Well, that is exactly what gold does for a portfolio. But most people think that you aren't allowed to put gold into your IRA. Now you can! It is called a Gold Individual Retirement Account (IRA), a form of retirement investment that involves purchasing gold rather than traditional stocks or bonds. In this blog post, we will explore the ins and outs of a Gold IRA and how it can prepare you for retirement.

Note: Mutual Funds aren't an investment type but rather an investment medium that owns various investment types. So, you can buy a mutual fund that invests in stocks, one that invests in bonds, or one that invests in both. And all sorts of other permutations.

What Is a Gold IRA?

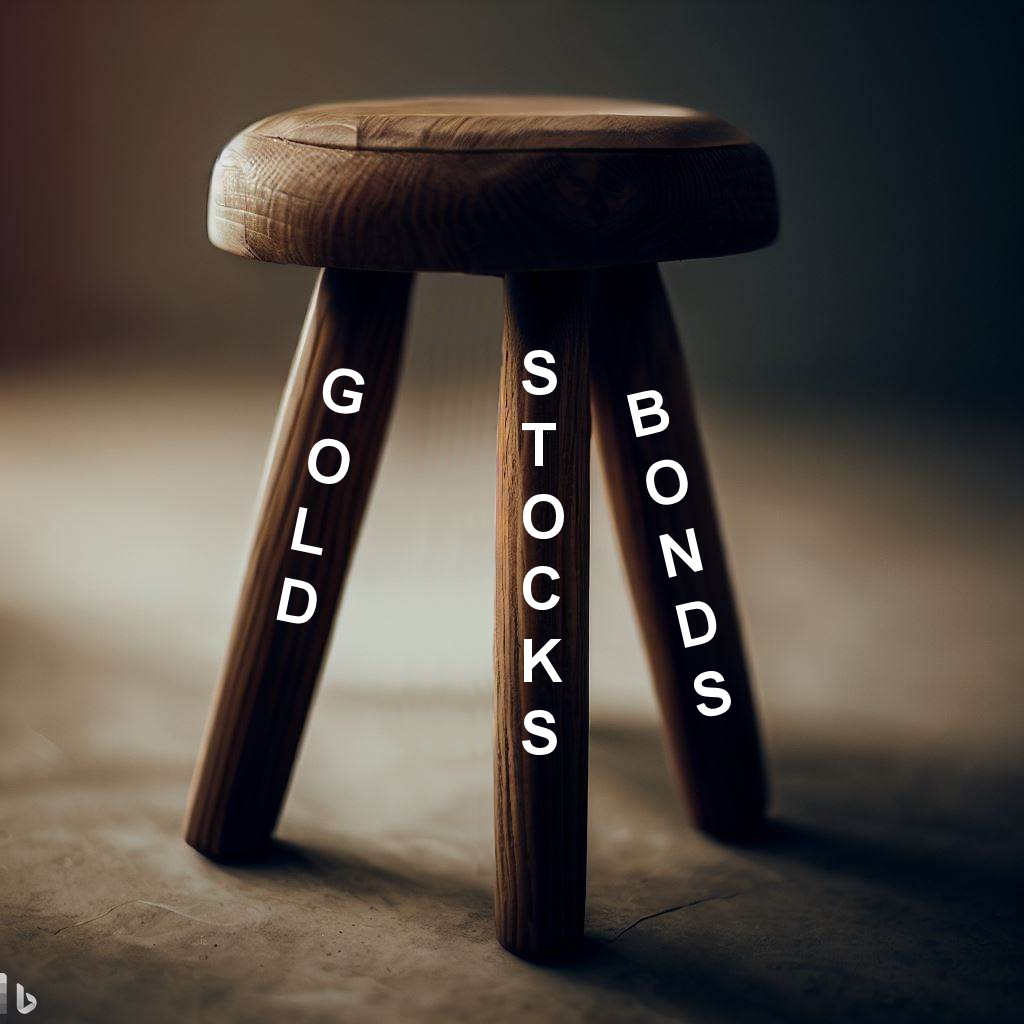

A Gold IRA is a self-directed individual retirement account that allows investors to diversify their retirement portfolio by investing in gold, silver, platinum, or palladium bullion. Unlike traditional IRAs, Gold IRA’s, as the name implies, are backed by gold rather than paper assets. The value of the account substantially depends on the market price of gold, which is steadily increasing in value compared to paper assets. Gold IRAs offer a layer of protection against inflation, fluctuations in the economy, and changes in the stock market, which can impact your retirement portfolio.

Why Invest In a Gold IRA?

Investing in a Gold IRA can provide substantial benefits for those planning for retirement. First of all, gold maintains value during a crisis because it is the only investment that isn't simultaneously someone else's liability. Over the long run, gold tends to maintains its value in the face of inflation, which ensures that you will have a stable income during your retirement. Additionally, a Gold IRA provides a secure depository for your gold but upon distribution you can take physical delivery, giving you full control over your funds. Investing in gold is a tangible way of preserving your assets, allowing you to prepare for any unforeseen events that might occur in the future. Fisher Capital Group lists the following benefits to a Gold IRA:

- Tax Deferment- You can move in and out of precious metals inside of an IRA tax free and penalty free.

- Diversification- Precious metal and gold IRA companies can help you diversify the impact of sudden, unsettling market swings in traditional stocks and bonds.

- Secure wealth- Older Americans have a lifetime’s worth of savings to steward safely through all seasons.

- Physical Asset- Debt based assets are often not backed with collateral. Gold is a tangible asset you hold in your hand.

- Secure Haven- Sleep better at night knowing that traditional market swings may be softened by a position in precious metals.

How to Invest In a Gold IRA?

To invest in a Gold IRA, you first have to set up a self-directed IRA either with a custodian or a fiduciary. Your IRA custodian will manage all of your precious metals investments, including buying, selling, and delivery/storage. Once you have set up a self-directed IRA, you can make sure the funds are diversified by investing in different types of precious metals, such as silver or platinum bullion, in addition to gold. You should seek out a reputable gold dealer who can help you properly evaluate your investment options and ensure that you are purchasing high-quality gold.

In conclusion, a Gold IRA is an increasingly popular and attractive option for those looking to prepare for retirement. It provides protection against economic uncertainty and inflation and ensures that your retirement portfolio has a tangible and stable value. Investing in a Gold IRA can be an excellent way to diversify your portfolio and ensure a dependable income stream for retirement. Before taking the plunge, make sure to do your due diligence and consult a reputable gold dealer like to guide your decision-making process.

You might also like:

- Gold is a "Crisis Hedge"

- Why Gold is a Good Investment for Inflationary Times

- Gold and the Federal Reserve

- Civil Liberties Rest Upon Sound Money

- Why Buy Gold?

- How Does Inflation Affect the Price of Gold?