Financial security is something that everyone desires. And if you’ve spent any time on this site you will know how important it is to plan for your future financially. One way many people invest for their future is through a plan like a 401k or an IRA that will allow them to grow their nest egg outside of their jobs.

The problem is that investing is tricky. It’s a realm filled with uncertainty.

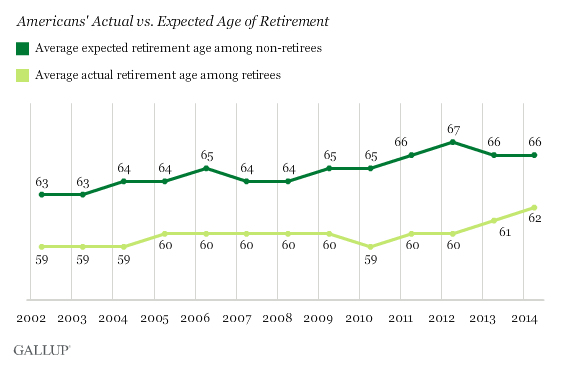

According to Gallup polls the average age of expected retirement in the United States has risen to 66 from 63 in 2002. That means that most Americans are less sure about their financial future than they were 13 years ago.

Let’s take a look at four types of investments you can make. This will allow you to grow your future with confidence.

1. Dividend Reinvestment Plans

According to Investopedia, “The word “DRIP” is an acronym for “dividend reinvestment plan”, but “DRIP” also happens to describe the way the plan works. With DRIPs, the dividends that an investor receives from a company go toward the purchase of more stock, making the investment in the company grow little by little.”

When you purchase a DRIP from a reliable company that has performed well with positive projections, you will find that your investment tends to grow. You pay few fees, and once you get started most companies that offer their stocks as DRIPs will allow you to occasionally purchase more DRIP stock at a discounted price or at least commission free.

You can utilize DRIPs to begin growing your investment portfolio and avoid commissions which eat into your investments. This is especially important when you are first starting out. If you are investing $20 at a time you certainly don’t want to be paying a $5 or $10 commission on it.

2. Your Home

While there are certain factors that can influence how your home’s value changes, your residence is generally something that acts as a sound investment over time.

The trick with utilizing your home as an investment vehicle is making sound decisions. One way is to use “sweat equity” that means buying a “fixer-upper” and adding your own time, labor and ingenuity to add value to your home (think HGTV).

According to How to Retire the Cheapskate Way by Jeff Yeager most successful early retirees tend to buy a less expensive home than they can afford (at least according to industry lending standards). They also tend to stay in those houses longer rather than “trading up” every few years and giving all that equity away to the real estate agent. (Although when you do buy or add to your real estate portfolio it pays to shop around not only for the best real estate deal but also for the best real estate agent. For instance, you may be able to save on commissions by using a Buyer Rebate Program like the one available from Reinvest Consultants.)

Jeff Yeager continues, “They also tend to pay off their mortgages early and buy homes that have the potential to generate income for them (i.e. a duplex).” A fairly new way generate rental income these days is through renting a spare room in your home via a website like airbnb.com.

Since buying a house is probably the biggest investment you will make in your lifetime, it pays to look at ways to get the best deal and make that home pay for itself.

3. Precious Metals

Precious metals like gold and silver can be a good investment vehicle, but the trick to making a confident investment is to know how they work. Gold is cyclical and so you need to buy it primarily at times when it is out of favor. The nice thing about Gold and silver is that you can buy it in any size increments to fit your budget. With the price of silver currently at $14.59 per ounce you can buy a silver dime for about $1.05. So for the price of a meal at McDonald’s you could get a pre-1964 Silver half dollar to start your silver hoard and then add to it bit-by-bit as you get a few dollars. On the other hand with Gold at $1123.80/oz if you have a few thousand to invest you can buy a couple of ounces of gold. But because gold is easily divisible you can also buy a ½, ¼ or even 1/10th of an ounce. Going the other way you can also buy 100 ounce bars if you can afford them!

One advantage of investing in precious metals is that they hold their value while currency depreciates in value. After all, a single 1964 dime is now worth over a dollar! And that is when the price of silver is low… imagine how much it might be worth when silver soars again.

4. Your Own Business

Contrary to popular belief, it doesn’t have to take an incredible amount of funds to start your own business. It only requires a certain amount of resourcefulness and the drive to perform.

Businesses built with these two ingredients can, over a period of five to ten years, generate incredible returns on today’s investments.

If you don’t want to create your own business, then consider a franchise or a part-time business. There are many ways to generate extra income, and the key to a secure retirement is to generate a source of passive income, whether that be stocks, real estate or a business. The key is to develop a system that will work for you so that rather than trading hours for dollars you can afford to spend your time on other pursuits while your personal money machine works for you.