Wealth transfer planning is essential to financial management. It ensures that assets are distributed according to your wishes while minimizing taxes and preventing family disputes. Crafting a flawless wealth transfer strategy requires attention to critical elements. This guide offers essential insights into the pivotal aspects of a successful plan.

Understanding Your Objectives

Before you begin the wealth transfer process:

- Take the time to define your objectives clearly.

- Identify your beneficiaries, whether they are family members, friends, or charitable organizations.

- Determine what you aim to achieve with your wealth transfer, such as minimizing estate taxes, providing for loved ones, or supporting charitable causes.

- Decide when you want the transfer to occur—during your lifetime or after your passing.

Understanding your goals will help shape your wealth transfer strategy and ensure alignment with your long-term vision.

Creating a Comprehensive Estate Plan

Components of a robust estate plan include a will, trusts, a power of attorney, and healthcare directives. A will specifies how your assets should be distributed upon your death. Trusts, which hold and manage assets on behalf of beneficiaries, can be tailored to meet specific needs, such as reducing estate taxes or providing for minor children. A power of attorney grants someone the authority to make financial and legal decisions on your behalf if you become incapacitated, while healthcare directives outline your medical treatment preferences.

Considering Tax Implications

Taxes can significantly impact the wealth transferred to your beneficiaries, making understanding and planning for tax implications crucial. Estate taxes are imposed on the transfer of your estate upon death, and proper planning can help minimize these taxes. Gift taxes apply to transfers of money or property made during your lifetime, and utilizing annual gift exclusions can reduce taxable gifts. Beneficiaries may owe income taxes on certain inherited assets, such as retirement accounts. Consulting with a tax professional can provide valuable strategies for minimizing tax liabilities and maximizing the value of your estate.

The experts at Bridges Trust tell us, “Trusts can be essential to keeping one’s estate in order — and involve more than just a simple transfer of assets... in our daily lives, despite continuous efforts to ensure financial security, sometimes it becomes daunting to deal with complex financial matters such as organizing assets, planning for the future, and providing for our loved ones. This is where trusts – a powerful and versatile estate planning tool – come into play. Trusts can make the process of settling your estate more manageable and protect your assets while providing for the management of your assets over a longer period. Given the significance of trust management, the role of a trustee becomes equally essential.”

Utilizing Trusts for Flexibility and Control

Trusts can provide various tax benefits and serve specific purposes, such as protecting assets from creditors or ensuring responsible wealth management. Different types of trusts cater to different needs. A revocable living trust allows you to retain control over the assets during your lifetime and provides for their distribution without going through probate. An irrevocable trust transfers assets out of your estate, potentially reducing estate taxes and protecting assets from creditors. Charitable trusts enable you to support causes you care about while receiving potential tax benefits. Choosing the correct type of trust for your situation is essential for achieving your wealth transfer goals.

Communicating with Your Family

Effective communication about your wealth transfer plans with your family can prevent misunderstandings and conflicts. Openly discussing your intentions ensures that everyone understands your wishes and the reasons behind your decisions. Holding family meetings to discuss your plans and any updates can foster transparency. Clearly explaining your rationale and involving professionals, such as your attorney or financial advisor, can help answer questions and clarify, ensuring that your family is well-informed and supportive of your decisions.

Reviewing and Updating Your Plan Regularly

Regularly reviewing and updating your wealth transfer plan ensures it remains aligned with your current situation and goals. Major life events, such as births, deaths, marriages, or divorces, can impact your plan, necessitating adjustments. Changes in laws or tax regulations also require updates to your plan. Even without significant changes, periodic reviews, at least every few years, can help keep your plan relevant and effective.

Seeking Professional Guidance

Wealth transfer planning involves complex legal, financial, and tax considerations. Seeking guidance from professionals, such as estate planning attorneys, financial advisors, and tax experts, can help you navigate these complexities and create a robust plan. Professionals bring specialized knowledge and experience, allowing them to tailor strategies to your unique needs and goals. Their expertise provides peace of mind, knowing that your plan is comprehensive, legally sound, and designed to achieve your wealth transfer objectives.

Smooth wealth transfer planning requires careful consideration of your objectives, tax implications, and family dynamics. By creating a comprehensive estate plan, utilizing trusts, communicating effectively with your family, regularly reviewing your plan, and seeking professional guidance, you can ensure that your wealth is transferred according to your wishes. These steps will provide peace of mind and help secure your legacy for future generations.

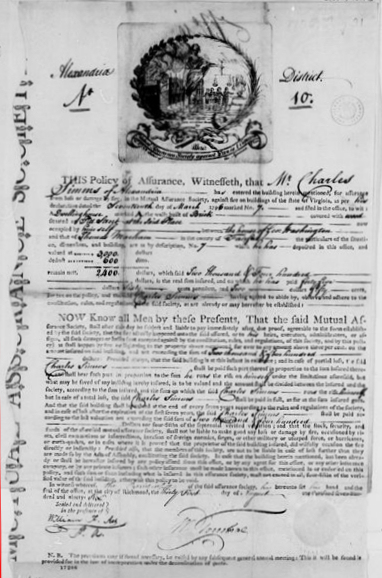

Image created with Meta AI.

You Might Also Like:

- Estate Planning in the Digital Age: Protecting Your Online Assets

- Estate Planning: How to Prevent Family Arguments over Your Assets

- 4 Reasons Estate Planning is a Must

- 4 Types of Trusts That Can Protect Your Assets

- Save Your Family Hundreds of Dollars, Choose the Right Funeral Home

- More Estate Planning Articles