As you grow older and accumulate wealth, your estate could become a source of contention among your loved ones. Sadly, a vast majority of families engage in disputes over assets after the death of a family member. These arguments are often emotionally charged, and sometimes their roots can be traced back to a lack of communication, transparency, and clarity on the part of the owner of the assets. This article will provide tips on how to prevent family arguments over your assets.

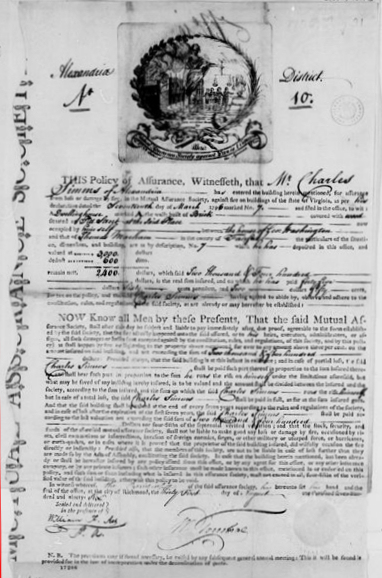

#1 Create a Will

A will is a legal document that outlines how your assets should be distributed upon your death. It should be as detailed as possible, leaving no room for misconceptions and misunderstandings. It should also be reviewed regularly to ensure that any changes you make to your assets are reflected in the will. By creating a will, you can ensure that your belongings are distributed according to your wishes, thereby reducing the likelihood of conflicts among your family members.

#2 Be Transparent with Your Plans

Clarity and transparency are essential when it comes to estate planning. It’s important to communicate your wishes to your family members while you’re still alive. By doing so, you can address any questions or concerns they may have, and they can prepare themselves for what’s to come. This can help avoid any surprises or misunderstandings after your death.

#3 Consider Trust Structures

Trust structures offer a way to protect assets from potential creditors, provide for beneficiaries, and limit tax liabilities. They can also be used to promote family harmony by ensuring that assets are distributed fairly among beneficiaries. Trusts have various advantages, including minimizing conflict and ensuring that your wishes are carried out according to your plan.

#4 Have Equal Distribution of Assets

Disputes over assets often arise when beneficiaries feel that they have been unfairly treated. It’s a good idea to distribute your assets equally to all beneficiaries, if possible. If you find it necessary for some beneficiaries to receive a larger share of the assets than others, be sure to communicate why this is so to avoid resentment and misunderstanding.

#5 Divide Assets by Percentages

Asset values change daily so listing dollar values can cause problems. For instance, suppose your estate is currently worth $100,000 and you want 10% to go to your church and $90,000 to be divided between your two children. If you write your will to say $10,000 to the church and the remainder to be divided equally between the two children. If your estate grows significantly over the years to say $250,000, your church will only get $10,000 not the 10% you intended.

On the other hand, if your estate shrinks to $20,000 due to Doctor bills etc. Your church will get half of your estate and your two children will only get $5,000 each. So, it is best to keep all numbers in terms of percentages rather than fixed dollar numbers.

#6 Seek Professional Legal Advice

Estate planning can be a complex endeavor. It involves various legal documents, laws, and regulations that can be challenging to navigate. Consulting with an estate planning attorney can help you chart a clear path forward. They can also provide you with invaluable advice on how to minimize any potential conflict among your family members.

Preventing family arguments over assets requires planning, transparency, and communication. By creating a detailed will, communicating your wishes to your family members, considering the use of trust structures, distributing assets equally, and seeking professional legal advice, you can reduce the likelihood of family conflicts over assets. Remember, the goal is to ensure that your loved ones are taken care of when you’re no longer around.

You might also like:

- 4 Reasons Estate Planning is a Must

- Questions to Ask When Hiring a Wealth Management Service

- Planning Your Legacy: 5 Estate Planning Ideas

- 4 Types of Trusts That Can Protect Your Assets

- Navigating Estate Planning and Probate Law

- Handling the Financial Burden of a Death in the Family

- Saving Money on Funeral Planning

- Planning Your Estate: 6 Things To Remember