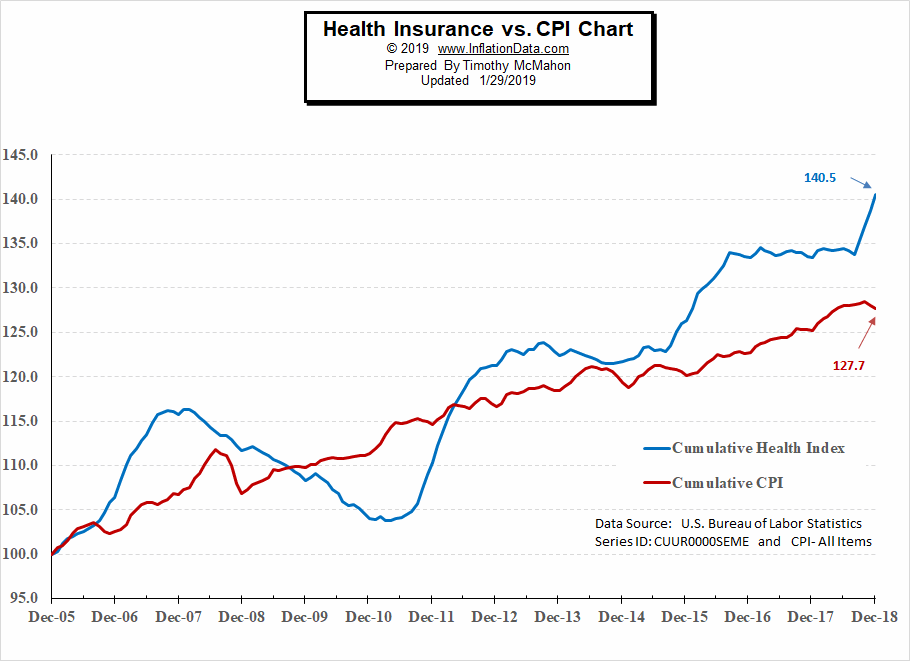

Even if you have insurance, medical care costs can be expensive. Many policies have deductibles and co-pays that you have to cover out of your own pocket. And to make matters worse health insurance costs themselves are increasing. As a matter of fact, health insurance costs are up over 40% since 2005 compared to overall prices being up “only” about 28% as you can see from this chart from InflationData.

Research All of Your Insurance Plan Choices

It’s crucial for families to all make informed and thoughtful insurance coverage choices. Research any and all insurance plans that are accessible to you and to the rest of your family members. Don’t commit to any until you have done a lot of studying. Ask all the people around you if they can recommend insurance plans that work well for them as well. The key is to decide on a deductible and co-pay that you can afford. All policies also have a maximum out of pocket limit that you should take into consideration.

Assess Your Medical Bills in Detail

People often make the mistake of getting lazy about their bill evaluations. You should never do this with your healthcare expenses. Meticulously assess any and all healthcare bills that you receive in the mail. If you notice any billing errors, notify the right professionals immediately. The last thing you want is to put unnecessary money into your healthcare needs. Suppose you develop a bad infection and regular antibiotics aren’t doing the trick. Your doctor might suggest an IV pump to administer a regular dose of antibiotics. No big deal right? Wrong! One of these simple pumps cost from $2,380 to $5,982. Without insurance you would be stuck with the whole bill. And depending on your insurance plan, your deductible and co-pay you may end up paying for a portion or even all of it anyway. But even if you are stuck with the full price you should find out how much the insurance company says they are worth, because often the provider will charge you the “list price” and then the insurance company will tell them “sorry we are only paying this much”. And the provider accepts that. So if the insurance company can buy one for $2,380 make sure you aren’t paying $5,982! Most providers will settle for what the insurance company would have paid them, if you simply ask.

Be Well-Versed in Your Benefits

Families should take proactive approaches to comprehending all of their healthcare benefits. If you want to be able to make the most out of your healthcare coverage, you should take the time to learn all you can about your benefits. The more you understand the benefits that are offered to you, the easier it will be for you to make intelligent choices and perhaps even decrease your costs considerably.

Find out about Generic Medication Options

Purchasing generic medications can help people slash their healthcare expenses in significant ways. If you want to reduce your medicine costs quite dramatically, it can be optimal to go for generic medications. These medications are in many cases just like their brand name counterparts. They’re often equally effective as well plus many insurance companies are now charging lower co-pays if you choose to go with a generic. For instance, the name brand drug might cost $50 and your insurance pays $40 and your co-pay is $10 but if you choose a generic that costs $23 your co-pay might be only $1. So both your insurance company and you both benefit.

You should never scrimp on healthcare requirements. That doesn’t mean that you should play the fool, either, though. If you want to handle your healthcare costs, there are various methods that can work beautifully. Be sure to learn everything you can about them and how they function.

You might also like: