There’s no questioning the value of a college education. Studies suggest that having one can even make you live longer, besides the obvious career benefits. However, the student loans left over after earning the degree can amount to a lot of debt, and you may be stuck paying it off for years. You can’t simply negotiate better terms or refinance as you can with some other types of debt. When you’re trying to organize your finances and eliminate debt, focus on paying student loans first. However, there are some other options to get free of this financial burden.

Should You Use the Income Based Repayment Option?

https://youtu.be/VXcKNGTVts0

Using the income based repayment option is a bit like paying the minimum on your credit card it may help you now but it will cost you a lot more in the long run.

Employer assistance

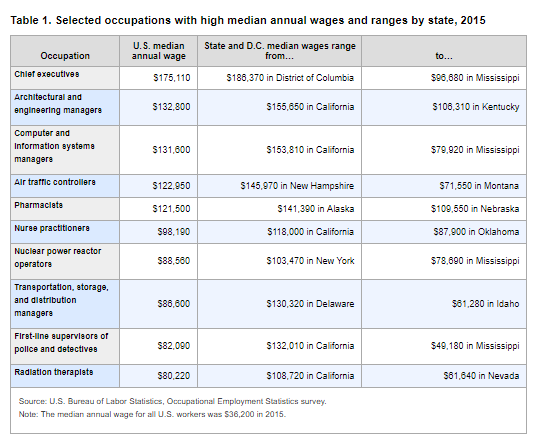

The US Bureau of Labor Statistics published a list of “Hot Jobs” i.e. jobs thatpay well and are in high demand, and if you are fortunate enough to have a degree in a field that leads to one of these jobs your employer may be willing to help you pay off your educational loans. Many organizations will be willing to do this if you sign a contract, or waive any bonuses. Here is that list:

So for example, if you hold an MS in engineering management, you’re very marketable and the employer may be willing to negotiate. In the table above we see that the median annual wage for an Engineering Manager is $132,800. But even with a Master’s degree you probably wouldn’t be making that straight out of college, but if a company was very interested in grooming you for that position they might use loan repayment as an incentive to get you to sign up. Knowing that they will be investing a great deal in the grooming process they want to be sure that once they’ve done all that you won’t jump ship for one of their competitors thus the “golden handcuffs” that require you to stay for a certain number of years or be liable for repaying them for the loan. For some companies this is a common means to recruit and retain top employees who are fresh out of college and worried about their student loans.

As Molly in the above video would say, “Live like You’re Poor now So you can enjoy a debt free life later”.

Loan Repayment Program

Oddly, the federal government may be willing to pay off some or all of your federal student loan debt. That is, if you go to work for the government. This is the same idea as employer assistance, but with strict rules. Some federal agencies may pay off up to $10,000 per year for six years. The maximum limit is $60,000. This is administered by the Office of Personnel Management. This only applies to federal loans, not private loans.

Loan Deferment

If you experience economic hardship, you may be able to get a deferment or forbearance on loan payments, and perhaps even a debt cancellation. This can work to your advantage whether you’re still in school or not. Unemployment, severe illness or injury, non-profit volunteers, and legal troubles may get you relief from your debt. You just have to fill out and file a financial status statement when applying.

Non-Profit Work

As noted above, certain volunteer or non-profit employment may satisfy the conditions for loan cancellation. For instance, signing up for a term in the Peace Corps or VISTA can lead to loan forgiveness. The good news is that this can also apply to a number of community-focused professions, such as police, teachers, healthcare workers, and lawyers.

Be wary of offers for helping you consolidate student loans. Break out your calculator and check the numbers, because it may actually cost you more over time. If you can plan a way out of student debt before you even apply for it, you may be essentially getting an education for free.

You might also like:

- College Funding Options

- Avoiding Student Loan Debt

- Money Saving Tips for Students

- Understanding New Student Loans

- Teaching Children While Saving for College

- Everyone Can Learn at Harvard (Infographic)

- The Quickest Ways to Pay Off Your Student Loan

- Saving for College with a 529 College Education Plan

- Ways Your Kid Can Help Pay for Their College Education