Most people experience some level of fear when trying something new. And if that new thing has to do with your finances, it can seem daunting and risky. This is often the case when you first begin investing for retirement. How much you should you invest? What if you need the money before you retire? What should you invest in? How much is enough for a stable retired life? This article attempts to highlight some ways you can successfully wade through the murky waters of retirement investing.

Start Early

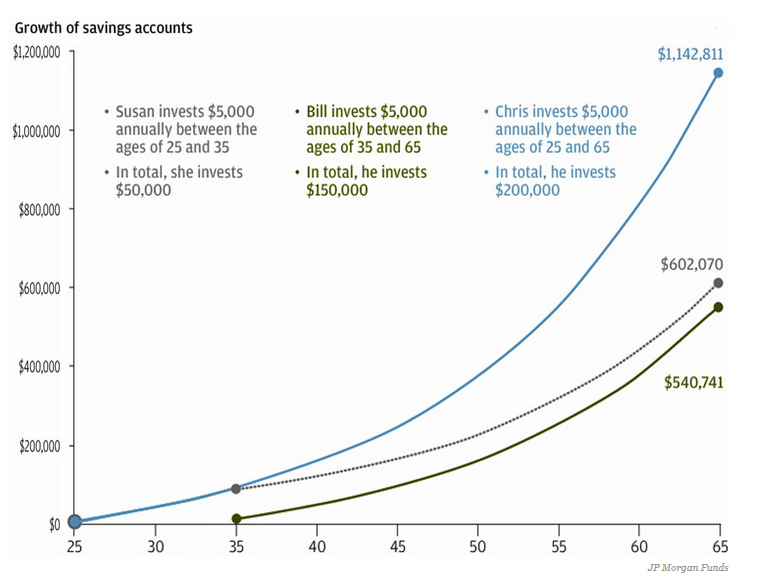

The best advice when it comes to investing for retirement, is to start investing early. This is because the power of compound interest is the most important component of the investing equation. For example, in JP Morgan’s “Retirement Guide” used the example of three people who all invest $5,000 per year in their retirement fund at a hypothetical 7% per year. Susan starts early but only invests from the age of 25 to 35 for a total investment of $50,000. Bill starts later but invests longer i.e. from the age of 35 to 65 for a total investment of $150,000 and Chris does both starting at 25 and continuing until 65.

At the age of 65, Bill’s $150,000 has grown more than 3½ times to $540,741. Interestingly, by starting early and having more time to compound but investing only 10 years Susan actually ends up with more than Bill her $50,000 grows to $602,070 multiplying over 12 times. For the first ten years Chris’ investments track Susan’s but when she stops investing Chris’ funds diverge sharply and end up at $1,142,811 when he turns 65.

Invest Consistently

In addition to investing early Chis’ other advantage is that he continues to invest consistently. One mistake new investors make, is trying to time the stock market. More often than not, the market swings up and down wildly in price and inexperienced investors get greedy when the market is high and fearful when it is low (the exact opposite of what they should be doing).

The better method of investing is to make regular investments with every paycheck no matter what the market is doing. This system is called “Dollar Cost Averaging” it involves investing a certain dollar amount periodically. It avoids the emotion of trying to time the market and in effect makes you a market timing genius because you buy more shares when the price is low and fewer shares when the price is high.

It is best for a beginning investor to purchase investments that give broad market exposure like ETFs or mutual funds, rather than trying to pick individual stocks.

Make Your Tax Decisions

The major advantage of Retirement Accounts is that they provide certain tax benefits. A Traditional IRA for instance allows you to use “before tax money” to invest. This means that Uncle Sam is in effect contributing to your IRA so you are able to start growing your money faster. The down-side of course is you have to pay taxes when you withdraw the money, so instead of paying taxes on his $200,000 investment Chris will have to pay taxes on $1,142,811.

Chris’ alternative would have been to invest in a ROTH IRA which is made with “after-tax money” the advantage is that it grows tax free and he doesn’t have to pay taxes when he withdraws the money. The down-side of a ROTH IRA is that if money is tight during the beginning, Chris might not have had as much money to invest (since some of it went to paying taxes) so it wouldn’t have grown to $1,142,811. If Chris had enough money so that he could pay the taxes and still invest the full $5,000 the Roth would be a better choice in the long run.

The most important thing for you to decide early on is, would you rather pay taxes on the front end of your investing or on the back end once the money has grown? It may seem like a simple problem to some, but the answer can carry many implications that one often doesn’t consider. It is wise to speak with a financial adviser at a wealth management institution such as Vanguard, State Bank of Cross Plains, Schwab, or others before deciding which type of retirement account(s) you go with.