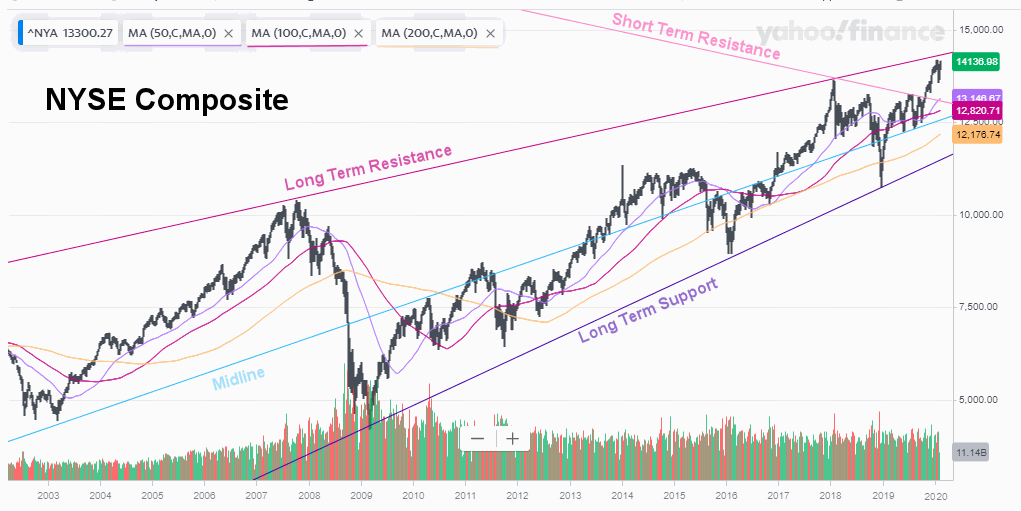

Wall Street continues its trek into record territory – Can it last?

Wall Street is recording its biggest bullish cycle ever. New highs are being reached during every new trading session – which is great news for those who trade the price movements of indices. While 2020 had a great beginning, many investors worry that Wall Street might not be able to keep up with this pace – especially with so many geopolitical and global economic uncertainties. Can the bull run last?

Better-than-expected earnings reports and solid economic data in the US are supporting the rise of American indices

Of the 324 companies listed on the S&P 500 that have already published their earnings, 71% did better than expected. According to IBES data from Refinitiv, this performance is well above the long-term average of 65%, which is supporting the rise of three main American indices: the Dow Jones Industrial Average, the S&P 500 and the Nasdaq 100.

US weekly jobless claims have dropped to its lowest level in 9-months, while payroll employment rose more than expected to 225,000 in January – higher than the monthly average gain of 175,000 from last year. The American economy grew 2.3% for the entire year. And the U.S. and China finally signed a “phase one” trade deal last month after a long period of geopolitical tensions.

Therefore, near-term growth prospects look good. However, a new study from MIT Sloan School of Management and State Street Associate states that there’s a 70% chance of recession in the next six months.

Downward Global Risk is Still Present

‘The researchers analyzed four market factors — industrial production, nonfarm payrolls, stock market return and the slope of the yield curve — on a monthly basis. They then measured how the current relationship between the four metrics compares to historical readings,’ explained CNBC.

‘Looking at data back to 1916, the researchers said that the index was a reliable recession indicator since it rose leading up to every prior recession. They found that when the index topped 70%, the likelihood of a recession in the next six months rose to 70%’, added the business and financial newspaper.

Many factors will continue to weigh on the global economic activity this year, which might pose new challenges to the stock market rise.

‘Downside risks remain prominent, including rising geopolitical tensions, notably between the United States and Iran, intensifying social unrest, further worsening of relations between the United States and its trading partners, and deepening economic frictions between other countries,’ stated the IMF in its last World Economic Outlook.

Let’s Not Forget about the Coronavirus.

The death toll has now climbed above 1,000. The coronavirus outbreak could trim China’s growth by as much as 1 percentage point in 2020. The unknown economic impact of the virus on China’s economy and subsequently the global economy will definitely affect other markets. The oil market is already greatly affected, as demand from China has dropped, which is of great importance as the country is the world’s largest oil and natural gas importer.

A Final Note

When investing in the stock market, remember to always diversify your portfolio to avoid risking your capital in one asset class or one type of asset. It’s also important to do your research and understand the relationship between economic cycles and market cycles. This way, you will be able to better protect your capital and increase your profit by rebalancing your portfolio accordingly to take advantage of the stock market and economic cycle you’re in.

You might also like: