We all desire peace of mind, but most of us don’t seek it proactively. The American ethos of staying positive and working hard towards achieving what is best for us often makes us forget about certain scenarios that are grounded in reality. We can’t play ostrich, dismissing the potential of encountering life emergencies. Although this may not be pleasant to think about, but it really needs to be considered. With this in mind, let’s review a few protective measures you can take against the unexpected:

Emergency Cash Reserves

You should do everything in your power to put away a monetary amount equivalent to three to six months of household expenses. You may need to skip going to Starbucks or to the movies for a while in order to build this personal emergency fund, but it will be worth it. Keep in mind that many mortgage lenders these days will ask for proof of emergency cash reserves in order to approve a loan.

Home Security System

You never know when someone might decide they need your stuff more than you do. So you should give some thought to how you are going to secure your stuff. Depending on the neighborhood you live in, you may decide more thought to security is necessary. But even the best neighborhoods have break-ins. And really high-priced neighborhoods may be prime targets.

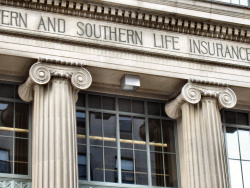

Life Insurance

Contrary to what many people believe, life insurance is not just necessary for people who work dangerous jobs. Depending on the kind of policy you choose, you may be able to combine it with a financial plan for retirement, and you may also be able to tap into some of the proceeds if you need emergency cash as long as there is a built-in saving or investment feature i.e. “whole life”. Some of these features add significant costs to a policy. If you are young and healthy you might want straight coverage i.e. “term” life insurance.

Full Coverage and Comprehensive Auto Insurance

If you are the kind of driver who sticks with the minimum auto insurance mandated by your state so that you can update your registration, you are hardly alone. Most Americans opt to get the cheapest insurance premium they can, but then they are surprised when they need to file a claim and realize how little coverage is provided. Upgrading to a full coverage policy with comprehensive features will not always result in excessively high premiums; depending on the insurer, you may even get perks such as free roadside assistance, a temporary rental car, and substantial discounts on other policies.

Home Insurance With Umbrella Coverage

Standard home insurance policies mostly protect against fires, but did you know that they can be easily upgraded to protect against losses such as civil lawsuits? Umbrella coverage is designed to provide coverage against unforeseen events such as lawsuits, house guests getting injured during their visit, or even if your dog bites the neighbor. When you get an insurance quote for umbrella coverage, you will see that your home policy premium does not go up that much.

In the end, you will never be able to know what the future may bring, which is why you should always be ready to face emergencies. When you are able to secure the protective strategies mentioned above, you will very likely sleep better at night.

You might also like:

- Benefits of Working With an Independent Insurance Agent

- Reassessing Your Insurance Coverage: Are You Protected in Case of an Emergency?

- Tips for Buying Life Insurance for Young Families

- 4 Life Hacks to Get the Best Payout From Insurance Claims

- What You Need to Know about Different Types of Homeowners Insurance

- 3 Ways to Pay Less for Insurance

- The Insurance You Need to Protect Your Family

- Things to Consider Adding to Your Auto Insurance

- When Should You Get Life Insurance?

- What to Consider When Shopping for Health Insurance

- 4 Things to Know Before Buying Car Insurance

- When is the Right Time to Buy Life Insurance?