Institutional investors have an advantage that you do not: they are professionals. However, that doesn’t mean that you can’t invest like a professional. You’ll need some basic understanding of how investments work. You should also ask yourself three key questions before you put down any of your hard-earned money:

How long has the company been established?

Companies that have been around for a long time tend to have more stable earnings. This is especially true for dividend-paying stock companies. Companies like AFLAC, McDonald’s, Pepsico, Walgreens, Consolidated Edison, and Johnson & Johnson are all household names but they’re also very stable predictable companies. These companies share profits with shareholders and have a long track record of paying these dividends. In fact, these particular companies have paid dividends every year for the last 25 years.

That’s not to say that start-up companies are a bad investment. Some start-up companies go on to be very solid companies with massive gains but some also go bankrupt. If you are just getting started and want to minimize the risk of loss, stick with large, well-established, companies.

What type of product or service does the company sell?

Do you understand what the company does for a living? If you can’t explain how the company makes its money in 30 seconds or less, then it’s probably too complicated for you to invest in. There’s also a matter of what the company actually sells. Some products are perennial and have mass appeal. These types of products have staying power and might protect you from uncontrollable volatility. For example, if you invest in an international company selling hamburgers, shampoo, or electricity, you have a better chance of success over the long term than if you invest in a company that sells plastic toys for a rare breed of male hamster in the northeast. Even legendary investor Warren Buffet refuses to invest in things he doesn’t understand.

How long do I anticipate that product/service being valuable?

When you invest in companies like Pepsico, you know you’re investing in a line of soft drinks and purified water. People drink this stuff every day of their lives and have done so since 1898 when the drink was first invented. People also use shampoo, soap, toilet paper, and other household products every day, so companies like Johnson & Johnson make for a very stable investment. In general, if the company makes a product with a mass appeal, and has a long track record of sales (i.e. people know, trust, and repeatedly buy the product), then it may be a good company to invest in. Consumable products work best since people have to continually repurchase, but electronics or other products that have become staples in peoples’ homes are also good.

Investing Basics

First, how much money will you invest in a company’s stock? Your investment capital should be money you won’t need for the next few years. It should also be money you are comfortable with losing should an investment turn sour. You also shouldn’t put all your eggs in one basket. You should limit any individual stocks to no more than 5% of your total investments.

While understanding the basics of a company is great, you’ll want to dig into its finances as well. Does the company carry a lot of debt? Does it pay its bills on time? How much cash is it holding in its bank account? Does it know what to do with its excess cash? Are its corporate managers doing a good job increasing sales and growth of the company? If a company isn’t growing or increasing sales, it’s dying. The long-term trend for any company should be growth.

Finally, have a plan. While investing “for the long term” is a good idea, you’ll eventually need that money. Many investors make an entry plan but they fail to make an exit plan. Map out what financial products you’ll use, and what you’ll do with the money, once you’ve hit your investment goals.

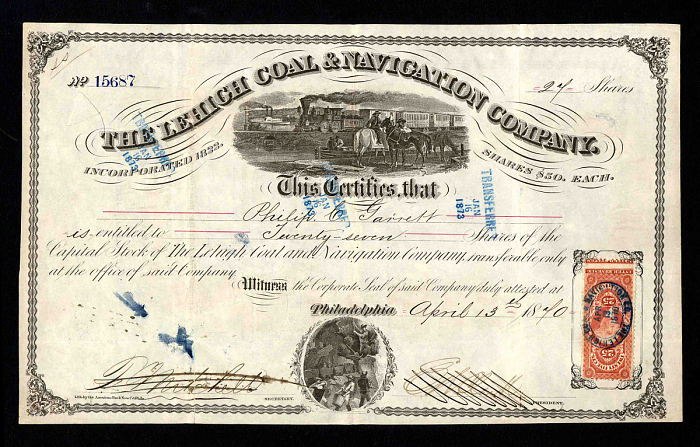

Image Courtesy of Smithsonian Institution Creative Commons License

See Also: