Parenting a teenager involves transitioning your child into adulthood. Unfortunately, the school system today doesn’t teach practical skills like budgeting. But one of the biggest things that will help ensure a secure financial future for your teenager, is learning how to create a budget. Managing their money is crucial in order for them to understand the value of it. Here are four tips on how parents can help their teens learn to manage their money.

Consider Their Income

The budget for a teenager might be less complicated than that for an adult, but it shouldn’t be taken any less seriously. When starting your teenager’s budget, you should examine their sources of money. They might have a part-time job, a weekly allowance, or both. You should get an estimate of how much they make on a weekly basis. This might fluctuate, but it should some general consistency. This can help you decide how best to direct their money.

Buying a New Car

When it comes time to get a new car (either for yourself or for the teenager) this is the perfect way for your teen to learn about budgeting and making wise purchases. It requires them to prepare for all kinds of scenarios, such as paying for gas and insurance as well as saving for emergencies such as repairs. A new car, doesn’t need to be incredibly expensive either. You can work with your teen to find one that’s reliable and efficient, teach them how to shop for a vehicle that has good ratings from places like Consumer Reports and then go online and search the local car dealer websites for the best deals.

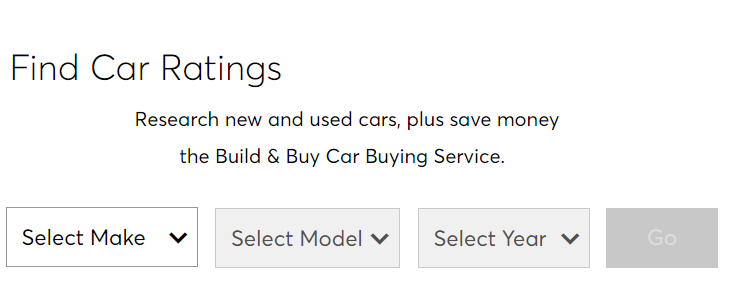

Some car websites like Young Automotive Group, actually have a search tool that lets you check ratings. It might look something like this:

Once you select the vehicle it offers the option to subscribe and get detailed info about the vehicle from Consumer Reports.

Examine Expenses

Your teen might not be paying the bills, but that doesn’t mean they can’t help you pay yours. If they see how much you make and then how much goes out to cover bills like your rent or mortgage, automotive expenses, food, etc. they might be less inclined to ask for money and more willing to work to earn their own.

Teach Them Savings

Teenagers might feel the urge to spend money as soon as they receive it. However, doing so is a bad habit that will cause them to waste money when they enter adulthood. You need to show them the benefits of self-discipline as it comes to money.

While teens might be reluctant to save a sizable portion of their paycheck or allowance, you can help them do so in a gradual fashion. For instance, you can have them put aside ten dollars one week and then eleven dollars the next week.

You might also like:

- Parent Problems: 4 Thrifty Ways to Prepare Yourself for Teenagers

- 3 Keys to Teaching Your Kids Financial Literacy

- How Much Does It Really Cost to Raise a Child?

- Give Your Kids or Grandkids a Financial Boost