A tax season to-do list can feel like a lot to take on, whether it’s getting your receipts in order or finding the best option to help you file. Though it might seem intimidating, filing early can alleviate some of the stress associated with this time of year. With Tax Fraud Awareness Week (January 29 – February 2) kicking off the beginning of the 2018 tax season, it is important to keep in mind the benefits of filing as early as possible.

Your refund comes faster.

Your refund comes faster.

The sooner you file your taxes, the faster you can expect to see a refund. The IRS issues 90% of refunds within 21 days of filing, which means you won’t have to wait until almost mid-year if you act fast. The majority of citizens choose to electronically submit their tax returns to the IRS, which also speeds up the refund process. They offer options on their website to e-file taxes for free on your own, but some tax preparation companies also offer free or low-cost services.

You can plan ahead for back taxes.

If you find that you owe money to the IRS while filing, doing so early gives you ample time to set money aside before Tax Day on April 17. If you’re unable to pay your back taxes immediately, the IRS may honor a 60-120 day extension if you fill out an application on their website. However, you have the potential to rack up late fees and interest payments on owed money the longer you wait, so it’s better to get it squared away sooner rather than later.

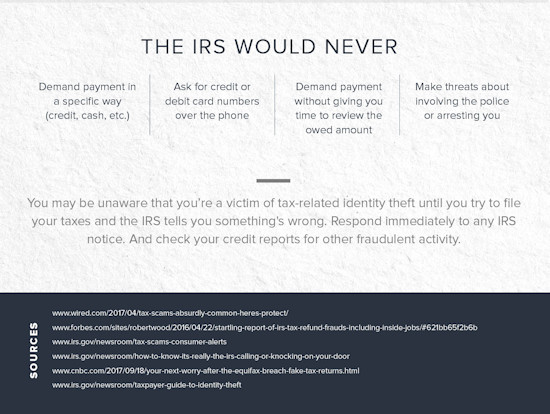

You can protect your identity.

Knowing how to protect your identity is key, especially during tax season. When it comes to filing, each tax report is associated to a unique social security number, so claiming yours as soon as possible reduces the risk of someone filing a fraudulent tax return in your name. Signing up for a service such as LifeLock which offers identity theft protection can help you stay safe during tax season by monitoring the use of your personal information. They’ll even alert you if there is activity or a possible threat associated with your identity.

You’ll save yourself some stress.

Crossing something off a checklist is a relief, and doing it before you have to is even better. If you file as soon as you get all the proper paperwork, you won’t feel like you have to scramble just before Tax Day to get it all done. Especially if you’re going through an agent, planning ahead will ensure that you can schedule an appointment that works best with your schedule.

So why not get a jump start on filing your taxes? Although it’s not the most exciting task of the New Year, you can save yourself time, energy, and maybe even some money in the long run by getting ahead of the curve.

You might also like:

- 4 Tips on How to Prepare for Tax Season

- Tax Season Tricks to Get the Best Return

- Hidden Write-Offs You Shouldn’t Forget in Your Taxes This Year

- Does the Consumer Price Index (CPI) Include Taxes?

Infographic courtesy of LifeLock.

Your refund comes faster.

Your refund comes faster.