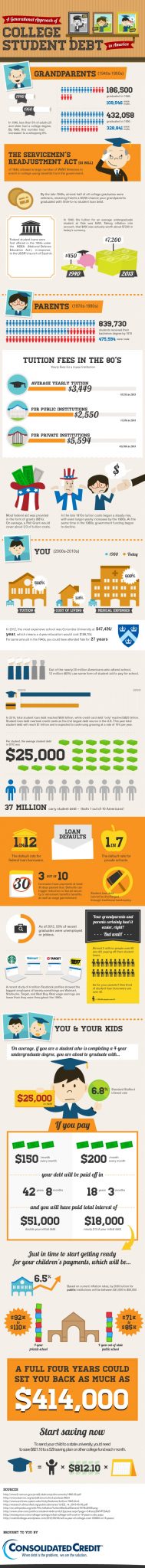

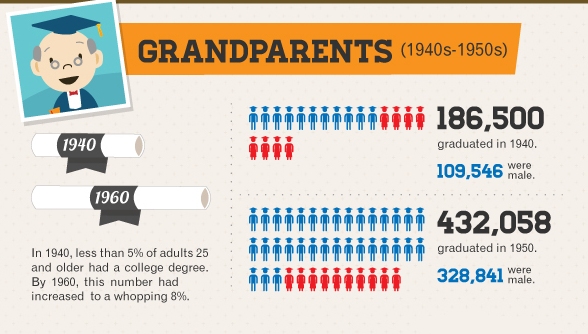

Back in 1940 attending college was a rare event with less than 5% of adults 25 and older having a college degree and almost 59% of them were male. Only 186,500 people graduated college the year 1940 by 1960 the post war G.I. bill had made college much more affordable for returning servicemen so in 1950 432,058 people graduated college but 76% of them were men.

By 1960, the number of adults 25 and over who had graduated college had climbed to 8%. Half of them had attended on the G.I. bill so they graduated college with little or no student loan debt. Also many did not believe in debt so they attended college part-time and worked while attending college so they could pay their bills as they went along.

By 1960, the number of adults 25 and over who had graduated college had climbed to 8%. Half of them had attended on the G.I. bill so they graduated college with little or no student loan debt. Also many did not believe in debt so they attended college part-time and worked while attending college so they could pay their bills as they went along.

By 1970, there were 839,730 graduates a year and only 56.6% of them were male. In the late 1970’s tuition began rising steadily partially due to the easy credit available from government student loan guarantees. Students no longer had to earn the money before or during college so they weren’t so worried about the cost and colleges took advantage of this situation and raised their rates. But as student loan guarantees increased grants decreased and students started graduating with more and more debt.

In 2010, total student loan debt reached $830 billion topping credit card debt at $825 billion making it the second largest debt in the country and creating fears that it will create some sort of crash like the housing crash of 2008. The average student in 2012 graduated with $25,000 worth of student debt. 3 out of 10 borrowers are more than 30 days past due. And student loan debt can not be discharged through traditional bankruptcy. Defaulting on student loans can haunt you for the rest of your life even affecting how much Social Security you can collect.

If you have $25,000 in debt and pay $150/month it will take you 42 years and 8 months to fully pay off your debt! And you will have paid $51,000 in interest in addition to the original $25,000 in principal. If you pay just $50 more per month you will only pay $18,000 in interest but it will still take over 18years to pay off the debt, just in time for your kids to start college! So college debt is becoming the modern form of indentured servitude.

The key is to go back to the system of your grandparents and not rack up the debt in the first place. These days it is easy to take classes online for a fraction of the cost of attending bricks and mortar classes. You can get the same diploma but you can arrange your class and study time around your work schedule so you can once again pay as you go.

Thanks to Consolidated Credit for the following info-graphic.