Investing may seem scary at first but it can be one of the easiest ways to build your net worth. The following infographic from Personal Capital outlines how you can start putting your money to work for you.

Step #1 Assess Your Current Financial State

It’s important to get your financial house in order BEFORE you start investing for the long term.

Build an emergency fund.

Build an emergency fund.

We’ve said this over and over here at Your Family Finances, the first step is to have an emergency fund. Otherwise, ordinary inconveniences become emergencies forcing you to rack up credit card debt or worse yet borrow from Payday loan companies or others who will charge you outrageous interest rates and put you on the long road to debt and poverty.

Paying high interest rates will eat you alive. Eliminate high interest debt. This includes all credit card debt, car loans etc. Make it your #1 priority to pay off all credit card debt every month. Save up enough to buy your car for all cash.

Take Advantage of Matching

Employer matching programs and tax advantaged retirement funds are ways of getting free money. You should grab every penny of free money you can get.

Set Realistic Savings Goals

Unrealistic goals sound great while you are excited about them which generally lasts until the first conflict of interest comes along. Sure you want to save up a Million dollars but then your friends come by and want to go out so… Poof there goes your goal. By setting REALISTIC goals that you can actually envision coming to pass you can actually have the will-power to stick to them.

Once you’ve got the emergencies covered you should start saving for expenses that you know are coming like education, events, a new car etc.

After short-term goals are covered you need to prepare for long-term goals like retirement, etc.

Analyze Your Risk Tollerance

The best way to sabotage your long-term investing is to panic. How would you feel if 20% of your portfolio value disappeared over a few months time? This can happen and generally does every few years. And then every so often (like in 2008) markets lose 50% or more. Fortunately, they generally rebound if you have invested wisely. But if you panic and pull your money out at the wrong time you lose. If this type of temporary loss would cause you extreme stress you should invest in less volatile investments (but of course less volatile investments create lower return over the long run.

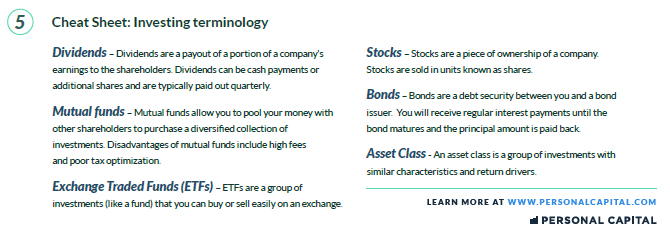

Learn the Language

Before you can succeed in any endeavor it pays to learn the language whether it is traveling to a new country or just playing a video game you need to understand the language and the rules of the game. The same is true for investing learn the terminology and the rules of the game and you will be much better prepared to succeed.

Personal Capital has put together a step by step guide breaking down investing for the first timer into 4 easy parts. With tool’s like their personal finance software, it can sync up your accounts so you can be organized and keep track of everything in one place.

You can download this investing guide from Personal Capital as a single InfoGraphic here:

You might also like:

Pingback: 5 Ways To Make Managing Your Finances Easier — Optio Money