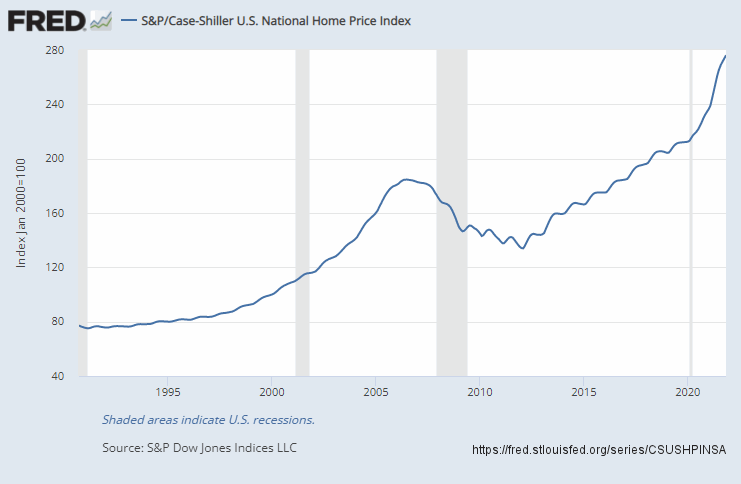

Everyone knows that house prices have skyrocketed in the last couple of years. In the following chart, we can see the “Case/Shiller housing index. They’ve set the index to 100 in the year 2000. Just six years later, the index was above 184, i.e., an 84% increase in a few years.

So we can see that around the new millennium, housing prices started going “parabolic,” i.e., they curved almost straight up. The common refrain was “housing prices always go up”. And then the economy fell apart, and everything came crashing down, including housing prices. By 2012 the index was back down to 134, i.e., a 27% loss. 184-134=50 and 50/184=27%. So obviously, housing prices don’t “always” go up. Generally, over time housing prices do go up with inflation. With housing prices once again going up parabolically, we might consider selling and using the gains to pay off debt and then buy again once housing prices are lower.

About a year ago, we published an article entitled 7 Benefits to Downsizing, which is one approach to reducing debt. In the following article, we will look at whether Selling a House to Pay off Debt is a Good Idea.

Is Selling A House To Pay Off Debt A Good Idea

Working to pay off debt feels endless for most people, so many look for various ways to speed up the process. For instance, some people look for a second job while some sell things. Even selling a house to pay off debt is not an uncommon practice. However, it’s not always the best solution. You, of course, have to consider moving costs, and you still need a place to live, so you will have rental expenses as well. You need to weigh the options before putting the “For Sale” sign on your lawn. To help you decide whether selling your home is the right financial move for you, we’ve prepared a list of things to consider before making your call. On top of that, in this article, we’ll cover scenarios when selling your property to pay off debt is a good idea.

What to consider when selling a house to pay off debt?

Selling your home is a huge decision that shouldn’t be rushed. Even if you are in a bad financial situation, you need to weigh this option for paying off debt carefully. After all, selling your home also implies moving and settling in a more affordable place.

Remember, there are also plenty of ways to make money with your house, and you should consider them before definitely deciding to list your home. Before making a final decision, make sure to ask your self following questions:

1) Are you going to earn enough profit from the sale?

Even though selling your house will help you get rid of a large chunk of debt, it may not completely set you free. Even completely sorting out your debt doesn’t mean anything if you don’t change your financial habits and create a realistic savings plan. If you skip these steps, you are risking ending up back where you started. It might go even worse – you can end up having to sell your house at a loss and face further financial troubles.

2) Can you refinance instead of selling?

One option to consider instead of selling is to refinance your mortgage. If you can get a lower interest rate or a longer-term you can reduce your monthly payments and use the extra money to pay down your debt.

3) How much is the rent in your area?

Selling your home might leave you debt-free, but you’ll also be home-free. You’ll need to find a more affordable living option and, therefore, consider rental costs in your area. You don’t want to end up struggling to pay the rent each month. It will make you regret you ever sold your house.

4) When is selling a house to pay off debt a good choice?

With housing prices sky-high, selling your home to pay off your debt might sound like a great idea. In reality, it still comes with many risks and challenges. If you could guarantee that houses would be 30% cheaper a few years from now, it would theoretically be a good idea to sell and buy again later.

However, there are some circumstances when selling is the only logical next step. If you recognize your living situation is one of them, perhaps you should consider selling your home to pay off your debt. Here are some scenarios when listing your home for sale might be the best way to go:

- If your mortgage payment is too big and takes so much of your paycheck that there is nothing left to use for debt, you got yourself in a must-sell situation. Ideally, your mortgage payment shouldn’t be more than 25% of your monthly income. However, if you end up paying half of your income for your mortgage each month, you should seriously consider selling and moving to a place you can afford.

- If your house is close to getting foreclosed on, it is better to sell your home and get something out of it, rather than ruining your credit with a foreclosure and getting nothing out of it.

- If you are planning on downsizing or retiring.

- If you know you will be able to buy an equivalent house cheaper.

- Regardless of your debt, selling your home could be a good choice if you plan to move. If you are emotionally tied to your house and have a problem letting go, take some time to rethink your decision. However, if you have already planned to move to a small town to save money or start fresh in another city, it ultimately makes sense to sell your home and pay off your debts. Make sure to crunch the numbers and see if this is a viable option for you.

How to sell your home faster?

If you’ve decided to pay off your debts by selling your home, here are some valuable tips to ensure you have a quick sale and get the best deal.

- Consult with your real estate agent and set the right asking price. If you go too high or too low, you are risking sending the wrong picture to potential buyers.

- Decluttering your house before the sale is one of the first things to do to make your home look more appealing. You will help you do what you intended faster if you make sure your house is neat and tidy.

- Even if you can’t afford expensive upgrades and repairs, you can still make an effort to make your home look more inviting and welcoming. Staging your home will ensure you attract as many buyers as possible.

- Hire a professional photographer to show your house in its best light and create stunning listing photos. Most buyers will first look online and then come and check out the home in person, so you need to make an excellent first impression.

The bottom line

We hope you enjoyed reading this article and, more importantly, that we’ve helped you decide whether selling a house to pay off debt is the right thing to do. Always have in mind that it’s important not to rush and thoroughly consider all your options before making the final decision. Otherwise, you could end up in a worse financial situation.

You might also like: