Saving extra money can be simple if you have a plan. Once this has been established, be patient to stay committed to your goals. Here are some ways to cut back to have more money in your pocket.

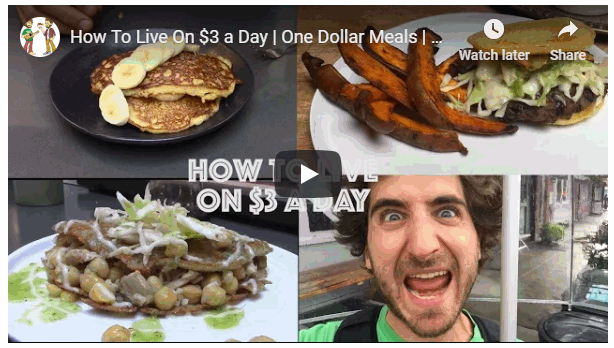

Prepare Your Own Meals

Dining out at trendy restaurants can take a toll on someone’s budget. For this reason, you might want to consider eating at home instead. You don’t have to be a chef to make delicious meals. If you don’t enjoy cooking, you can make a sandwich or salad. Research easy recipes online or use a cookbook. When you purchase groceries, make smart choices. Instead of splurging on unhealthy items, you can buy something more satisfying. Even if you are wise about your grocery shopping during the week, this can free up some extra money you can spend on eating at your favorite restaurants on the weekend.

Have Free Fun

You don’t have to overspend on amusement parks, vacations or movie tickets. Try having a family game night or get creative with arts and crafts. Volunteering for a worthy cause can be meaningful and fun if you genuinely enjoy changing the world. View exhibits at a free museum or take your dog for a walk.

Save Energy

In their article Tips for Saving Money Aggressive Mechanical Contractors, Inc. recommends. “Replacing a dirty air filter with a new one helps your HVAC system run more efficiently, which lowers your energy bills.” They also remind us “Older windows aren’t as energy-efficient as newer ones. New windows have features that help keep heated air in your home and lower the risk of drafts. You should also check around your windows for any gaps or cracks. Sealing these up is another way of saving money on your energy bills, since it stops cold air from coming in and heated air from escaping.” A tube of caulk can cost less than $5 and reduce your heating bills by that much in just a few days it could possibly be one of the best investments you ever make.

Driving less often cannot only save you money, but it can help the planet as well. Ride your bike, go for a walk, use public transportation, carpool or commit to staying home more often. Your vehicle will not contribute as much pollution to the environment, while you’ll save extra on gas.

Eliminate Other Purchases

If you don’t need something right now, then maybe you can do without it until you have more money. Getting your nails done or your hair cut can likely wait a month or two. Saving up for something you really want can be exciting and rewarding. Cancel gym memberships, magazine subscriptions and other unnecessary services. You can exercise by doing yoga, jogging or walking a nature trail. Plus, you won’t have to worry about paying extra bills each month.

Managing your budget wisely has plenty of benefits. These are peace of mind, motivation to succeed and the ability to put your life back in order. Besides this, you’ll have the freedom to spend money for a more independent lifestyle.

You might also Enjoy: