How to Get Money Interest Free

By Tim McMahon |

Tips for Strategically Using Your Pre-Tax Health Savings Account (HSA)

It is no secret that the cost of health care continues to rise. You might feel that it is almost out of reach of the average American family to afford quality medical care when they need it the most. Thankfully, there are certain mechanisms that you can put into place to save you money. One of those involves a Health Savings Account or “HSA”. This is a way to noticeably save on your tax bill while being assured that you have money set aside to pay for a wide range of medical expenses. It is a win-win situation that you will want to be taking advantage of.

Read MoreIt’s Not Too Early to Begin Budgeting for Your Summer Vacation

Summer vacation is something that we all look forward to. This holds especially true for children as Summer Vacation becomes the highlight of their year and often creates lasting family memories. However, affording a summer vacation can be tough on most of us. Often people will simply put the expense on their credit cards and end up paying massive interest on the debt. A better plan is to start saving beforehand so you can keep the interest in your own pocket. Here are a few things you can do to budget for your next summer vacation.

Read More3 Hacks in Building Your Family’s Emergency Fund

Showing your love and appreciation for your family can go from heartwarming birthday messages and memorable outings, all the way to investing in your future. More than anything, financial preparedness is one of the best things you can give your loved ones. Having savings and investments in place helps take care of any future financial needs or unexpected incidents. Although financial preparedness includes things like life insurance, part of being financially prepared is simply having a family emergency fund. Creating this fund lets you focus on the essential things and rest easy knowing you’re prepared for any situation that can happen. When you first get started, building up your emergency fund can seem like a daunting task, though the process can be simplified into three steps:

Read MoreHow to Keep Your Home’s Heating Bill from Rising When Temperatures Fall

Heading into the winter months as temperatures fall, many home heating bills will begin to rise, some dramatically. Fortunately, there are several things you can do to reduce your monthly heating expenses.

Read MoreHow Will a Fender Bender Affect Your Long Term Finances?

An average of 10 million car accidents happen every year. While some drivers are lucky enough to escape these accidents without a scratch, the fact is that most people sustain injuries to themselves and their vehicles. Even after insurance, the costs associated with car accidents can be overwhelming.

Read MoreThe Insurance You Need to Protect Your Family

When all is going well, we might think insurance is just a waste of money but, just when you think you have everything under control, life decides to throw you a curveball. Whether your little one was hit in the mouth at baseball practice or your newly licensed teen had a fender bender, having the right kind of insurance can go a long way toward keeping you and your family protected. Below are five of the most important types of coverage you should have.

Read MoreFinancial Options: How to Limit Your Annual Expenses

When it comes to handling your finances, it may seem like you have to make tradeoffs. This philosophy may be true, but you can still have fun while doing it. Here are some of the techniques that will help you to reduce your annual expenses without impacting your lifestyle.

Read MoreYour Simple Guide to Buying a House in 2020

Are you ready to stop throwing away your money on rent and buy into the American dream of owning a home? Though owning a home sounds nice, it’s a big commitment too. If you’re ready to be king/queen of your domain, then here are some tips to simplify house buying in 2020.

Read MoreAffordable Buying Options for Your Teen’s First Car

A teen’s first car is a special vehicle. Unfortunately for parents, getting that special vehicle can be an expensive proposition. If you’re looking to get your teen his or her first car, you might want to consider one of the affordable options below.

Read MoreA Quick Guide to Starting a Family Emergency Fund in 2020

One of the quickest paths to financial ruin is to incur an unexpected financial strain such as medical bills or a car breaking down and having to borrow money, whether in the form of a loan or by using a credit card, in order to pay for it. Luckily, there is a solution. Having an emergency fund for cases just like this is the perfect way to avoid these slippery financial slopes. So, what is the best way to begin an emergency fund this year?

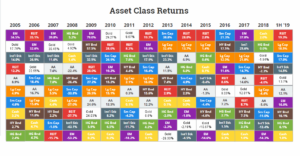

Read MoreMaking an Investment Plan That Accounts for the Rising Cost of Living

Average living costs tend to rise everywhere, which is something that investors need to consider when determining the longevity of their investments. An investment might increase in value, but it can be a net loss if its value rises more slowly than the cost of living. Whether you’re investing for retirement, your children’s education or another goal, read on to learn how you can make sure your plan keeps pace with the rising cost of living.

Read MoreHandling the Financial Burden of a Death in the Family

Dealing with a death in the family is stressful. But, when it comes to handling the financial burden of the funeral and other expenses, the already sad situation can seem unbearable. Here are some helpful tips you can employ to make your financial burden easier to handle so you can focus on the process of grieving when a loved one dies.

Read More