The folks at Earnest have created an infographic detailing a great “Money Saving Challenge” that can help you get started on the road to financial stability. As the year starts we tend to make “New Year’s Resolutions” but by the time February rolls around we have generally forgotten them so by following this Money Saving Challenge

we here at Your Family Finances are encouraging you to step up and get back in the game. If you follow the plan in this challenge you will have some guidelines to help you along the way rather than just a vague goal of “somehow” getting your financial life straight.

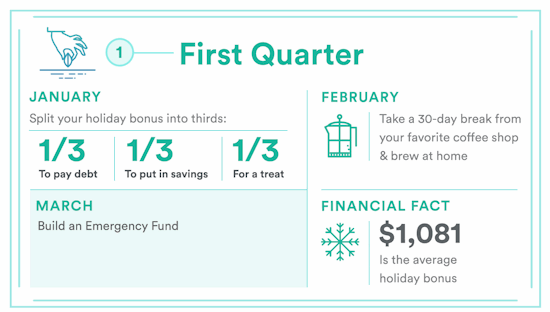

During the “first quarter” i.e. the first 3 months of the year your goal is to:

- Pay Down Debt

- Start Saving

- Don’t get too strict with yourself or you will be tempted to quit.

If you get a Year End bonus you should divide it into thirds and put it toward these goals. Did you know the average bonus is actually over $1000? Even if you didn’t get a bonus you can still work toward these goals. You can start by giving up buying Coffee at a local coffee shop and brew it at home. We have mentioned how much you can save by brewing at home many times including here. In this challenge you should take that savings and put it toward building an emergency fund.

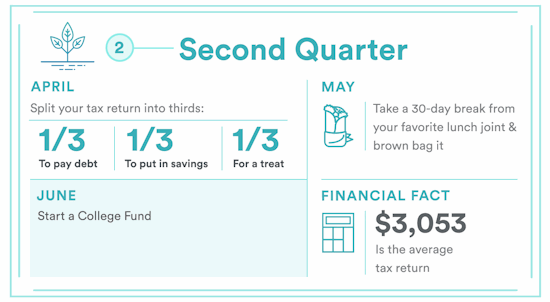

In the second quarter, i.e. April, May and June you should be getting your annual tax return. Since the average tax return is over $3,000 once again you can split it into thirds and pay down debt, save a third and treat yourself with the final third. At this point (if you are average) you will have reduced your debt by over $1,300 which should already be having an impact on how much interest you are paying. To boost your savings even further, during the month of May avoid eating lunch out and “brown bag it” and you will have a couple of hundred dollars extra to start a college fund.

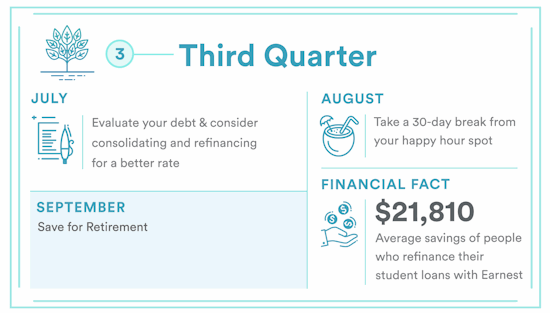

By the third quarter, i.e. July, August & September, you should have a better handle on your debt. At this point you can consider refinancing to consolidate and get a better rate. To further boost your savings plan consider skipping “happy hour” or eating out after work this should give you a few hundred dollars to boost your retirement fund.

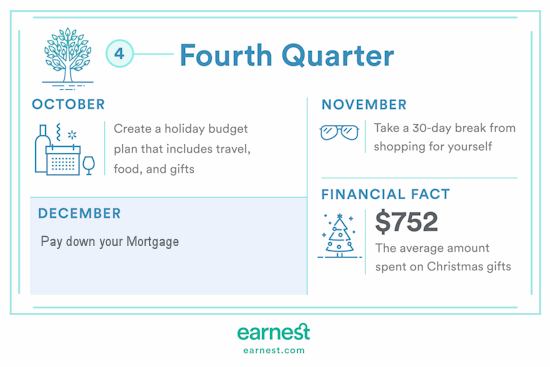

During the last 3 months of the year, you should create a holiday budget knowing that you will probably spend more than usual on gifts and celebrations. Knowing this it should be part of your budget. If you are “average” you will spend about $750 extra for Christmas presents etc. so where is that money going to come from? You need to plan for it and one way is to stop buying “presents” for yourself realizing that you will probably be getting gifts from others anyway. If you get any cash gifts you might consider using them to make an extra payment toward the principal on your mortgage. See: How Pro Homeowners Pay off Their Mortgage Faster Than Their Neighbors for more tips on how to pay off your mortgage faster.

You might also like: