Money plays a major role in your family’s quality of life. Thankfully, it’s never too late to get your finances in order and the New Year is a great time to get your finances on the right track. Consider some of the best tips to help get you started.

Establish a Budget

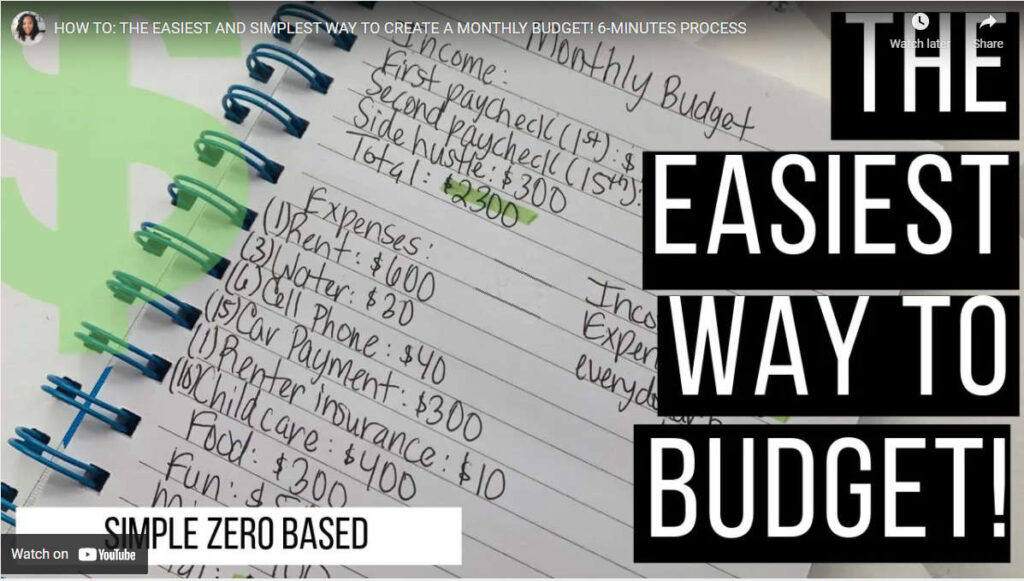

If you think that budgets are elementary tools, think again. Major corporations stick to a budget. Step one is knowing how much is coming in and how much is going out. Step two is knowing WHERE it is going. If you don’t know where your money is going, it’s impossible to get a handle on it. List all of your income and all of your expenses each month. Some expenses might be quarterly (i.e. once every 3 months) or annual (once a year). For quarterly expenses break it down by dividing it by 3 and adding a line item for that every month. And set that much aside to cover quarterly bills. Likewise, you should set aside 1/12th of annual bills every month.

As you create your line items, make sure you have enough money to cover everything. If you don’t you will have to decide what you need to cut out. Assign yourself money to spend on yourself each month. Sticking to a budget requires discipline. By prioritizing some of your wants in the budget, it’s easier to create a sustainable budget you’ll actually adhere to.

Set Goals

Think about your financial goals. Consider how much you’d like to have in savings by a certain year. Many financial gurus encourage people to keep at least a year’s worth of expenses in an emergency fund. If you’d like to make that a goal, be sure to set aside a separate savings account at a local bank or a credit union in order to set that money aside. If you’d like to take the family on a trip to Disney World or save up to pay for your children’s college education, figure out the financial logistics of those goals so you can start working them into the budget.

Develop Additional Income Streams

Additional income streams help to secure your household from a financial perspective. If you’re solely relying on one stream of income, you’re on shaky ground. If you lose your job, your entire household suffers. Instead, develop additional income streams that will supplement your income in substantial ways. A few income streams include rental property, reselling, and freelance writing. The best way to become financially independent is to develop “passive” streams of income i.e. income that does not require exchanging hours for dollars but rather things that you can do once and get paid over and over.

Automate Your Line Items

When the direct deposit check hits your account, automate ways to spread that money across various accounts, bill collectors, and more. Plus, when you automate certain bills, you can enjoy a certain percentage off of your overall bill. When line items get automated, there’s less confusion or effort to exert on your part.

If you’ve maintained poor spending habits over the years, it can be tempting to get down on yourself or become discouraged to the point of analysis paralysis. A good time to get the ball rolling in the right direction is the New Year. It’s also best to remember to take it one decision at a time. By consistently making the right decisions over the long haul, you’ll be able to get your finances in order and develop a financial situation that’s synonymous with the type of lifestyle you’d like to experience.

You Might Also Like: