Why Do I Need a Long Term Care Insurance Policy?

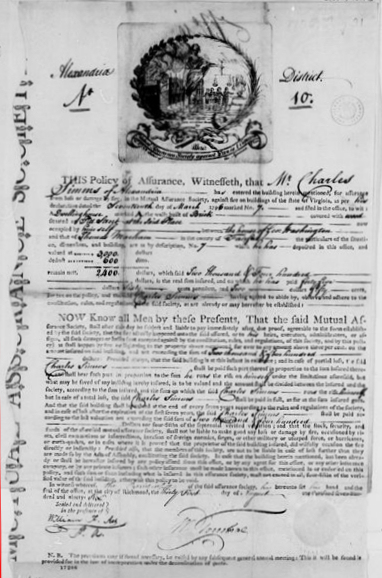

For the first 32 years of my life, I gave absolutely no thought to long-term care insurance policies. By the time I turned 33, I was thankful my grandparents had the foresight to purchase a policy. Both were diagnosed with probable Alzheimer’s disease and my father, their only son, was struggling with cancer and dementia symptoms of his […]

Why Do I Need a Long Term Care Insurance Policy? Read More »