Cars are not just a mode of transportation. Now, they are a status symbol. For some, they signify passion, for others it signifies their personality or their desire to help the environment. You will see various car enthusiasts who know different automobiles in and out and others who update to new vehicles every other year!

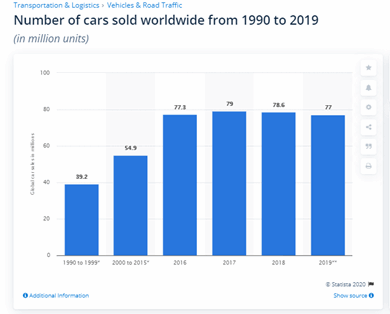

According to Statista, 77 million vehicles were sold in 2019 alone! Although the number of new vehicles sold appears to be leveling off many people still dream of getting their first car. Often that involves buying a used vehicle.

If you are thinking of jumping on the bandwagon and purchasing your first car, know that you are not alone.

A first-time car buyer journey is quite an adventure. According to Pure Cars, an average car shopper considers at least 14 brands during the purchasing process, but only ends up visiting two dealerships at most before sealing the deal.

To reach this stage of final purchase, you must first go through a series of steps to ensure that the first car you buy is the right one for you. Here are tips that will work along the way.

Decide whether you want a new car or a used one

As per Trusted Choice, every new car loses at least 11 percent of its original value the moment you drive away with it from the dealership. This means you can decide to sell your vehicle the next day, and you will merely get 89 percent of the value you spent on it the day earlier!

Not to mention that every year following your purchase till the fifty years, the value of your automobile depreciates by 15 to 25 percent. And what happens after five years? Well, the car values around 37 percent of the original price!

There are two ways to look at this. Firstly, as a buyer of a new car, it’s crucial to know that you should never look at your car as a mode of investment. Secondly, it showcases how inexpensive used cars are.

Unless you have enough resources to purchase a vehicle without the need for loans, it is advised that you buy a used car.

Set a budget

Whether you decide to buy cars with bitcoin or with cash, the fact remains that the purchase will leave a dent on your wallet. The question arises, can you make this purchase without straining your resources too much?

To make sure you don’t overspend and hence regret it later on, always decide on a budget first and then think about which car you wish to buy.

Don’t just consider the cost of owning a car. Instead, look at the expenses that it will bring along with it as well. This includes fuel, maintenance, and insurance cost. Begin your budgeting by first deducting all mandatory expenses from your disposal income.

This can include items like rent/mortgage, utilities, food expenses, health insurance, and your spending allowance. The amount that you have left after it is the money you can spend on purchasing and owning a car.

This amount is what you can afford for a cumulative of your car payment installment, fuel, insurance, and maintenance cost. So, don’t think of this amount as a ceiling for your budget. Do your research and deduct other associated expenses to find out the value you can spend on the actual purchase process.

Research

Just because a given car seems like a lucrative choice in an advert doesn’t mean it is the best one for you. Similarly, you shouldn’t just go by a car dealers’ advice either. Remember, his job is to make the sale.

Now that a plethora of information is available online, consumers can easily take control of the purchasing process. Research and compare different cars. Do so by reading up reviews of other consumers, analyzing the specifications of each option, and using various platforms for searching a car.

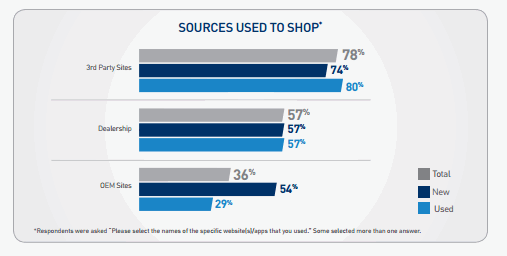

This can include 3rd party sites, dealerships, and OEM sites. As per AutoTrader, now 3rd party sites are often sought for both new and old car purchases, with over 78 percent of users opting for the platform.

By considering three different platforms, you can easily compare prices and assess which option is giving you the best deal.

Pick a financing option

Do you want to lease a car or purchase one upfront?

The answer to this depends on your budget, your desired automobile, and your long-term plan.

Generally, for first-time buyers, leasing might seem like a tempting option. After all, mostly, this is the only way one can afford a new car despite a limited budget. However, leasing has its limitations.

You need to remember that the leasing contract lasts for years. So, between those times, if you decide that your vehicle is not matching with your expectations, there is nothing you can do about it.

Additionally, relocation to a new state can also be a problem, depending on the dealership you have chosen. Some don’t allow users to relocate before paying their dues. Others might put restrictions on the miles driven per year.

Apart from leasing a car, there are various other financing options you can consider. This includes auto loans and credit unions. If you don’t have the resources to buy your car upfront, you might want to consider other financing options instead of leasing.

Always Test Drive

It doesn’t matter whether you have conducted thorough research about a given vehicle and feel that it is the best one for you. It doesn’t matter how many consumers have praised it for its performance and specifications.

At the end of the day, it is your perception and opinion about the car that will decide whether it is the right one for you. And to form the correct opinion, you need to test drive it. See if you are comfortable with the driving experience or not. You will be surprised by your final verdict!

Ending Remarks

With these five tips, you are ready to purchase your first car. Pick wisely, and soon you will be ready to drive away in your new ride.

You might also like: