Having a family investment plan is a great first step that will contribute significantly towards a financially secure future. It is important to take account of your family’s needs and create a blueprint of how to save and invest.

However, creating an investment plan is one thing and making it work is something else. It is common for investment plans to go bust due to some frequent mistakes that most investors make. Knowing how to avoid the pitfalls will add value to that plan you have in place.

Lack of Objectives

Having goals gives you the proper motivation to invest wisely. Putting money to work and knowing why you are doing it are two very different elements. Of course, it is nice to see favorable returns that grow your savings account, but without objectives, you have no yardstick to know how well you are doing. For instance, if you are investing to get a bigger house, or pay for college or a vacation you know the goal i.e. an exact amount you need for the downpayment, tuition, room and board, etc.

Before you can draw up an investment plan, you have to know the goal. Saving for a vacation requires an entirely different time-frame than investing for your two-year old’s college fund or your retirement. The vacation fund should be in a bank account where its value won’t drop just as you need it. Investing for longer term goals like college or retirement need to be able to grow so a bit of volatility along the way is an acceptable risk in exchange for greater growth.

Ignoring Risk vs. Reward Ratios

Investing in the stock market is a popular choice for a majority of investors looking to enhance the returns on their portfolio. However, studies show that about 37% of investors believe that an investment plan does not need to include stocks. As with any other investment options, stocks come with their risks. Concentrating on just one investment class can hurt your investment plan, especially when the market is not doing well. Diversifying the portfolio allows you to spread out the risks and profits as well. A good diversified plan includes short-term savings (bank accounts), medium-term savings (money market accounts) and long-term investments (stocks, bonds, mutual funds, IRAs, gold, Exchange-traded funds (ETFs), annuities, etc.)

The key is to match your time frame with the appropriate risk/reward ratio. Short-term investments need to be low risk (low reward) because you need the money to be there when you want it. Longer term investments need to grow and you will have time to switch it out as the time gets closer.

But remember higher risk doesn’t always translate to higher reward. The best investment is a low risk/ high reward investment. They are harder to find but when you find one you should jump on it. One example is an annuity with a guarantee period. They are available where they give you a minimum return guarantee of say 7% for the first 10 years but also allow you to earn more if the market does exceptionally well. The trade-off is that you may lose a bit at the top end. Suppose the overall market appreciates 15% in one year… the annuity might only pay you 12%. But the downside risk guarantee (no lose 7% minimum) is worth giving up a few percentage points at the top end.

Too Aggressive or Too Conservative

When implementing an investment plan, it is possible to go either one of two extremes, which can be aggressive or conservative. A risk taker will gamble with their investment, and as much as the returns may be substantial, the losses could be colossal as well. Although they may make it big at the beginning, in the end, gamblers end up losing.

Alternatively, some investors are too risk averse, and that means shying away from potential moneymaking opportunities. Being too conservative with investments may keep your nest-egg safe, but it also means that the value of your account won’t grow much (or with current low-interest rates at all) and your purchasing power will actually decrease courtesy of inflation. The solution is to find a way to balance the two. It is better to spend some money on a paid financial advisor and get sound advice than keep implementing a poor plan and lose your shirt.

High Fees

Another reason an investment plan may not be worth anything is due to retirement manager fees. If you are using an investment firm, you have to consider the costs of buying funds, owning and selling them. You also have to count the cost of administration.

For instance, some mutual funds are “front-loaded” meaning that you pay a fee to buy the fund, but then you also pay an administration fee while you hold it but no fee when you sell.

Other funds, have a “back-end” fee, once again you pay an administration fee while you hold it but also a fee when you sell but no fee when you buy. This may seem better since you get to invest your principal plus any fees you would have paid up front. But since you are paying a percentage of the sales price, you end up paying more at the end balancing it out.

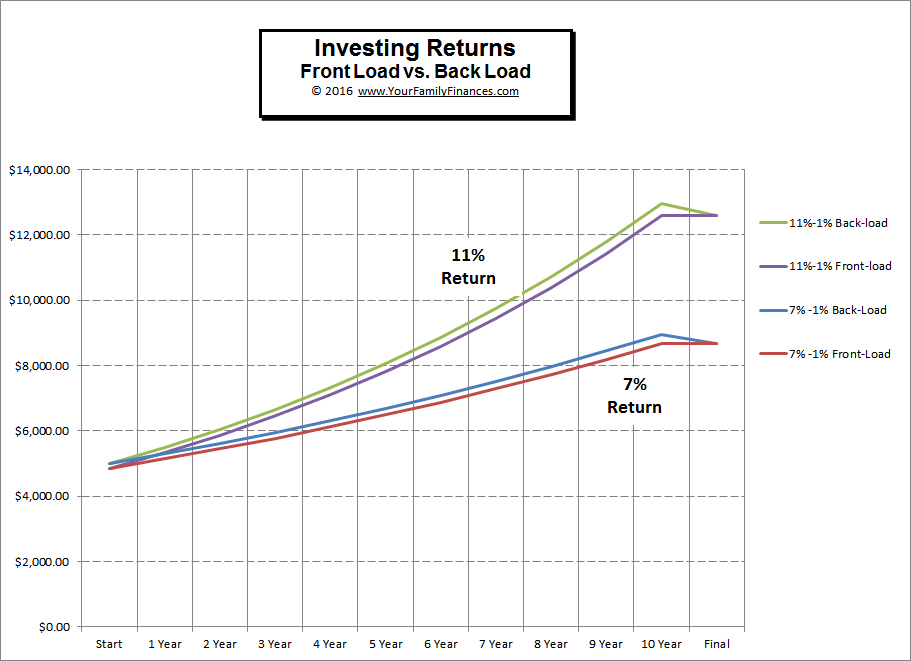

Here’s an example:

Compare two funds the first one has a 3% front-end load and 1% annual fee. The second fund has a 3% back-end load and 1% annual fee. You are investing $5000. for 10 years. We look at what happens when each fund earns 7% per year (minus 1% administration fee) and when it earns 11% (minus 1% administration fee) .

Note that in the back-end loaded fund even though you had invested more to start you ended up giving more back at the end resulting in exactly the same total return. But if the returns had been higher say 11% with a 1% annual fee your total return would be much higher. So the key is not whether it is a front-end load or back-end the key is higher returns or lower annual fees since they cut into your total return and even 1% higher fees can result in a much lower total return over time.

Here is the actual data for the chart above.

| 7% -1% Back-Load |

7% -1% Front-Load |

|

| Start | $5,000.00 | $4,850.00 |

| 1 Year | $5,300.00 | $5,141.00 |

| 2 Year | $5,618.00 | $5,449.46 |

| 3 Year | $5,955.08 | $5,776.43 |

| 4 Year | $6,312.38 | $6,123.01 |

| 5 Year | $6,691.13 | $6,490.39 |

| 6 Year | $7,092.60 | $6,879.82 |

| 7 Year | $7,518.15 | $7,292.61 |

| 8 Year | $7,969.24 | $7,730.16 |

| 9 Year | $8,447.39 | $8,193.97 |

| 10 Year | $8,954.24 | $8,685.61 |

| Final | $8,685.61 | $8,685.61 |

| 11%-1% Back-load | 11%-1% Front-load | |

| Start | $5,000.00 | $4,850.00 |

| 1 Year | $5,500.00 | $5,335.00 |

| 2 Year | $6,050.00 | $5,868.50 |

| 3 Year | $6,655.00 | $6,455.35 |

| 4 Year | $7,320.50 | $7,100.89 |

| 5 Year | $8,052.55 | $7,810.97 |

| 6 Year | $8,857.81 | $8,592.07 |

| 7 Year | $9,743.59 | $9,451.28 |

| 8 Year | $10,717.94 | $10,396.41 |

| 9 Year | $11,789.74 | $11,436.05 |

| 10 Year | $12,968.71 | $12,579.65 |

| Final | $12,579.65 | $12,579.65 |

It may be difficult to tell exactly how much you are paying to implement an investment plan. The point is that the higher the costs, the less your investments will grow. It is possible though to minimize some of the costs; it is a matter of understanding them. Reading the fine print before getting into any contract will help you get a grip on hidden costs.

A successful investment plan is a tough goal to meet, and it requires dedication to get it right. Arranging for your family’s financial future comes with its obstacles but knowing where they are will help you sidestep them. Investing in expert financial advice also goes a long way.