranteed a secure retirement since it now depended on your individual contribution, as well as the company portion. Today Dennis Miller will look at some alternatives to save your retirement.

Can a Double-wide Save Your Retirement? Read More »