Financial literacy is one of the most important things you can teach your children. The earlier you can get kids to understand the importance of saving money, the better. Teaching your children money management skills early will help them prepare for emergencies and ensure they can afford life’s necessities when the time comes. Here is how you can teach your teens to handle money wisely.

Teach Them the Value of Money

One of the major problems today is that most people don’t understand the value of money. You hear them say things like “it’s only $5” or even “it’s only $50”. The first key to understanding the value of money is to convert every price into hours. By that, I mean saying to yourself, “how many hours will I have to work to pay for this?” Of course, this means that every item has a different value for everyone. If you are making $10/hr, a $5 item will cost you a half hour’s worth of work. On the other hand, someone making $60/hr (a dollar a minute) will only have to work 5 minutes to buy that $5 item. So the higher-paid individual think a $5 item is cheaper than a person earning less per hour.

But once you start thinking in terms of the time necessary to earn something, you will be less likely to waste money.

One of the major problems with welfare is that it removes the “hours idea” from the equation. For welfare recipients, money just magically appears without any labor involved so it is easier to waste it because it doesn’t really have any tangible value.

This a good reason to require your children to work for their allowance. It creates the link between time and money in their brain early.

For advanced thinkers: The time necessary to earn something is actually worse than the simple example above (since you have to pay taxes and have expenses and wasted time getting to and from work.)

Teach Them to Think Outside the Box

Once they understand the link between time and money, they are ready for phase two. True financial literacy involves transcending the time/money link. If you can only exchange time for money, you will never get rich because everyone has a limited number of hours. So, you have to figure out how to multiply yourself. You must find ways to do things once and get paid over and over. This can be via royalties on a book, music, or even youtube videos. It could also be via recurring commissions, stock dividends, rental income, or a variety of other ways.

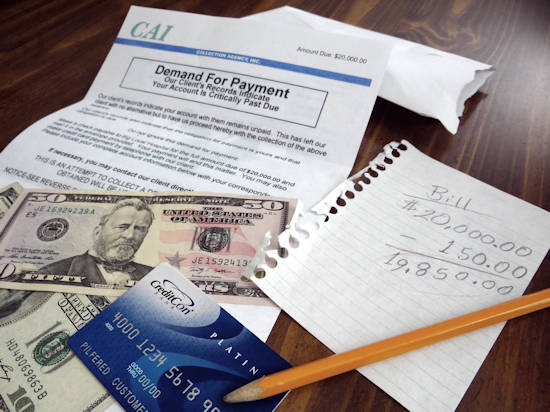

Teach Them to Create a Budget

Budgeting is one of the most critical steps for your teen to take toward financial responsibility. Encourage your kids to speak with you about finances. You can show your child how to write a monthly budget. Teach them to weigh the pros and cons of each purchase and consider the cost of any long-term effects. Let them learn from their mistakes by suggesting that they write down the amount they spent on a particular item and how much they wish they had saved instead. Teens often spend impulsively. They are constantly focusing on the moment. A monthly budget can help them to make decisions better.

Find Ways to Save Money

Suggest that they make a list of ways they can save money. They should look for discounts, coupons, and ways to reduce purchases. This will help your teen learn to shop smart and save money simultaneously. Your teen might even be able to find some unexpected places where they can find coupons that you wouldn’t usually think about.

Plan for Savings

In addition to budgeting for expenses they should budget for savings and investing. Often a credit union provides better benefits at a lower cost than a traditional bank. According to the Credit Union of Denver, credit unions provide things like apps to manage your money, plus:

- A variety of Checking and Savings options

- Automatic Bill Payments and alerts

- Business accounts

- Card Alerts

- Credit and Debit cards

- Credit Score checks

- Direct Deposit for paychecks

- Investment and Retirement options

- Online Banking services

- Overdraft Protection

- Safe Deposit Boxes

- Youth Accounts

Teach Them to Be Smart With Credit Cards

Credit cards are tempting for many teens and adults, but they can be dangerous if misused. Your teen must understand the implications of using credit cards and paying off the bill each month. Set an example by using a credit card wisely and encouraging your teen to make their purchases that way. If they think of every purchase in terms of hours worked (as mentioned above) it will be easier for them to resist the temptation of going into debt. Also, teach them the dangers of debt early by loaning them money and charging them interest (make it a written contract). Once they see how little money goes toward principal and how oppressive debt is, they will be reluctant to do it in “real life”.

Help Them Find a Source of Income

Teaching them to save is an excellent way to help their future, but if they have no source of income, then they will have nothing to save. You may need to explore local teen jobs for them and encourage them to find job opportunities for the summer or even part-time jobs that can help them earn extra money. A regular job can also help them gain skills they can use in their future careers. You can also consider investing in a part-time business for them. Many young students succeed with a lemonade stand or other small, home-based business ventures.

You might also like: