Owning your first home is a major milestone that you should be proud of. However, there are plenty of things you need to do to prepare for it. This includes signing a mortgage, which is a loan you’ll pay back on a monthly basis to the bank you borrowed money from to pay for the house. In order to be a responsible homeowner, you need to have a solid understanding of your mortgage.

You first need to understand how a mortgage works… there’s more to it than just the fact that the bank gives you money to buy the house and you pay it back with interest. According to the U.S. Consumer Finance Protection Bureau, “In the beginning, you owe more interest, because your loan balance is still high. So most of your monthly payment goes to pay the interest, and a little bit goes to paying off the principal. Over time, as you pay down the principal, you owe less interest each month, because your loan balance is lower. So, more of your monthly payment goes to paying down the principal. Near the end of the loan, you owe much less interest, and most of your payment goes to pay off the last of the principal. This process is known as amortization.”

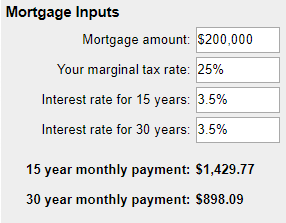

Thus reducing the principal balance early through either a higher down payment, or through frequent early payments toward principal will have the greatest effect on reducing the overall interest that you pay. Also shortening the term of the loan will drastically reduce the interest amount. For instance, a 15 year mortgage will only be slightly more expensive on a monthly basis than a 30 year mortgage because interest will make up such a big portion of the longer loan. Many mortgage companies offer a 15 vs 30 year mortgage calculator like this one from Premium Mortgage Corp that can help you determine if you can afford the higher payments of a 15 year mortgage. For instance, if we use the following inputs:

A $200,000 mortgage at 3.5% with a 15 year term saves you $65,955, but is $532 more per month. Obviously, getting an extra almost $66,000 in savings is a good deal but you have to be able to come up with an extra $532 every month. Most mortgages allow you to prepay so you could lock in the lower payment but still pay extra toward principal every month (just be sure the money is going to principal and not prepaying the next month’s payment).

Here are three tips for navigating your first home mortgage.

Read the fine print

A mortgage agreement is a legally-binding document. Therefore, it’s imperative that you have a thorough grasp on how it works before you even think about picking up a pen to sign it. You can’t just skim through and expect to understand it. While all mortgages are ostensibly similar, each one will have its own provisions, as drafted by your lender. A bank representative will tell you about the main points, but you should still do research on your own. Look through it carefully and ask as many questions as possible. This isn’t a matter of paranoia. Instead, it’s you showing how responsible you are and how seriously you’re taking this incredibly important investment.

Negotiate rates

Just because you’re offered a certain amount for a mortgage doesn’t mean you’re obligated to immediately accept it. You might receive one offer from a bank, then discover that they were seriously undercutting you in terms of value, based on your credit history and reports from other banks or lenders you spoke with. While you want to be as reasonable as possible when it comes to negotiating, you should also be firm. If your lender makes you an offer that you believe to be unfair and you can make the case for why that’s so, you should definitely speak up.

Use a mortgage company

Mortgages can be tricky, especially for people who are new to buying homes. Instead of stressing yourself out unnecessarily, you can work with a mortgage company to find a mortgage that you can afford. Loan officers will work with you to help you find the absolute best mortgage possible.

When buying a house, you don’t want to rush the process. The same goes for going through a mortgage. It’s vitally important that you proceed carefully. With these tips, you can get through your first home mortgage with success.