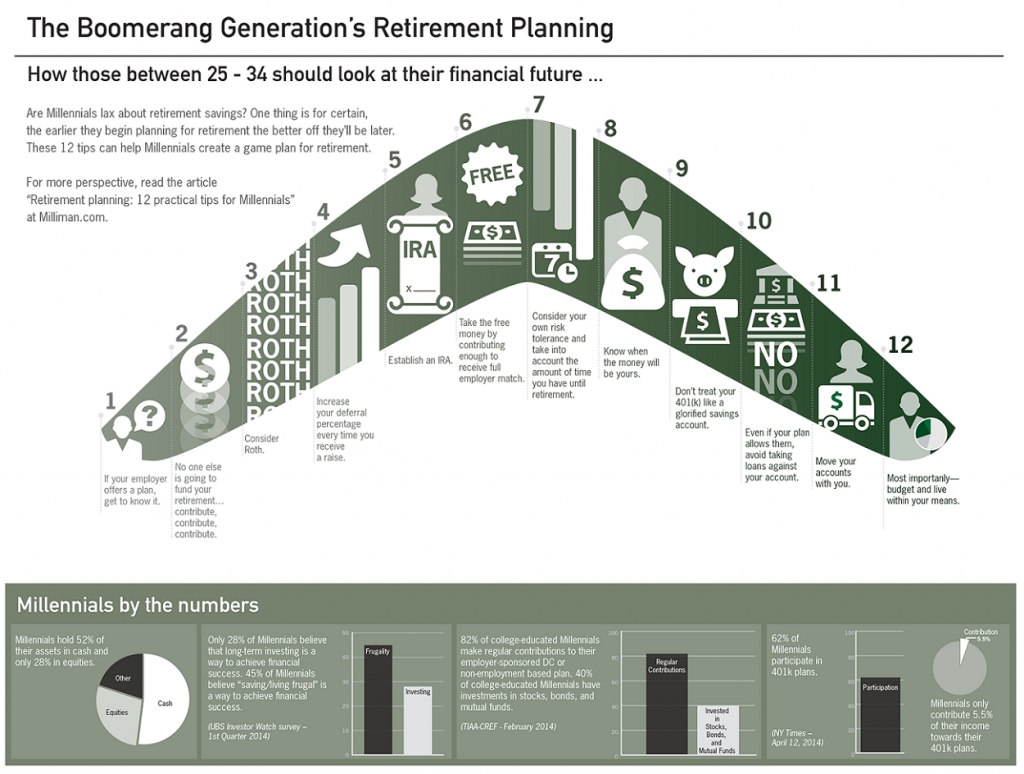

Recently, our friends at Milliman Employee Benefits created an infographic on retirement planning for the millennial generation.

Millennial’s parents were from the “boomer” generation and because so many of the millennial generation are returning to live with their parents they have gotten the nickname the “boomerang” generation. Of course, if you are living in your parent’s basement, retirement planning may be the last thing on your mind but as the economy improves and you get established you should certainly be planning to set some money aside for retirement. As we have said many times, the key elements to successful retirement planning are time, consistency and rate of return.

So the sooner you start the more time you will have for your money to grow. The next key of course is consistency which means that you need to have some money taken out of every paycheck. When you are first starting it is OK if the amount is small, the key is to get started and then increase your investment with every paycheck. After all, before the raise you were living on that amount so if you take half your raise and add it to your retirement fund you won’t miss it!

The final factor in growing your retirement fund is the rate of return. Currently, with interest rates low it is difficult to get a high rate of return from fixed income investments like bank accounts, CD’s, and even bonds.

So you should have a significant portion of your retirement funds in a diversified portfolio of stocks. Over the long term stocks should do well even if they have a few set-backs along the way. ~ Tim McMahon, editor.

Milliman Infographic: The Boomerang Generation’s Retirement Planning –