Recently as I was opening my mail I got a large envelope from my Credit Union and another one from AAA and interestingly both were trying to sell me Life Insurance. My first impulse was that I didn’t need any more Life Insurance and I consigned them to the same destination as most of my junk mail. But then I got to thinking about it and decided to do a bit of a comparison.

So after fishing them out of the trash I located the rate tables… then I realized that even though both were for life insurance, it wasn’t really comparing apples to apples. The Credit Union was offering me “Credit Union Life Insurance” which I assume is the same as “Savings Bank Life Insurance” and is basically just Term Life Insurance which is generally pure life insurance coverage with very few bells an whistles.

Credit Union Life Insurance

The sales pitch said I could apply for up to $150,000 of TruStage™ term Life insurance benefits to age 80 from CMFG Life Insurance Company. Since I’ve never heard of CMFG I jumped over to AM Best’s Insurance Rating page and found that Best gives them an “A” rating. But in ratings terminology “A” doesn’t always mean perfect. In this case, A++ and A+ are better than an “A” there are also A-, B++, B+ all of which AM Best considers “Secure” with the first two being “Superior”, the second two being “Excellent” and the third two being “Good”.

Three Levels of Insurance

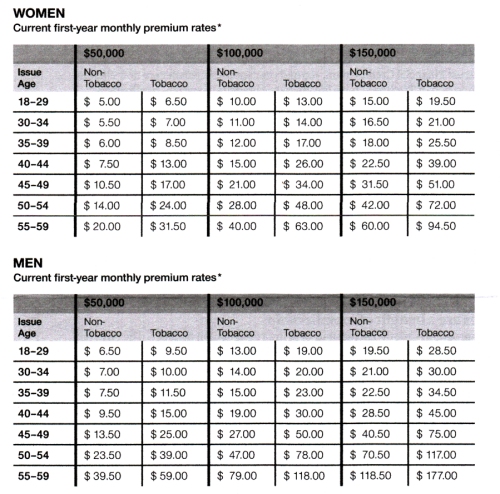

Next I found that they offered three levels of insurance $50,000 $100,000 and $150,000 broken down by gender, 5 year age groups and tobacco usage. A little reading told me that as I aged my rates would go up each time I entered a new age bracket. Personally I prefer something called “Level Term” which means you pay a little more when you are younger but the rates are fixed for the term of the policy (generally 10, 15, 20 or even 30 years). By looking at the table below we can see that since I’m a male non-smoker in the 55-59 year range $100,000 worth of life insurance would cost me $79 per month or $948 per year if I use their auto-pay plan.

AAA Life Insurance

And since the final 5 year rates on the Credit Union policy are from 75-80, it appears that from age 80-85 I would have no choice but to buy from AAA.

The first thing I noticed on the AAA insurance sales pitch was a “stamp” that said “No medical Exam Required” this may be great if you are really lazy and don’t want to answer eight questions or if one of your answers to those eight questions would get you denied coverage or perhaps, if your answer would get you “rated” i.e. you have to pay more due to poor health, etc.

We can see that if I had to answer the tobacco question “Yes” on the previous policy it would raise my monthly payment from $79 to $118 costing me $39 a month more and raising my annual bill $468 or about 50% higher. And I’m sure if I had to answer the AIDs question “Yes” I wouldn’t get coverage at any price.

As Much as You Want… Sort Of

As Much as You Want… Sort Of

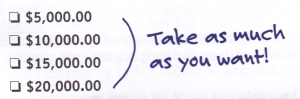

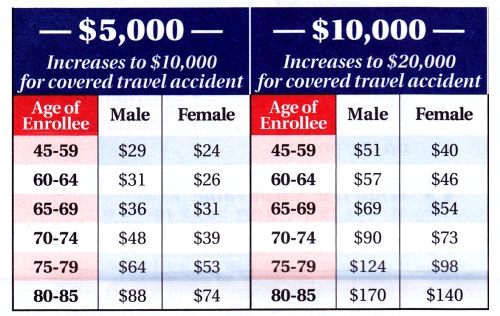

The next thing I noticed was in big bold letters “Take as much as you want” but the maximum listed was only $20,000 or less than half the lowest amount offered by the Credit Union. So we wouldn’t be able to get $100,000 coverage like in the other policy.

AM Best Rating

I’ve heard of AAA so I probably wouldn’t bother looking up their AM Best rating but to be fair we should probably look it up as well… Hmmm… “A-” OK slightly worse than the one offered by the Credit Union but not too bad.

How Does the Price Stack Up?

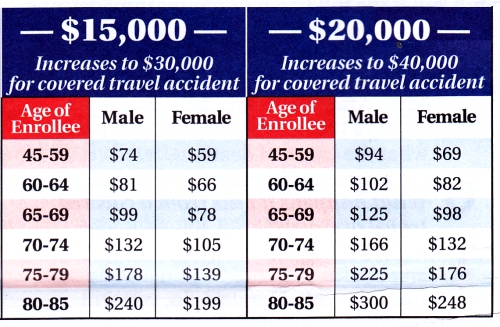

Since AAA doesn’t offer $100,000 what would happen if I bought five $20,000 policies? Of course this is just hypothetical since they probably wouldn’t sell me five policies but suppose they did?

Five Times the Coverage for Less Money

The credit union policy provides five times the coverage for less money… what’s up with that? Because AAA is guaranteeing coverage they know they are going to get all the smokers and all the Aids patients and those denied coverage by other companies, so providing coverage is going to cost them more, but 5 times more? Maybe they are just counting on people being ignorant or lazy? Don’t be one of them, be sure to compare prices and coverage before you send any money.

And remember guaranteed coverage means guaranteed higher premiums… it will cost you a lot more so only use it as a last resort, if you can’t get anything else. “Level Term” is probably cheaper in the long run than coverage that increases every five years, especially if you can lock in the rate at a fairly young age. Just remember that all “Term” policies are only good for a specific time period even if it is 30 years. After the term expires you will have to get a new policy and if your health is bad at that point you may be stuck getting a “guaranteed coverage policy” like the one offered by AAA.