Peer-to-Peer lending is a simple type of financial transaction that occurs between individuals or “peers” without the need for a financial institution. Cutting out the “middle-man” allows the lender to get a bigger cut while saving the borrower money at the same time. Much like selling your used car to an individual rather than trading it into a dealer.

Because of the potential for increased profits, Peer-to-Peer lending has even attracted the attention of larger investors hoping to make better returns than are available elsewhere. While this type of lending may sound risky at first, since investors have no “safety net” and can only rely on the borrower themselves, there are some unique features to help limit risk, that aren’t common with most other loan practices. For instance, with modern peer-to-peer lending, an investor doesn’t simply make a loan of let’s say $10,000 to a single borrower. The investor can instead spread his $10,000 over 400 different loans at a price of $25 each. This drastically lowers the risk for the lender. With this type of lending, large numbers of investors are often pulled together, who each take on a small slice of a large number of different loans, and the risk is distributed evenly. Most investors can expect to see a decent and steady expected rate of return after certain fees and potential defaults.

The Risk of Default in Peer-to-Peer Lending

In today’s economic climate, unfortunately, there are plenty of defaults. As far as peer-to-peer lending goes, investors can only choose from unsecured loans, so you have no recourse in the case of a default. Despite the scary word “unsecured,” the majority of people who borrow through peer-to-peer lending channels have a tendency to pay back their loans. Investors can pick loans based on their risk category with higher-risk borrowers paying higher rates. With familiar tools like income verification and credit scoring, lenders (investors) can match their risk tolerance and desired income goals.

By giving investors these types of tools, they can build up an extensive portfolio that is catered specifically to their own risk tolerance. As with most investments, the riskier loan types almost always offer higher rates of return as the interest rates are much higher for the borrower and there is a heightened chance of the borrower defaulting. “A” grade loans typically come with low rates of default and single-digit interest rates while riskier loans are coupled with borrowers with lower credit scores.

Prosper and Lending Club are currently two of the largest peer-to-peer lenders out there today. Lending Club, as it stands today, funds over $36 million in loans each month. Funding over $756 million since 2007. With 93% of investors earning between 6% and 18% interest on those loans. As far as Prosper goes, they have funded over $360 million in loans since 2006 and that number should only continue to rise.

Company Profits?

So how do these companies actually make money? Fees are given to both the borrower for taking on the loan and to the lender themselves as a processing fee. These fees are normally around 1-2%, which is quite small compared to that of a bank, which normally has fees around 8-9%. Generally, any funds that the lender invests are typically locked into the loan for three to five years.

Although peer-to-peer lending offers a large amount of benefits for investors, there are also plenty of positives for the borrowers as well. For instance, most companies offer rates that are very enticing and much lower than those of a bank. Most borrowers who utilize these companies are looking to either fund major purchases or pay off credit card debt.

What is the difference between Micro Loans and Peer-to-Peer Lending?

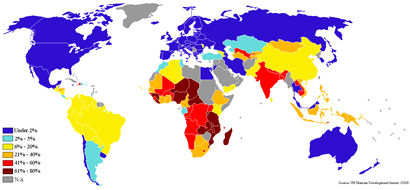

Just as it sounds, Micro loans are very small loans, usually made to people in developing countries allowing them to start small businesses buy buying a goat, or a sewing machine or even a bicycle, etc. These loans are typically less than $2000 and have a very good repayment rate. Because the borrower is usually working with a sponsor helping to provide guidance. Charities typically get into this type of lending, with sites like Kiva allowing everyday people to make microloans to people in developing countries. However, charity sites like these typically have a low rate of return and may in fact carry no interest rate at all.

Peer-to-peer loans in developed countries on the other hand typically range from $2,000 to $25,000 and have higher interest rates, a lower repayment rate, and little to no counseling.

The internet has revolutionized the music, movie, and shopping industry and now peer-to-peer lending is on a steady place to completely change how many people borrow money.

See Also:

- Ten Percent Yields Without Buying a Single Stock (Peer-to-Peer Lending)

- Which Type of Loan is Best?

- Should I Roll My Mortgage Insurance Premiums Into the Loan?

- Most Unusual Reasons for Applying for a Loan

- Free Yourself From Debt

- Is Financing Your Child’s Mortgage Right for Your Family?

- Credit Scoring On Mortgage Refinancing