It is an unfortunate fact that navigating the probate process can be very complex, and many people don’t know how to handle a loved one’s estate after they pass away. Luckily, with a little bit of research and some professional legal help, you should be able to quickly overcome those challenges so that you can move on with your life.

Address the Issue Early On

One of the best things that you can do for your family and loved ones is come up with an estate plan early on. Waiting until you are extremely ill or injured is only going to make this legal process much more complicated than it needs to be. There are legal ways to simplify the process if handled beforehand, such as putting all assets into “Joint Custody” accounts. In this type of account if any of the owners pass away the rest of the owners still own it without any changes necessary. If any of the heirs have a substance abuse issue or other special needs you should definately contact an attorney to properly provide for asset transfer and create a will. This will vastly simplify the process for later on.

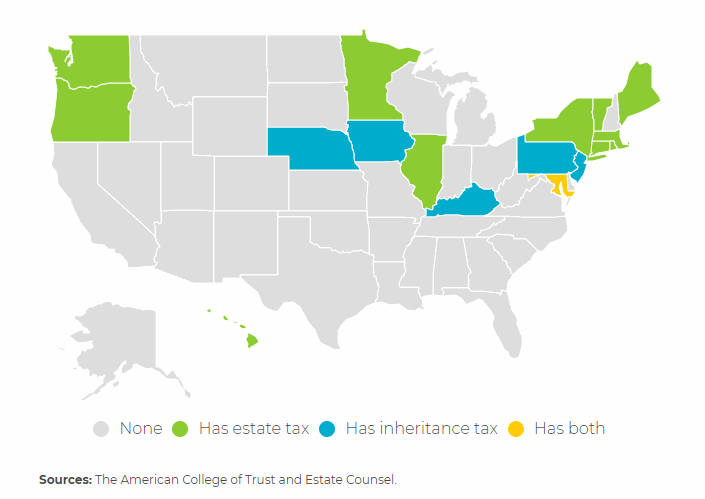

One thing most Americans don’t need to worry about is Death Taxes (aka. Estate Tax) unless you own a Farm or Business. According to an excellent article by Nerdwallet, “Estate tax is a tax on the transfer of property after death. The federal estate tax generally applies when a person’s assets exceed $11.4 million in 2019 and $11.58 million in 2020 at the time of death. The estate tax rate can be up to 40%. Some states also assess estate tax. Property left to a surviving spouse generally isn’t subject to the estate tax… A few states impose inheritance taxes, which are different in that they are paid by heirs rather than by the deceased’s estate.” States have much lower thresholds than the Federal Government. They range from $1 million in Oregon to $5.7 million in Maine. Fortunately, a surviving spouse is exempt from inheritance tax in all states.

Here are the states that have estate taxes, inheritance taxes or both in 2020.

Address the Immediate Needs

After a death occurs, there are a few steps that you will need to take before you even consider going through the probate process. That includes transferring the body to a mortuary, notifying loved ones, taking care of pets, and obtaining a pronouncement of death. You might also have to ensure that their dependents are safe and being looked after. That might include a minor, an aging spouse, or an adult relative with disabilities.

Don’t Make Any Rushed Decisions

It is an unfortunate fact that financial issues can become very murky following a death, and that is one of the reasons why some families immediately try to take ownership of various possessions. Unfortunately, those rushed decisions often make the probate process much more stressful and lengthy than it needs to be. Instead of taking ownership or starting feuds with other family members, you should contact an attorney to explore your options. Often financial advisors will try to pressure you into making investment decisions. This is NOT the time to be changing your investment portfolio. Grief counselors and independent advisors suggest that it is best to put off these decisions for a year or so until you are in a better position to make such important decisions.

Contact an Attorney

Working with an experienced probate attorney is going to make your life much easier in the coming weeks and months. One of those legal professionals can look over all of the available data to determine how all of the assets are going to be distributed. They can also take care of other time-consuming tasks like paying off old debts and figuring out end-of-life expenses.

This process is never going to be easy, but there are some steps that you can take to make your life as stress-free as possible while settling a loved one’s estate. With a solid plan in place, you will be able to avoid some of the most common mistakes that are made following the death of a loved one.

You might also like:

- Planning Your Estate: 6 Things To Remember

- It’s Never Too Early to Begin Preparing for Retirement Financially

- Handling the Financial Burden of a Death in the Family

Save Your Family Hundreds of Dollars, Choose the Right Funeral Home