The death of a loved one is a trying time. There are a lot of things that need to be done once the funeral arrangements have been made and the guests have paid their respects. Here is a list of items that will help you get started in knowing what lies ahead in order to get the estate in order. Tim McMahon~ editor

1. Is a Will Available?

The first step in the management of the estate that has been left by a deceased love is to ascertain whether a last will and testament has been left detailing the wishes of the individual. The last will and testament may have been left in a safe place within the home of the individual such as in a safe or in a document folder. If the will is not readily available the family may consult with the individual’s solicitor as to whether they are aware of the creation of a will.

2. Designate an Executor or Administrator

An executor or administrator is the person legally responsible for distributing the estate of the deceased individual. An executor should do so according to the wishes expressed by the individual within the last will and testament. An administrator is designed when a last will and testament is not available. The executor or administrator should be a close family member who is responsible and fit to manage the responsibility of complying with the wishes of the deceased individual.

3. Seek Legal Counsel

The family lawyer or solicitor will be able to provide the surviving family members with legal advice applicable to managing the estate of a deceased loved one. If desired solicitors can even manage the legal processes that are required in order to remove that particular burden from the family. Moreover, specialist legal professionals are available who deal exclusively with such situations. While legal council is not a requirement it is recommended in order to ensure that the legal processes are completed without problem or delay. Years of experience in this field ensure that specialists are able to manage the appropriate legal processes in a highly efficient manner.

4. Apply for Probate

The family member who is designated as executor or administrator is responsible for applying for a grant of probate. This grant gives the individual the legal authority to manage and distribute the estate in accord with the wishes expressed within the last will and testament. The grant of probate can be obtained from the probate registry. However, in an instance when a last will and testament is not available the administrator should apply for a grant of letters of administration in place of the grant of probate. The cost of the letters of administration is very similar to the probate cost.

5. Act On the Wishes Expressed Within the Last Will and Testament

When the grant of probate has been obtained the executor will then have the legal authority to access the estate of the deceased individual and distribute it in line with their wishes. Probate legally provides the executor with this authority but it also includes a significant responsibility to fulfill the wishes of the deceased loved one. In the absence of the last will and testament the grant of the letters of administration provides the administrator with the powers necessary to access the estate.

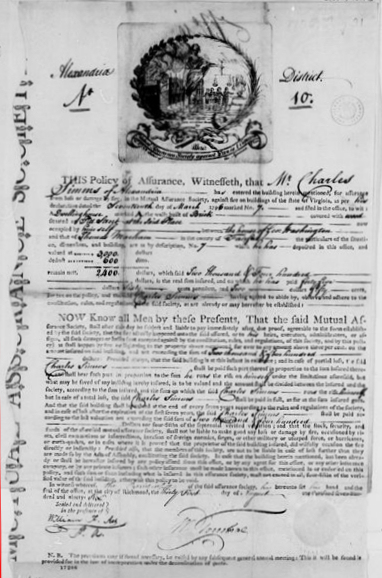

Image Created by Meta AI

See Also:

- Living Your Dreams: Five Benefits to Preparing for Retirement Now

- Saving tips for seniors – Making mobility problems more affordable

- Retirement – Don’t Let A Chronic Condition Ruin Your Life

- The Pros and Cons of an Early Retirement

- Annuities: a Great Way to Fund Your Retirement

- Do you know what you need to retire?

- Retirement Planning- Start Early