Average living costs tend to rise everywhere, which is something that investors need to consider when determining the longevity of their investments. An investment might increase in value, but it can be a net loss if its value rises more slowly than the cost of living. Whether you’re investing for retirement, your children’s education or another goal, read on to learn how you can make sure your plan keeps pace with the rising cost of living.

Use a Calculator

Investment and retirement calculators are great tools to check in on the health of your portfolio. You can find calculators for free online or purchase a premium app or software package. Many financial gurus offer custom calculators based on their programs. You can also look for calculators tailored to your specific needs, goals or life circumstances. The Retirement Planning Calculator tells you how much money you will need in the future to equal what you are currently spending. The Cumulative Inflation Calculator calculates total inflation in percent between exact months and years since 1913.

Get Professional Advice

Whether you’re a novice investor or a seasoned pro, qualified wealth management advisors provide a valuable resource for managing your assets. Forming a relationship with a financial advisor is a great way to start your investing journey, and even the most experienced investors can benefit from a new perspective on their accounts. Seek out an advisor who has experience working with your financial goals.

Diversify Your Portfolio

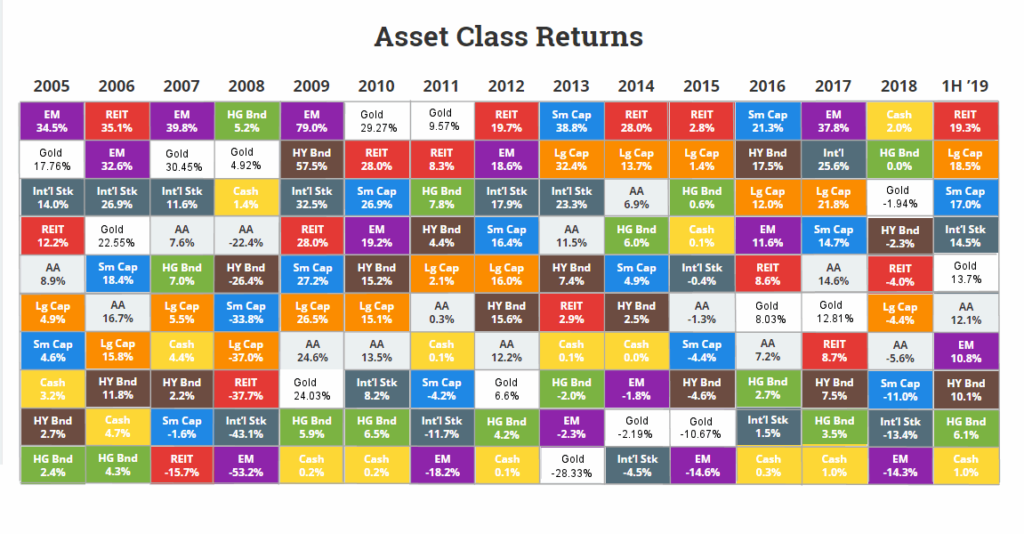

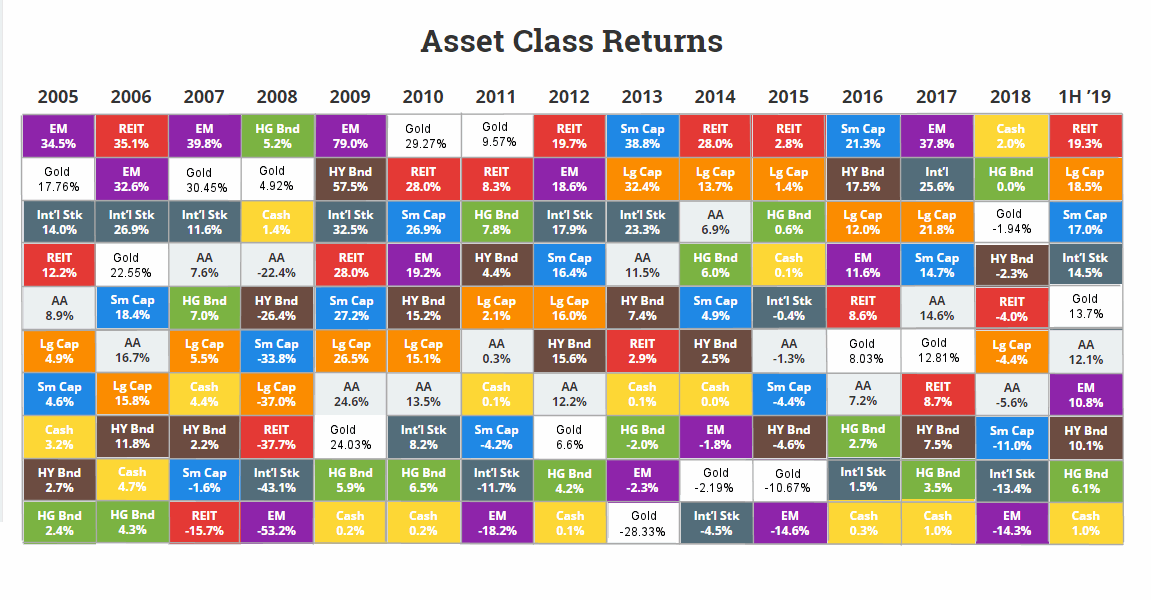

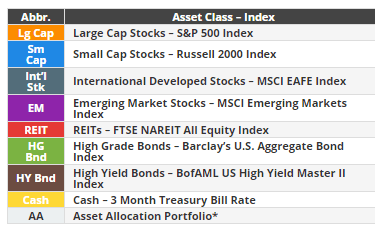

One of the best things you can do to strengthen your investment portfolio is to diversify it. Diversification means that you invest in a wide variety of stocks in order to spread your wealth around. This makes your portfolio much more stable because it doesn’t rely on only a handful of assets that can rise or sink or at any time. Consult with your financial advisor about the best way to diversify your portfolio to protect it from market volatility. A well-diversified portfolio includes Large Cap and Small Cap (Cap = market capitalization i.e. the number of outstanding shares multiplied by the share price. Basically the size of the company.) It also includes both foreign and domestic companies, some Corporate bonds, some Government Bonds, and as this article says possibly some Gold. Gold is Still King of the Investing Market. Gold tends to keep up with inflation and tends to go up when other investment vehicles go down. The following chart shows the top-performing asset class for each year since 2005. By having some money invested in each class you can balance out your returns and beat inflation over the long term.

Predict Future Trends

Any investor will tell you that they wish they could have invested in valuable stocks like Apple or Google twenty years ago. Hindsight is 20/20, but with a diversification plan you can increase your chances of picking a long-term winner. The best bet for a non-professional investor is to skip trying to find the next Google and invest in Exchange Traded Funds (ETFs) and Mutual Funds instead. That way instead of trying to pick one good stock, find a good fund that will pick the right stocks over and over. This way you have professionals picking the individual stocks and instead you will focus on diversifying into various market sectors. A small investor just starting out should choose an already diversified fund. When you get a little larger you can diversify even further with several funds that take different approaches.

Although investing in the stock market can help you reap large profits, the amount of risk involved isn’t for everyone. Before you start investing in stocks you need to have an emergency fund and eliminate high-cost debt like credit cards. If you want safer investments, consider bonds, CDs or a money market account… they are a good place to start. Once you have them covered you can move on to higher return type investments. But if Chris Ciovacco is right in his analysis the stock market could very well be entering a new “Secular Bull Market” which means big moves upward for the 15 or 20 years. Unlike the last 15 years which were a Secular Bear Market (basically flat with some major drops). If this is true, you want to invest in stocks sooner rather than later.

See Also: