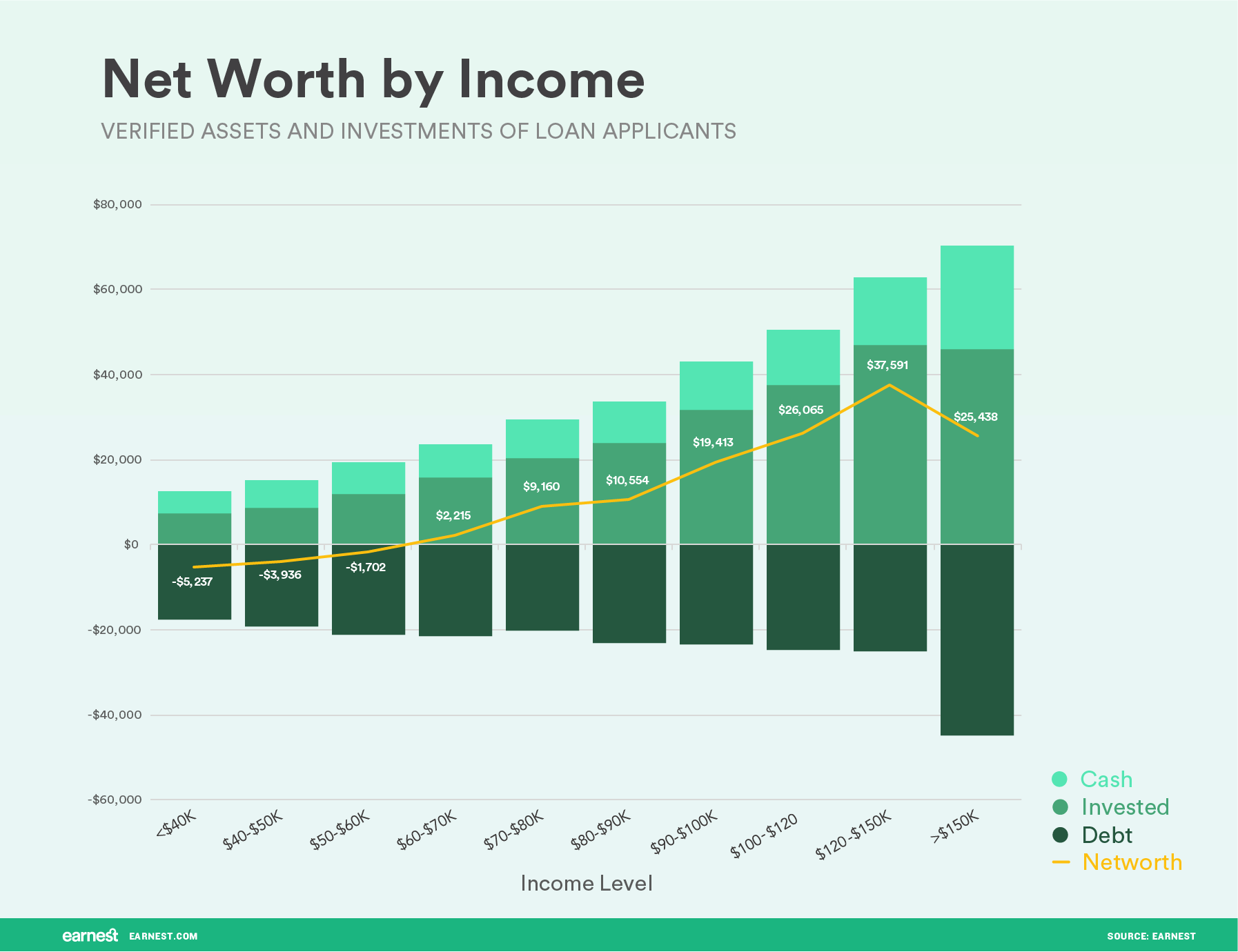

Your “Net Worth” (financially speaking) is calculated by adding up the value of all your assets (thing you own) and subtracting the value of all your liabilities (things you owe). So that means you add up the value of your house and car and savings accounts and brokerage accounts and cash on hand, etc and then you subtract credit card debt, car loan, student loans, mortgage etc. and the amount you have left is your net worth. Often young people may have a “negative net worth” meaning they owe more than they own. This is quite possible due to student loans.

In the chart below earnest analyzed net worth vs. income based on anonymized data from in tens of thousands of applications for student loan refinancing. We note that those with an annual income in the first three groups i.e. those with an income of less than $60,000 per year all averaged a negative net worth. As you would expect, net worth tended to climb as income rose but surprisingly those with annual incomes above $150,000 actually had a lower net worth than those with incomes in the $120,000 to $150,000 range primarily because they incurred much higher levels of debt. Perhaps they felt they could use that debt to invest and create more wealth in the long run?

Based on their study they determined that “on average, people in every income bracket have 1-2 months of monthly salary in cash.” Which is well below the recommended 3-6 months of emergency cash reserve.

With debt at an all-time high in the United States and with most Americans carrying thousands of dollars of debt, it is no wonder that many people are looking at ways to cut back, pay down debt and trim expenses. While some changes are obvious, such as making a budget and sticking to it each month, some ways to pay down debt may be a bit more hidden. Here are four smart resources for raising cash if you feel as if you are in debt up to your eyeballs.

