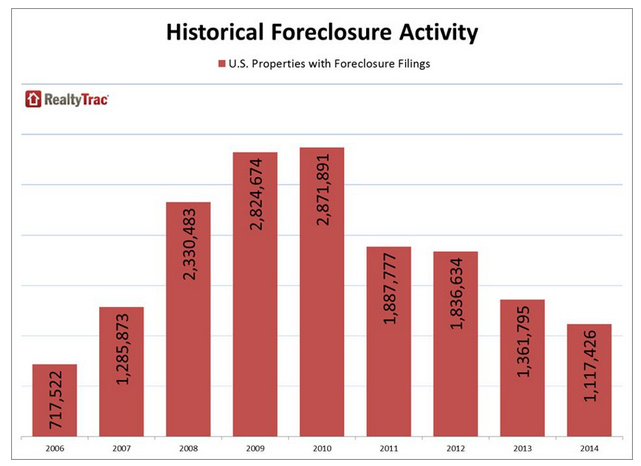

Buying a home is the biggest single purchase most people will make in their entire lives and so it is also an opportunity to make one of the biggest mistakes as people learned beginning in 2008. Up until then the new millenium only included rising home prices and so even a bad deal would come out good if you waited long enough. But then according to RealtyTrac, in 2007 the tide began to turn and over a million foreclosure filings were recorded. Fortunately, the actual number of completed foreclosures was roughly half that amount, but that was just the beginning. Foreclosure filings almost tripled to 2,871,891 by 2010.

In most cases, you are going to need a mortgage to finance the cost of purchasing your next home. And that is where the trouble begins. Here are a few things borrowers should consider before taking out a mortgage to ensure that they are ready for the responsibility of paying off that loan.

In most cases, you are going to need a mortgage to finance the cost of purchasing your next home. And that is where the trouble begins. Here are a few things borrowers should consider before taking out a mortgage to ensure that they are ready for the responsibility of paying off that loan.

Do You Have a Stable Job?

When you fill out a mortgage application, you must tell the lender where you are employed, how long you have been employed and how much money you make each year. While your odds of being approved for an application are relatively high if you have had the same job for two or more years, you should consider what happens after you get the loan. It may be a good idea to think about what you would do if you lost your job or decided to change careers before the loan was paid off.

How Much Will the Home Appreciate in Value?

Before buying a home, you should have a good idea as to whether it will appreciate in value over time. Buying in a good neighborhood is a start. Additionally, you should have a good idea as to whether or not the home could be sold for what it is worth and in a timely manner. This is because any appreciation is on paper only until or unless you are able to liquidate the property.Some areas are worse than others and even some states are worse than others. Currently according to Statisticsbrain the foreclosure rate in New Jersey is the highest in the country with 1 out of every 451 homes in foreclosure. Nevada is second with 1 out of ever 555 homes in foreclosure. The national average is 1 out of every 1,210. Areas with high foreclosure rates mean that there are more homes on the market and this drives prices down and gives you more competition should you need to sell.

Real estate agents, from Re/Max of Boulder, Inc, recommend that prior to closing on any deal to buy a home, you should discuss recent home sales in the area and projected appreciation rates over the next several years.

How Will You Use the Home?

How you plan on using the home will play a role in determining which mortgage is best for you. For instance, those who plan on selling the home within five years or using it as a rental may want a mortgage with an adjustable rate as the initial interest rate may be lower than market averages. However, those who plan on staying in the home forever may want a loan with a fixed rate because the loan payment will never change and rising interest rates could change an affordable mortgage into a disaster waiting to happen.

Don’t Forget the Hidden Expenses

Over the long run a home purchase acts like a forced savings plan. You have to pay your mortgage every month and so over the years you build equity… so by the time retirement rolls around you should own your home free and clear. At that point you could “downsize” and take a nice chunk of equity out to help fund your retirement. But there are hidden costs to home ownership, things like maintenance, real estate taxes, and insurance also need to be paid. So be sure you have enough income to cover these as well as just barely having enough to pay the mortgage.

Buying a home is an exciting event in an individual’s life. However it is important that anyone who buys a home is ready for the responsibility that comes with paying a mortgage for anywhere from 10 to 30 years into the future.