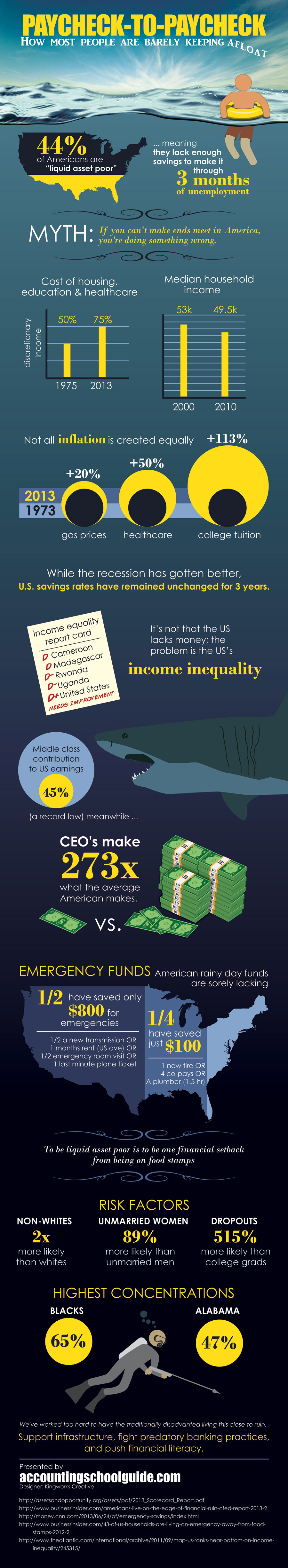

Did you know that 44% of Americans are “liquid asset poor” i.e. live from paycheck to paycheck? If you have less than 3 months income in savings you are “liquid asset poor” and are just one set-back away from disaster. If you are in this boat you are not alone. And it isn’t entirely your fault, Americans are getting poorer. From 2000 until 2010 median household incomes fell from $53,000 to $49,500 and adjusted for inflation the situation is much worse.

Compared to 1975 a much larger percentage of our income goes toward housing, education and healthcare. Over the last 38 years total inflation has increased 348.18% but gas prices have increased 20% more than average, healthcare has increased 50% more than average and college tuition has increased a whopping 113% more than prices in general.

One reason for the increases in healthcare and education is because of government “assistance”. By guaranteeing student loans and offering easy access to financing, students are actually less concerned about the cost of their education, so colleges were able to raise rates with very little price resistance.

As far as healthcare is concerned the push toward universal insurance has had the same effect. People with company paid insurance plans have little to no incentive to be concerned about the cost of medicines and healthcare, so prices continue to rise.

Source: Accounting School Guide