Sell Your Old Coins or Jewelry

Chances are high that you have something in your home that is worth a lot of money to someone. For some, it may be gold or silver jewelry, some of which may never be worn because it is out of style. Jewelry of all kinds can be sold for the metal and the stones. Another possibility is to sell your coin collection. Coin collections are worth the most if they are complete or if they include very old or rare coins.

Sell Unwanted Household Items

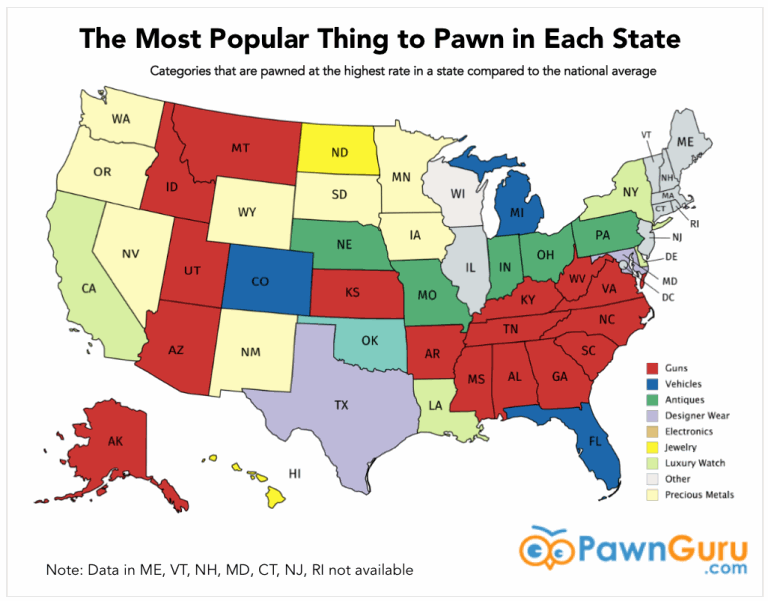

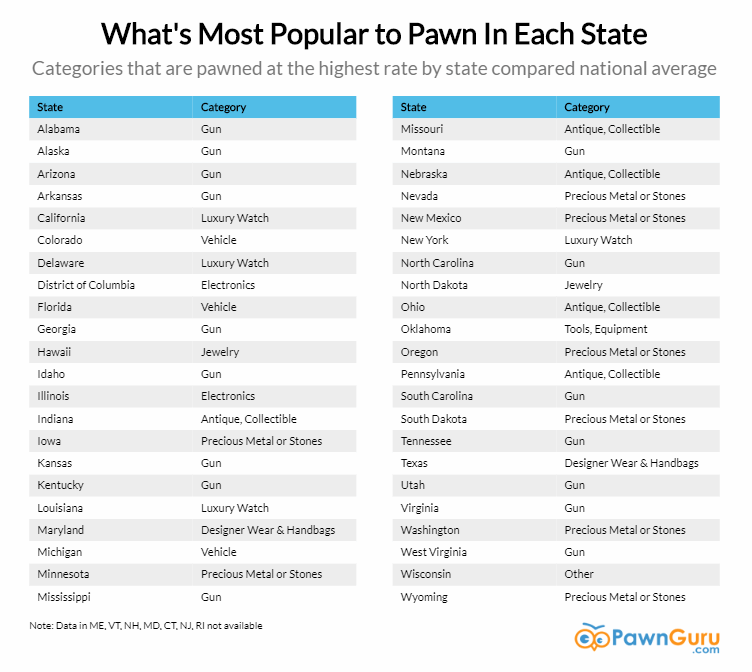

While general household items and appliances may not be worth as much as jewelry and coins are, they can still command plenty of financial gain when they are sold in large numbers. One popular item to sell is used electronics with Apple products high on the list due to their higher perceived value. Go through your home and gather up duplicates as well as items that you have not used in the past six months and items that you have no plans to use again. Many can be sold online while others can go for good prices at a community or private garage sale. When people get really desperate for cash they might consider Pawning an item even though they would probably get more for it by selling it. Here are some items that are typically pawned which tends to vary by state.

Rent out Your Space

If you can find nothing to sell, you may want to rent out what you do own to make some extra cash. You might consider renting out your home or a room to travelers through a site like AirBnB. You may even be able to rent out certain possessions, such as appliances and technology, or your vehicle. Or pick up a side gig like driving for Uber.

Get a Line of Credit

If you own your own home, you may want to look into a home equity line of credit. Although it may seem counterintuitive to take out a new line of debt to pay down your old debt, the benefit of a home equity line of credit is that it usually comes with a far lower interest rate that consumer (credit card) debt does. Just be sure that you will be able to pay off this line of credit before it comes due to eliminate the possibility of costly fees and possible foreclosure.

When you feel as if there is nowhere else to turn to pay down your debt, you will want to consider these four smart options. Some of them may seem unusual or may seem as if they would not make much income, but you may be surprised at what you find when you clear out your house and get rid of unnecessary possessions. By putting the items that you do own to work for you, you can increase your wealth and pay down your debt.

You may also like:

- 3 Ways Keeping Tabs on Your Credit Helps More Than Just Your Finances

- How to Develop a Millionaire Mindset

- Avoid being “house poor” by taking these 4 steps

- How Responsible Parents Care for Their Financial Future

- How Real Estate Helps You Leapfrog To Wealth

- 4 Tips to Better Managing Your Finances and Assets